Whenever someone is thinking about becoming a currency trader, one of the first questions they typically Google is: “How much do you need to start trading forex?”

This is a question worth talking about.

Typically, you can open an account with a hundred bucks or less. However, this is not going to be enough. Instead, determining what is ideal for your situation requires more thought.

In this guide, we’re going to explain two methods for calculating your deposit.

They work regardless of your trading style and they are so easy to understand that you will immediately see that the calculated deposit makes perfect sense.

For those in a hurry, you can jump right to the calculations:

To get the full picture, you will want to read the entire guide. If you don’t have the time to do that now, just bookmark this page and come back whenever it’s convenient.

Please note that this guide is not for gamblers. This is for people who are serious about trading and want to find a deposit size that allows them to achieve sustainable profits.

You Need Enough Money to Keep Your Risk Profile Low

One of the key elements of successful trading is risk management.

You can have an awesome strategy and still lose money if you risk too much of your account per trade. On the other hand, you can have a terrible strategy and still be around breakeven if you keep your risks small.

The most widely used technique for risk management is called fixed fractional, meaning you risk a certain fraction of your trading account on every trade. This fraction is typically 1% or 2% of your account.

In essence, the fixed fractional method concentrates on capital preservation and sustainable growth.

The trade size is always proportional to the money in your account, so the impact of losing streaks is nerfed. At the same time, winning streaks gradually increase the traded position size, letting the compounding effect kick in.

This simple method can safeguard your account for a long time, even if you’re not immediately profitable.

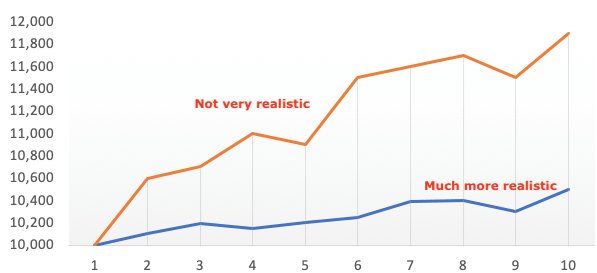

Keeping your risk low is absolutely necessary for long-term profitability. Unfortunately, it means your account will grow “slow and steady” instead of “fast and exponential.”

In other words, don’t expect spectacular gains. Something like a 10% yearly average is outstanding even when you’re an experienced trader.

Now that this has been clarified, let’s review two methods you can use to calculate your deposit.

Calculating How Much You Need to Start Trading Forex – Method 1

The first method is based on two simple variables:

- Desired return

- Expected performance

We explain them below and then take a look at two example calculations.

Desired Return

The desired return is the amount you want to earn from trading in dollars.

For example, if you want to supplement your monthly income, this amount might be $500 per month. Or if you want to trade for a living, calculate how much you need to live comfortably. The desired return will be that number.

Expected Performance

This is the percentage return you expect to achieve on your account.

Obviously, this is not a matter of guessing. You must place your assumption on data – and the way you get that data is by backtesting your strategy.

We’re not going to get into backtesting now, but we have a guide that explains how to backtest your strategy. We encourage you to check out that one if you need help.

It’s important that you keep things realistic and don’t overestimate your performance, as faulty expectations will cause you problems down the road.

Examples

Using these two variables and some high school algebra, you can easily calculate your deposit.

Let’s consider two examples:

Situation 1:

- Desired return $1000 per year

- Expected performance +3% per year

deposit * 0.03 = 1,000

deposit = 1000 / 0.03 = 33,333.33

In this case, you’ll need to deposit $33,333.33 to gain $1000 yearly from trading forex. You can check that this number is correct by multiplying the deposit by 1.03. You’ll get about $34,333.33 or $1000 profit on the original amount.

Situation 2:

- Desired return: $500 per month

- Expected performance: +8% per year

In this case, your deposit can be calculated as follows:

First, translate the yearly performance into monthly performance.

0.08 / 12 = 0.0066

deposit * 0.0066 = 500

deposit = 500 / 0.0066 = $75,757.57

In this case, you’ll need to deposit a whopping $75,757.57 to supplement your income with $500 a month from trading forex. Again, you can proof check similar to the previous example. Multiply the deposit by 1.0066 and you’ll get $76,257.56, or $500 more than the original amount.

Calculating How Much You Need to Start Trading Forex – Method 2

The second method is slightly more difficult than the first, but it’s still not rocket science. It is based on three variables:

- Pip value

- Your typical stop distance

- Risk per trade

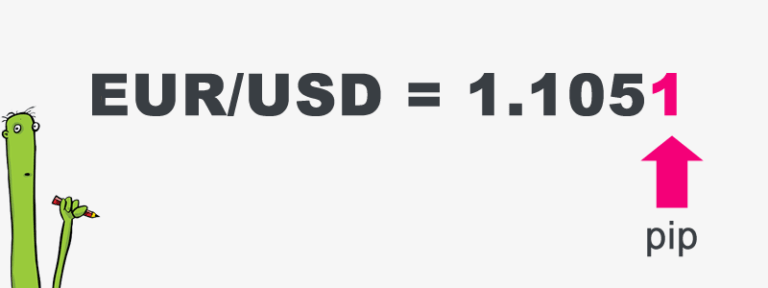

Pip Value

The pip is a unit of change in an exchange rate of a currency pair.

The value of one pip typically varies between currency pairs because of differences between the exchange rates of various currencies.

As a general guideline, there’s a phenomenon that you can keep in mind:

Whatever currency you deposited to your account, when that currency is quoted on the right side of a pair, the pip values are fixed.

For example, if you have a US dollar account, any pair that is XXX/USD, such as the EUR/USD, will have a fixed pip value:

- Standard lot: $10 (100,000 unit)

- Mini lot: $1 (10,000 unit)

- Micro lot: $0.10 (1,000 unit)

This guide gives you a more detailed explanation of how to calculate pips.

At the end of the day, you don’t need to bother with calculating anything; you can simply use a pip value calculator.

Your Typical Stop Distance

Stop losses probably don’t require much introduction.

The reason why knowing your typical stop distance is useful in calculating your deposit is simple.

Stop losses are expressed in pips and, as we have already discussed, pips have a certain value. If you know that your stop distance is 30 pips, then those 30 pips must equal X% of your account, X being the maximum risk per position.

We also mentioned that the risk profile should be low, about 1% or 2% of your account per trade. With these numbers in mind, you can easily calculate an appropriate deposit, as you’ll see in the following examples.

(If you want to explore some of the most popular ways of placing stops, we have a free eBook that you can download from here.)

Examples

When calculating the deposit size with this method, you must choose a position size, as it influences the value of one pip. Consider your goals and keep things reasonable.

You can calculate with micro lots and get fairly low deposit requirements, but that means you’re going to trade for cents. It’s great for practicing, but not so much for making money.

We’re going to calculate with standard lots (100,000 units) where one pip is worth about $10.

Don’t forget that forex is a leveraged market, so you don’t have to deposit the whole amount—just a small fraction as collateral. In the US, you can access a leverage of 1:50 for major forex pairs, which means that the bare minimum you need to trade a standard lot is about $2000.

(But the optimal amount is higher, as you’ll see.)

Situation 1:

- Pip value: $10 (standard lot)

- Stop distance: 30 pips

- Risk: 1%

30 pips at $10 / pip = $300

$300 * 100 = $30,000

In this case, you must multiply 30 pips by the pip value of $10. The $300 you get is your risk on the position, which must correspond to 1% of your trading account. Therefore, multiplying $300 by 100 leads to an account size of $30,000.

Situation 2:

- Pip value: $10 (standard lot)

- Stop distance: 50 pips

- Risk: 2%

50 pips at $10 / pip = $500

$500 * 50 = $25,000

The calculation works similarly to the previous example. This time, you risk 2% of your account, which amounts to $500, considering the 50-pips stop distance. From this, multiplying by 50 gives you the entire required balance of $25,000.

Note how increasing your risks dropped your deposit requirement despite the wider stops. It shows that the less money you have, the more risks you must take to make the same return.

You Need to Create a Buffer

Both discussed methods lead to a deposit that promotes sustainable trading. That is, you can trade with low risks while earning the money you want.

There’s only one problem: With both methods, the capital you come up with is the absolute minimum for whatever you’re trying to achieve.

We know what you’re thinking: I’m perfectly fine with that.

So, let us put it another way: If your first trade is a loss, you immediately fall below the minimum capital requirement.

In the very last example, you found that you needed $25,000 to trade. In this situation, if your first trade is a loss, you’ll be down to about 24,500 (2% risked), which is below what you deemed appropriate.

This is problematic because you might need to take smaller positions or otherwise alter your trading plan. If you happen to have a few more losses, with the increasingly smaller position sizes, you’ll have a hard time getting back to your starting point.

Therefore, to ensure that you always have enough money to achieve your goals, add a buffer.

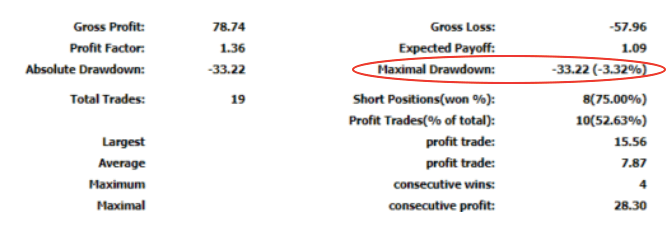

Head over to your backtesting report and take a look at the maximal drawdown.

Then take this percentage number and multiply your minimal capital requirement by this amount. The number you get is the “buffer.” It must be added to the minimal capital requirement to get your final deposit.

For instance, if your maximal drawdown is 10% and your minimal capital requirement is 50,000, your final deposit will be (50,000 * 0.1) + 50,000 = 55,000.

A buffer ensures that you stay above your minimum. The only way to fall below your minimum with a buffer is to have a larger drawdown than what your backtesting suggested. In that case, you indeed want to stop trading and reevaluate things.

Typical Costs You Will Face as a Forex Trader

One mistake people frequently make is thinking that depositing money into a brokerage account is the only “cost of trading”.

It might be if you’re just gambling, but if you’re trading as a business, you have other costs to consider (and we don’t think about trading fees).

Learning Costs

Every profession requires learning, and forex trading is no exception. You can’t just sit down and trade for a living. That would be nice, but it’s unlikely to happen.

There are plenty of resources, and unless you decide to enroll in a course, you don’t have to spend much on learning because you can find everything online for free.

The real cost of learning forex is all the money you lose when you begin live trading and make expensive mistakes. We strongly encourage you to start your trading career with a smaller account and slowly transition to a bigger one, after you get used to live trading.

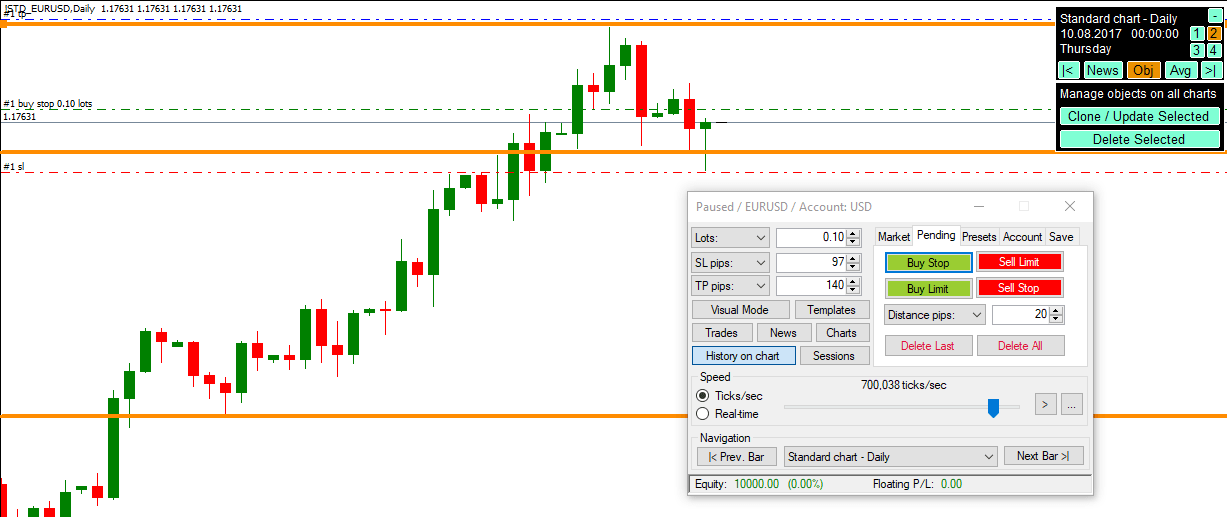

Backtesting Software

Backtesting is the process of applying your strategy to historical market data to see how it would have performed. It’s an essential element of successful trading; however, without proper backtesting software, it’s difficult and time-consuming.

The cheapest solution is probably Soft4FX, which costs $97. It is great software and is what we currently use at ForexSpringBoard. You can learn how to do backtesting with Soft4FX here.

If you need a more advanced solution, your best choice is ForexTester, which starts at $299. This amount can quickly increase by hundreds of bucks if you want all the features and lifetime access.

News Services

This is not as essential as a backtesting software, but you may benefit from purchasing a subscription to Bloomberg, The Economist, or any other news service for industry participants.

These typically cost hundreds of dollars a year.

Opportunity Cost

We put this one last because it’s a special one.

Opportunity cost means that whenever you choose to do something, you lose out on other alternatives. For example, the opportunity cost of the funds tied up in your trading account is the interest you could get in the bank or the profit you could get with an alternative investment.

Simply ask yourself the following question: When I trade, what is the next-highest-valued use of my resources? Is it really worth trading and foregoing that option?

Opportunity costs don’t have to be material things.

If trading makes you feel good, you might still want to do it even if you could get better results elsewhere. But at the same time, if you get amazing gains but don’t have time for other important things in life, the opportunity cost might be too high.

What Do Professional Forex Traders Say? – Opinions on How Much You Need to Start Trading Forex

In this last section, we dive into the insights of some famous forex professionals regarding the topic.

We strongly encourage you to follow these individuals, as they are among the most transparent and honest information sources you can find.

Nick from TraderNick

Nick’s key message is this: If you’re a new trader and you’re just getting started, don’t think about how much money you can make.

You must focus on protecting your capital and then growing it, rather than the other way around.

A good starting amount to deposit is around $500 and trading 0.01 lots.

He says that you can always increase your lot sizes later; the first thing to do is get consistent on a small account with low risks so you don’t lose money that you can’t afford to lose.

The tolerance and patience you gain while trading the small account are also invaluable.

Nicholas from The Duomo Initiative

Nicholas begins by telling us his story of starting forex.

He didn’t have much money to trade with, but he was so confident in his ability to make money that he wanted to go live right away.

He opened a trading account and took 500 pounds from his wage as a deposit. Now, if you have watched the video from Nick, you might remember that this account size is perfect for learning to trade profitably, but not so much for making money.

Unfortunately, instead of using the account as a means of practicing, Nicholas took excessive risks in his desperate attempt to pull in some real profits.

He didn’t know what you should have already realized: that is, losing trades are inevitable. Risking a huge chunk of money in your account is like playing Russian roulette. You might be lucky for a while, but it’s just a matter of time before you’re done.

This is exactly what happened with Nicholas. He quickly blew up his account.

Unfortunately, instead of realizing what went wrong, he took the same 500 pounds from his next monthly wage and deposited it into the account only to lose it the exact same way. He kept doing this for a while. By the time he stopped, he had burned through a few thousand pounds.

Fast forward to now. He says that if he had just waited, he would have had a big chunk of cash to trade with. This would have given him a higher earning potential and a more conservative risk profile.

Nicholas recommends that you risk only 1% or 2% of your account per trade. As for calculating the minimum deposit, the second method we talked about in this guide is based on the concepts he talks about in the second part of the video.

Rayner from TradingWithRayner

Rayner recommends that if you’re new to trading, you should put in as little as possible.

Whenever you learn something new, you’re going to struggle initially. This is a great way to minimize your losses he says.

The great thing is that your losses are limited, but you’re still being exposed to the psychological challenges of trading with real money, which will help you grow as a trader.

To calculate the exact amount that allows you to practice your strategy, he mentions the second method we discussed—that is, using pips, stop distance, and risk. For the latter, Rayner recommends risking no more than 2% of your trading account.

He also points out that trading is not a quick way out of debt. It’s not like having a job that pays you consistently. In fact, there is a high probability that you will lose money, so avoid trading if you are having financial difficulties.

Conclusion

Starting forex isn’t that complicated. The deposit requirements are super low, and you can get an account up and running in minutes.

What is harder is making consistent profits and keeping your risks low. The two are kind of related, as you can’t make money in the long run without proper risk management.

Before jumping into the markets, take some time to identify your goals and calculate an appropriate deposit using either of the two methods we presented in this guide.