Here it is: a one-stop forex gap guide to help you understand the essentials of gaps and how you can trade them.

Here’s what we’ll talk about:

- What is a forex gap?

- What causes gaps in the forex market?

- What happens when there is a gap?

- How to manage forex gap risks

- Do forex gaps get filled?

- How to trade gaps successfully

- Forex Gap Trading Strategy PDF and walkthrough

Let’s dive in!

What Is a Forex Gap?

A forex gap is a situation in which the market jumps from one candle to the next with no tradable prices in between.

Normally, when a candle closes, the next candle opens at the same level. If the EUR/JPY daily candle closes at 104, the next day’s candle opens at 104.

This is due to the forex market’s high volume of activity and the fact that trading occurs continuously.

If Apple stock is listed on the NASDAQ, and the NASDAQ closes for the day, you won’t be able to trade Apple until the next day, when the NASDAQ reopens.

It makes no difference if other stock exchanges are open on the other side of the world, as those exchanges do not trade Apple stocks.

In comparison, currency trading is not limited to a specific exchange. Currency transactions (AKA forex trades) happen across various institutions around the world.

If one financial center (such as New York) closes for the day, other trading centers around the world are still open and you can trade currencies.

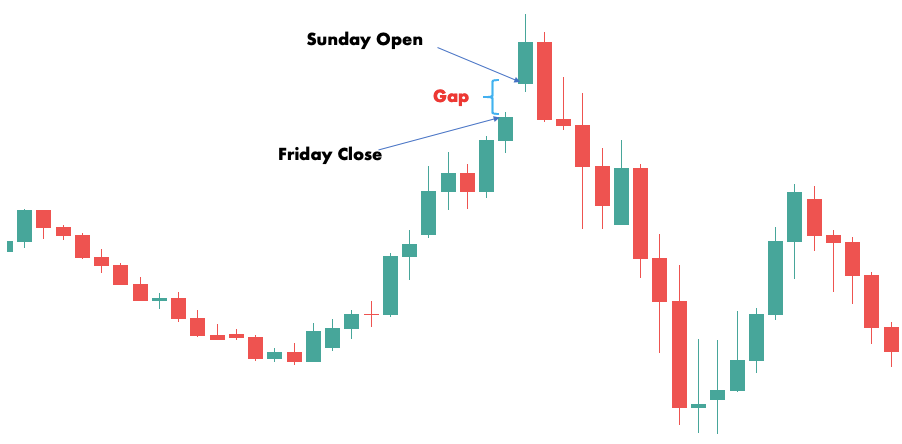

So, the forex market doesn’t really close the way other markets do. When a candle closes, the next candle opens at the same level without delay.However, on weekends, even the FX market is closed. This means the closing price on Friday and the opening price on Sunday can be different. As a result, forex gaps can occur.

What Causes Gaps in the Forex Market?

The answer is simple: Gaps are caused by a drastic imbalance between supply and demand that prompts the exchange rate to jump many pips from one price to another.

Let’s dig a bit deeper.

We already told you that when the market closes on Friday, it might open at a different price on Sunday.

Weekend gaps arise when a noteworthy event takes place over the weekend and the market reopens with a large order imbalance. In such cases, a gap might occur because there are only buyers or sellers and no one to take the other side.

You might be wondering how the market can move from the closing price while it is closed.

Recall that the forex market is decentralized. So, when we said that even the forex market is closed for the weekend, that was only half true.

Yes, most brokers and banks are closed, and retail trading hours normally end on Friday evening. Nonetheless, certain hedge funds and organizations might continue to trade with one another.

Some retail brokers also provide weekend trading for their clients:

This article belongs to ForexSpringBoard.com. Do NOT copy.

So, technically, the market is open 24 hours per day, seven days per week. However, liquidity over the weekend will be almost nonexistent.

When volumes are low, even a single transaction can move the market disproportionately because there is not enough volume to take the other side.

Also, take into account that when the market reopens on Sunday, only Wellington and a few small trading desks will be operational.

Because the majority of traders are not yet active, volume will be low and spreads will be extremely wide, so even the first transaction can result in a significant gap.

Furthermore, not all brokers resume trading as soon as Wellington opens. If the market opens a few minutes before trading restarts at your broker, the initial price you see might differ from the last price you saw on Friday.

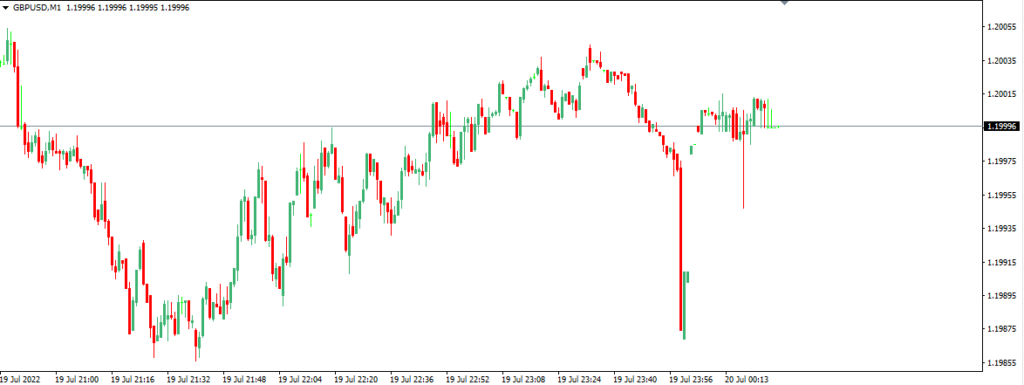

Gaps can also occur during normal weekdays in the “Asian” session when US and European traders are offline and volume is thin. Here’s an example from our MetaTrader terminal.

Finally, key events such as economic data releases, central bank rate decisions, and other major news events can trigger gaps at any time.

Gaps might occur in this case because the interbank market reduces its bids and offers shortly before and after major announcements due to a reluctance to quote with the increased uncertainty.

This leaves retail brokers with no prices to show their clients.After the release, interbank traders adjust their prices, resulting in a higher or lower price gap.

These gaps, together with the Asian session gaps, are normally smaller than the weekend gaps (you might not notice them on the daily chart), but they can cause some headaches.

What Happens When There Is a Gap?

When there is a forex gap and you do not have an open position, the gap will have little effect on you. You might decide to open a trade based on the gap (we’ll get to that later), but the current gap will not influence your balance.

On the other hand, if you have open positions or pending orders, you could be severely impacted.

Assume you’re trading the NFP release, one of the most anticipated monthly events in forex, by opening a small position prior to the release and betting on a price increase.

Further, assume that you, as a responsible trader, set a stop loss a few pips below your entry price.

If the NFP comes in below expectations and the market gaps down, your stop loss might be filled at a lower price than you specified.

In other words, you’ll lose more money than you wanted to risk on the trade.

A similar scenario can arise if you leave your position open over the weekend and the market opens at a different level on Sunday. In this case, the risk is even higher because there could be a larger price change in two days.

The difference between an order price—like a stop loss order—and the actual fill or trade execution price is called slippage.

When beginner traders see slippage, the first thing that comes to mind is that their broker is manipulating the market against them. However, keep in mind that interbank traders are subject to the same slippage risk that you are.

On top of that, slippage is a two-edged sword.

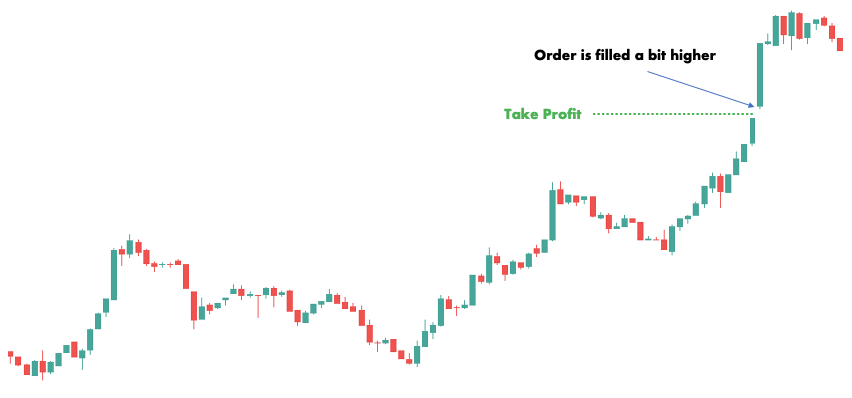

For instance, when you are long and the market gaps though your profit target, your take profit order will execute at a higher price, allowing you to make even more money than planned.

However, the risks of a negative impact are usually too great to ignore in the hope that the favorable and unfavorable scenarios will simply balance each other out.

How to Manage Forex Gap Risks

The most effective way to manage gap risks in forex is to avoid trading when gaps are likely to occur.

While unexpected events can happen at any time, you can identify, in advance, the majority of situations that cause gaps.

The most obvious is the weekend gaps, which you can easily avoid by not holding positions over the weekend.

If you still want to do so, you can at least get flat before weekends with scheduled events such as a G20 meeting or a Chinese data release.

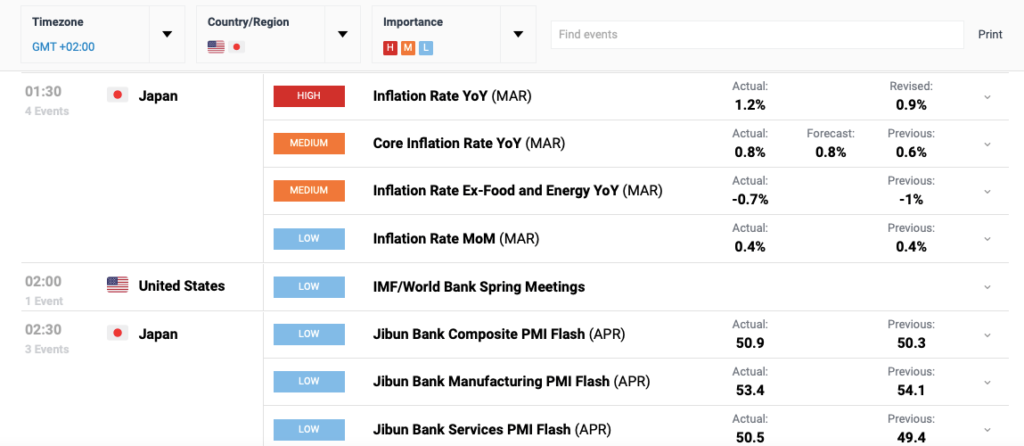

The other type of gap risk stems from volatility around important news releases. You can typically also identify these in advance using an economic calendar.

It will show you when high-impact economic data is scheduled to be published, which means you can avoid trading just before and after the release.

Now, if not trading around events that might cause gaps does not sound like a viable solution to you (perhaps trading news is your strategy), you can mitigate gap risks by decreasing your position size.

For example, if your stop loss is 10 pips on a trade with a high gap risk, you can add another 5 pips to account for possible slippage.

So, instead of calculating your position size based on a 10-pip risk, you will calculate it based on a 15-pip risk. This will result in a smaller position size.As a final thought, you can also somewhat reduce gap risks by abstracting from trading lesser-known currencies.

The Thai Baht, for instance, does not trade as frequently as the US Dollar or Euro, so it is more likely to experience situations in which buy or sell orders accumulate without matching counter-orders, resulting in gapping.

Do Forex Gaps Get Filled?

Unfortunately, there is no clear answer to this question. Sometimes they are filled, and sometimes they are not.

(By filled, we mean that the price has returned to its pre-gap level.)

In general, gaps that are the most likely to get filled are those that occur when the market is significantly out of balance.

This can happen, for instance, when something important occurs over the weekend and there are only buyers or sellers on the market; no one takes the other side.

In this case, a large order imbalance develops, pushing the price away from its Friday close and resulting in a significant gap when the market reopens on Sunday.This gap might then be filled as liquidity returns to normal and the imbalance corrects itself.

Read more to find out how to trade gaps successfully.

How to Trade Gaps Successfully

If you search the internet for forex gap trading strategies, you’ll see that many of them revolve around the idea that “the price always fills the gap.”

They will make simple recommendations such as “go long when the market gaps down” or “go short when the market gaps up.”

Simple methods like these ignore one critical feature of gap trading (apart from the fact that the price does not always fill the gap)—namely, that gaps usually occur when something significant happens.

If you want to trade gaps successfully, a good starting point is to understand what created the gap in the first place. By doing this, you’ll be in a much better position to determine the best course of action.

For example, if you know that the gap occurred because a politician made a disturbing statement, you might figure that it is more likely a kneejerk reaction than a rational assessment of the situation and decide to bet against it.

On the other hand, if news emerges over the weekend that the Euro is about to collapse and the EUR/USD opens with a massive gap on Sunday, positioning for the filling of the gap might be a bad idea.The selloff will most certainly worsen as even more traders race to unload their Euro assets.

So, while you can try various forex gap trading strategies, and some of them might succeed, there is a huge advantage to remaining current on market events and integrating that knowledge with gap trading.

Forex Gap Trading Strategy PDF and Walkthrough

Now that you know what forex gaps are and how to trade them successfully, it’s time to take action.

To that end, we have prepared a pretty neat forex gap trading strategy PDF that you can use to experiment with trading forex gaps.

This PDF includes multiple strategies that you can easily backtest with software like Soft4FX.

(Read this guide if you’re new to backtesting.)

To get the forex gap trading strategy PDF for free, simply fill out the form below.

If you don’t want to fill it out, don’t worry; we’ll walk you through the strategies right here.

The PDF version is just for your convenience (although it contains a surprise strategy that we don’t share here).

Gap Trading Strategy #1: Fading the Weekend Gap

Do you want to learn how to make forex gap trading simple and profitable?

Let’s not sugarcoat it: You must put in the hard work. There’re no excuses. However, the strategy we’re about to show you is extremely effective. Even beginners can master it quickly.

The trade opportunity arises when there is major news over the weekend and the market reopens at a new level on Sunday.

Simply take the other side of the gap when the market reopens.

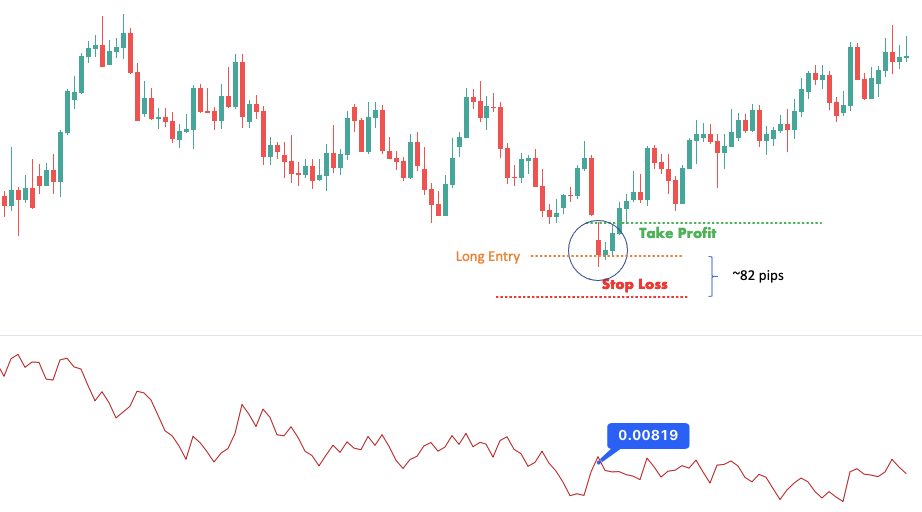

Put your stop loss one average daily range away and close the trade when the gap is 90% filled. You can use a technical indicator called the ATR to see the daily range.

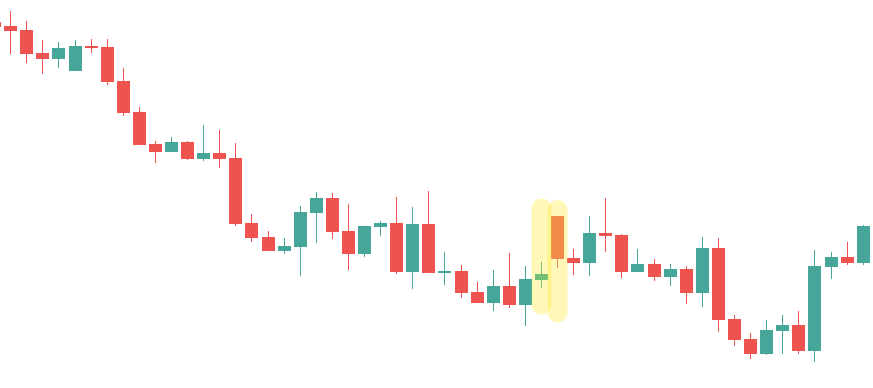

Here’s an example:

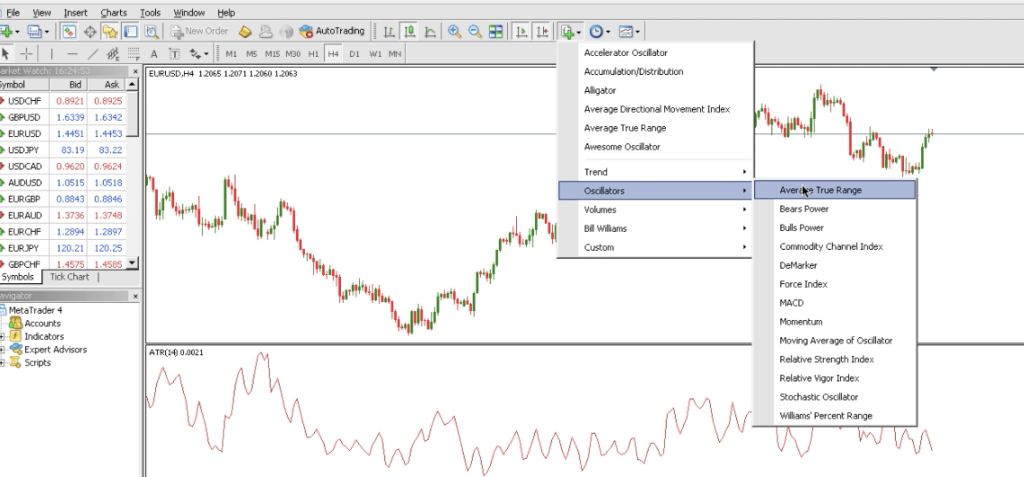

The reddish line at the bottom is the ATR indicator.

If you’re using MetaTrader, go to the indicators list, click “Oscillators,” and then click on the Average True Range.

After you’ve applied the indicator, you can see the reading. A number of 0.0050, for example, indicates that the currency pair moves 50 pips on average during the day.

This technique has the advantage of being simple, and it is easy to backtest or automate with a script.

Now, if you want to completely supercharge it, remember to utilize what we mentioned a little earlier when discussing the key to successful gap trading.

Dig into the news, analyze the market, and determine which opportunities to trade. Be smart about your trading!

Gap Trading Strategy #2: Trend Trading with Gaps

Many traders love to trade trends. If you fall into this category, gaps can be a good addition to your toolset.

The truth is, nobody wants to buy at the top or sell at the bottom. That is why traders wait for retracements to enter the trend.

And what better retracement than a massive gap down in an uptrend or a massive gap up in a downtrend?

When the trend is strong, such gaps are similar to flash sales. They allow you to enter the trend at a better price and are often filled very quickly as traders catch on to the opportunity.

In a nutshell, here’s how the strategy works:

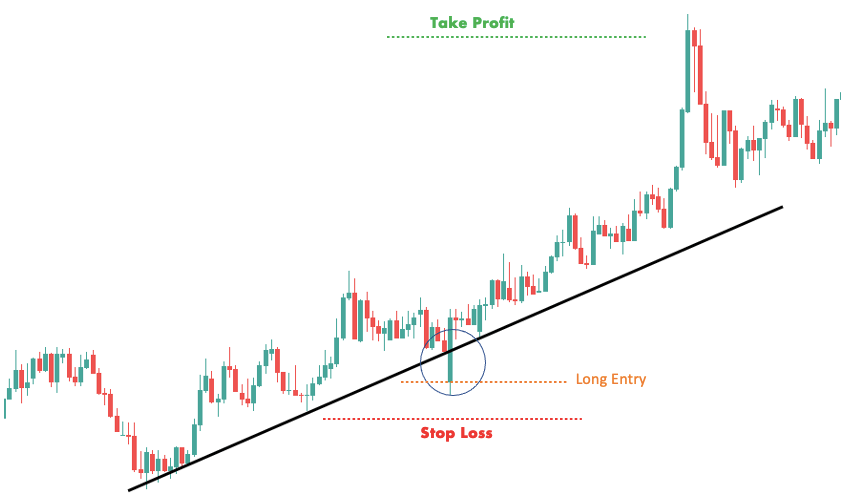

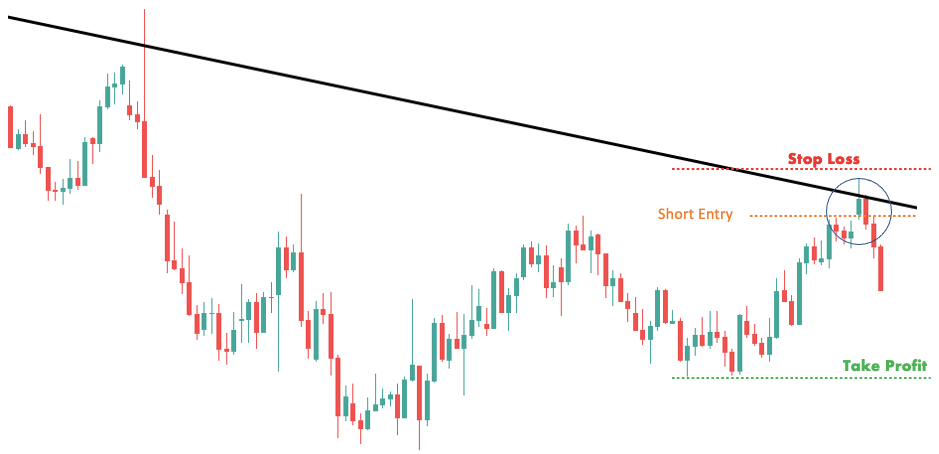

First, check that the market is trending. There’s an uptrend when the market makes higher highs and higher lows. There’s a downtrend if it makes lower highs and lower lows. You can easily identify both situations with a trendline.

If you are uncomfortable drawing trendlines (which you should not beif you read our guide), you can use a moving average instead. If the market is rising, it is above the moving average; if the market is falling, it is below the moving average.

Once you know the trend, the rest is easy. If the market is in an uptrend, wait for a gap down, then go long.

If the market is in a downtrend, wait until there is a gap up, then go short.

Place your stop loss above or below the gap (depending on the trend) and your profit objective at the nearest support/resistance.

Gap Trading Strategy #3: [Locked]

The final strategy for today is a surprise included only in the gap trading strategy PDF file, which you can get for free by filling out the form below:

So, if you haven’t done so before, now is the moment.

Conclusion

This guide covered a lot of ground, including what causes gaps in the forex market, how to manage gap risk, gap trading tactics, and much more.

While gaps are less prevalent in the forex market, they still exist and can hurt you if you are unprepared.

Fortunately, the vast majority of forex gaps can be predicted because they occur when volumes are low, such as when the market starts on Sunday, during the Asian trading session, and just before important news releases.

When you know when gaps are likely to occur, you can either avoid trading during those times or trade with reduced position sizes. You can also wait for the gap to appear and then exploit it using the strategies we mentioned.