Forex is one of the hardest ways to make money online.

In fact, according to a document from ESMA, 74-89% of retail accounts typically lose money on their investments. Furthermore, the average losses per investor range from €1,600 to €29,000.

These are pretty scary numbers.

When it comes to planning and executing trades, you’re going to make mistakes. This is unavoidable.

We’ve made mistakes as well, and we’re sure we’ll make more moving forward. That’s life.

But with that said, we’ve realized that most mistakes are avoidable. So many forex traders make the same blunders time and time again, which is what inspired us to write this guide.

Whether you’re a rookie trader or a seasoned professional, you’re not free from errors.

With this straightforward guide, you’ll learn 13 common forex trading mistakes and traps. If you realize that you’re making some of these mistakes, you can take the proper steps to fix them.

Let’s get started.

Common Mistake #1: Unrealistic Expectations

Let’s be honest: If you’re just getting started in forex, you’re not going to make a lot of money anytime soon.

Of course, there are exceptions. But exceptions are everywhere; it’s just pretty unlikely that you’ll be the next “wonder kid.” Instead, you’re probably going to go down the same road that most traders do.

And believe us, that road is a bumpy one.

Now, this doesn’t mean you can’t be successful. Even if you have small capital, returns can compound over time. However, most traders don’t understand what it takes to get there.

Successful trading comes down to a mix of knowledge, personality traits, and mindset. Neither of these is something that you can’t develop, but without hard work and commitment, you’re bound to fail.

We touched on these in more detail in another article. Click on the blue text if you want to know how to develop the must-have traits of a successful trader.

Common Mistake #2: Trading Without a Plan

No doubt, having goals and maintaining a positive attitude will go a long way towards achieving almost anything. But merely expecting something to happen will not make it happen.

If your trading is based on gut feelings and random trade ideas, you’re in big trouble. Even the Law of Attraction dictates that you must have a plan and take action. Otherwise, it doesn’t work.

Here’s the thing:

Forex is an uncertain environment where anything can happen at any moment. Unlike the games you can play in the casino, it doesn’t have a built-in system that you must follow.

On the one hand, this is great because trading doesn’t force you to be a loser. On the other hand, you’re solely responsible for creating a plan so that you can always act in your best interests.

Your plan must define how you will enter and exit the forex market (trading strategy) as well as how you will handle the psychological pressures that come with trading.

Common Mistake #3: Ignoring the “Bigger Picture”

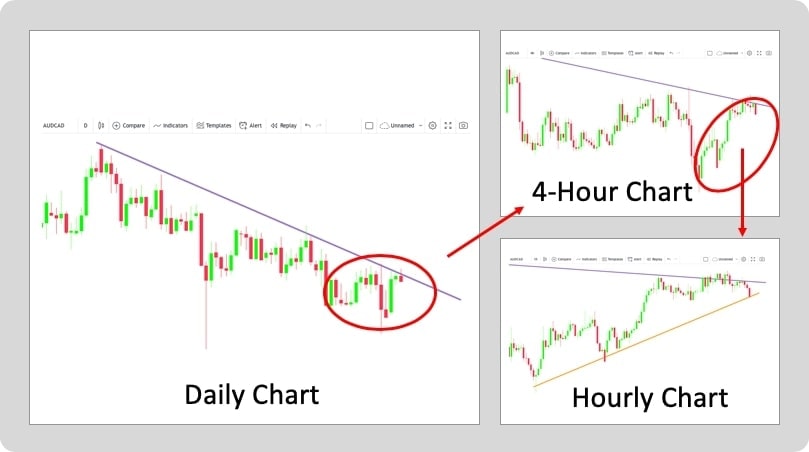

Your trading platform is made up of at least nine different timeframes. Out of those, how many do you follow?

If your answer is “one,” you’re missing out on a huge opportunity to find high-probability entry and stop levels.

Here’s what you need to know.

In general, technical analysis tools are more reliable in higher timeframes. These are the charts that are affected by the news and casual confusions to a lesser extent, so you can expect a more balanced price action.

This is true at every level.

The daily chart is more reliable than the hourly chart, and the five-minute chart is more reliable than the one-minute chart.

Now, this doesn’t mean that if you’re using a low chart, you must switch to a high one. But there’s really no reason to limit your analysis to your preferred timeframe.

Typically, three different periods give you a broad-enough picture of the market. Using more than that is unnecessary and can be confusing. See some examples below:

- D1, H4, H1

- M30, M5, M1

- H4, M30, M5

You must start your analysis from the top and head down until you reach your preferred timeframe.

When marking zones and trend lines, use different colors or widths for each chart. By doing this, you can better indicate which area might be more significant.

Common Mistake #4: Paying Limited Attention to Exits

If you’re like many people, you spend most of your time on trade entries while paying almost no attention to trade exits.

That’s unfortunate because a proper exit strategy can lead to smaller losses or bigger gains – depending on the situation, of course. But, needless to say, planning an exit strategy can be challenging.

Oddly enough, it’s the profit-taking that requires more thought.

It’s important to spend time tweaking your stop placements or developing ways to exit even before your stop is hit. However, in general, if you set your stop at a reasonable level, and if you don’t move it once it’s there, you’re good to go.

Exiting a profitable trade is much harder. Once your position is in the green, you’ll feel a sudden desire to grab your profit before it melts.

Even if you set a take profit, you’ll be in constant doubt. Maybe there will be a reversal; should I exit? The trend appears healthy; should I add to my position? People stress about these things all the time.

The truth is, if your emotions are involved, you’ll seldom make rational decisions. There’s no way you can predict, with 100% accuracy, the best time to close a trade.

Therefore, the best you can do is to test as many set-ups as possible. Then go with the one that shows the best results.

Common Mistake #5: Not Backtesting Your Strategy

This is related to point 4 above. Without backtesting, you have a limited ability to optimize your strategy. On top of that, you’re depriving yourself of the ability to grow in confidence in both yourself and your system.

That’s why it just doesn’t make sense that most people don’t test their strategies.

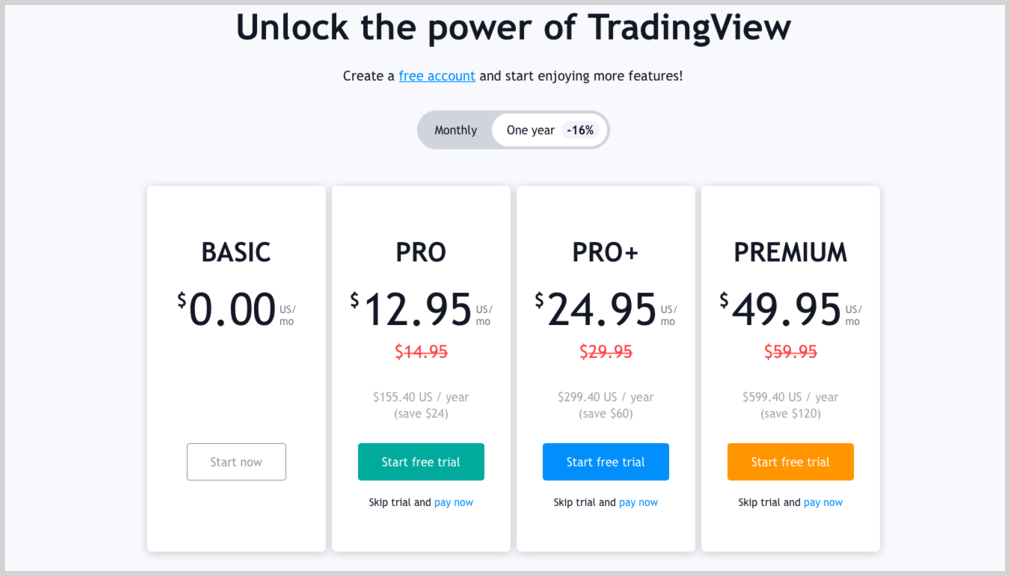

There are great opportunities out there. For example, TradingView offers a free market replay mode. Even if you need more extensive features, you’ll find a suitable option for a fair price.

If you haven’t tested your strategy, don’t push it to the back burner. We have put together a free PDF list for you, to give you an idea about what to measure when testing.

Fill out the form below and we’ll shoot you an email with the PDF attached. If you’ve been missing out on our educational emails, make sure you also tick the appropriate box.

Common Mistake #6: Trading Against the Trend

One of the simplest, most popular, and most proven methods of achieving success in forex is to trade with the trend. There’s even the added benefit of trading less, which means more time and fewer commissions.

Despite all this, a surprisingly high number of traders try to catch market tops and bottoms. Don’t get us wrong here; you can do what works for you. But if you’re struggling to see results, consider trading trends.

Common Mistake #7: Not Reading Trading Books

We don’t care what kind of trader you are. Whether you’re a long-time veteran or a complete beginner, you can benefit from reading books.

Highly successful people like Warren Buffet and Jeff Bezos have very strong reading habits. Buffet, for example, suggests reading 500 pages a day.

While that is beyond the reach of most of us, you can probably find a way to improve, especially when the average person reads only four books a year.

If you don’t know where to begin, here are some of our favorite books:

- Trading in the Zone by Mark Douglas

- Reminiscences of a Stock Operator by Edwin Lefèvre

- Naked Forex by Alex Nekritin and Walter Peters

- Trading for a Living by Elder Alexander

- How to Make a Living Trading Foreign Exchange by Courtney Smith

- The Art and Science of Technical Analysis by Adam Grimes

- Market Wizards by Jack D. Schwager

Simply set a time-of-day routine. For instance, you can read a chapter every morning, before your brain is overloaded by the day’s errands.

Common Mistake #8: Not Cutting Your Losses Quickly

Some traders like to postpone the closing of losing trades. The reason why is a psychological question. However, hoping for a reversal and avoiding regret are likely the biggest parts of the equation.

This will usually backfire because you will be kicked out of the market by either a string of losses or one large loss.

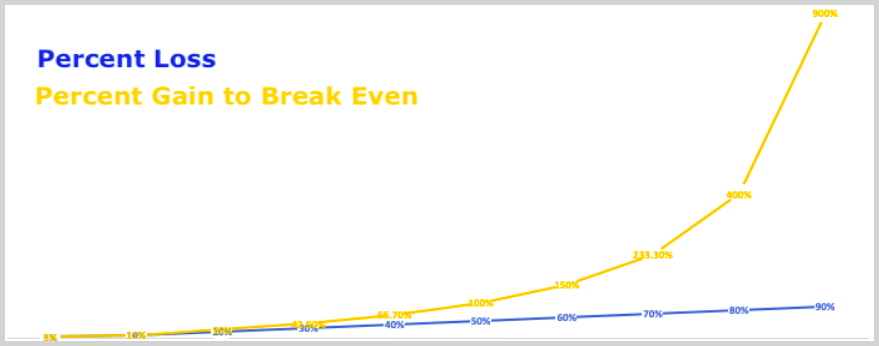

Instead, it’s better to take a loss while that loss is small. You’ll have losses anyway and taking risky gambles to avoid them will do nothing but lead to a deep hole.

Risking no more than one or two percent of your capital per trade is a great way to keep your account safe and grow it over time.

Common Mistake #9: Concentrating on Money

The best way to make money in forex is to not worry about it. Just do your job really well and the results will come.

Basically, this is how highly successful people make money in every area. Steve Jobs, for example, created enormous wealth over his career but always pursued his passion instead of chasing paychecks.

Good doctors, lawyers, engineers … They don’t count money while working. They are 100% devoted to the perfect execution of their tasks.

Sure, they don’t have to watch their money fluctuating up and down with every tick. However, this shouldn’t be a problem if you have a solid money management plan in place.

If you want to be a good trader, you must concentrate on keeping your risks low and finding high-probability trades. That’s how you can come out ahead in the long run.

Common Mistake #10: Overlooking Long Timeframes

Lots of traders neglect long timeframes such as the daily and above because they don’t like waiting for trading signals. They want to make as many trades as possible to increase their chances of winning. This often leads to poor trades, which leads to lost money.

There’s nothing wrong with trading on smaller charts if you put quality ahead of quantity. In particular, if you already have a working system, there’s no reason to change.

However, if you’re just getting started, trading longer charts might be a better option. There’s no evidence to suggest that frequent trading is more profitable.

The difference is mainly in your personality and time commitment. If you’re comfortable with a system that works on a longer chart, you don’t have to be trading that much. That means you have more time for your family and other things you like.

Common Mistake #11: Forgetting About Currency Correlations

Everybody knows that there are different currency pairs. But what most people don’t realize is that certain currency pairs are interlinked. They will often move together or against each other.

This is called a positive or negative currency correlation.

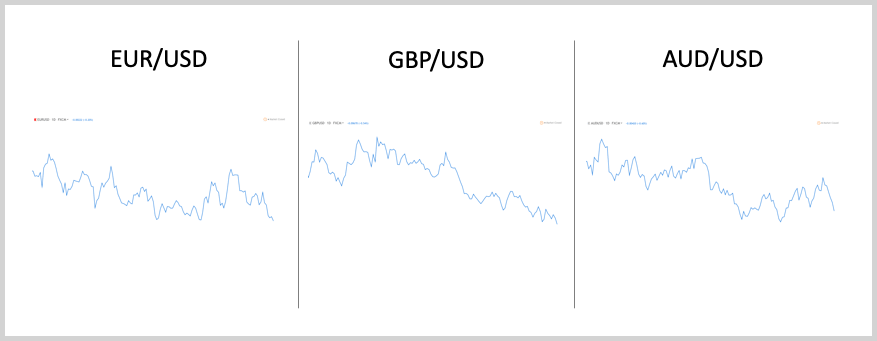

For example, EUR/USD, GBP/USD, and AUD/USD are all positively correlated. In other words, these pairs tend to move in tandem because they all have the US dollar as their counter currency.

On the other hand, USD/JPY, USD/CAD, and USD/CHF are negatively correlated with the above-listed pairs. They tend to move in the opposite direction because they all have the US dollar as their base currency.

This might be blurry for those who aren’t familiar with currency quotations and the mechanism of forex trading. No worries; click on the blue link and our guide will appear in a new window.

Of course, the degree to which currencies are correlated varies. Fortunately, there’s a great tool you can use to check the strength of different currency correlations.

This is a valuable insight that you can use to optimize your risk-taking. For example, as of the time of this writing, the GBP/USD and GBP/JPY are 80% correlated. If you open a buy position on both, your overall GBP exposure might be too high.

Common Mistake #12: Falling Into the “Cycle of Doom”

Too many people have great trading strategies but fail to leverage them. At first, they love the strategy but then, as they experience more losing trades, they begin to lose faith. They make some tweaks and eventually look for something else, thinking the strategy is wrong.

This is what Andrew Lockwood calls the “Cycle of Doom”.

This is a pretty unfortunate situation because, in many cases, there’s nothing wrong with the strategy.

What you need to understand is that forex trading is all about holding a slight edge over the market. In other words, every strategy has plenty of losing trades. Sometimes there are long losing streaks, such as 7-8 losses in a row.

To know the specific characteristics of your strategy, you must perform extensive backtesting – something we’ve already talked about in this guide.

Common Mistake #13: Being Lazy About Transaction Costs

If you’re just opening your trading account and making a deposit without thinking about commissions, you’re doing it wrong. This is a common mistake among beginner forex traders.

You might have realized that brokers have different account types tailored to different traders. Going with the “standard account” is not always the best option. The last thing you want to do is overpay in trading fees.

Charging spreads are the most general way in which forex brokers get compensated.

Typically, they offer variable spreads, which means the amount you pay fluctuates depending on market circumstances. But most brokers also offer accounts with fixed spreads, or commission-based accounts with no spreads at all.

The least you can do is compare the accounts your broker offers and do some math to figure out which best suits you. Ideally, you should also check out several other brokers, as they might have a better offering for your needs.

Conclusion

Forex trading is a great career but it’s easy to make mistakes, especially if you’re a beginner.

We hope that the common forex trading mistakes and traps we have collected have helped you see what you should avoid or do better.

If you’re a beginner, review this guide before you start trading live. If you’re an advanced trader, refer to it often to ensure that you’re steering clear of these errors.