Do you struggle to be consistently profitable?

The fact is, even if your strategy rocks, you could still be driving away results by neglecting one simple thing.

If your trading style is inadequate, your performance might not reflect your strengths. What’s even worse is that it can lead to self-doubt, losses, and disappointment.

It may prompt you to look for a better strategy. But that’s not going to help, as the root of the problem is not your strategy.

It’s the wrong trading style.

The good news is that today you’ll learn how to fix that.

In this post, we have broken down the different trading styles and discussed who should choose each.

Before we dive into that, let’s find out what a trading style is, so that we are all on the same page.

What is a trading style?

A trading style is a particular manner of trading, typically determined by the length, timing, and frequency of your trades.

What it looks like varies from trader to trader. Some prefer short-term trades while others swear by a buy-and-hold approach.

There’s no one best solution here.

People have different circumstances, personalities, and lifestyles, so there has always been a range of approaches to trading.

Fortunately, there are common characteristics that allow us to group these approaches according to what we call “trading styles.” So, instead of taking the “just jump” approach, you can investigate what works for people in shoes similar to yours.

In other words, you can choose the most suitable trading style upfront and spare yourself the trial-and-error part.

Sound good? Keep reading.

What are the different trading styles?

This is where things get more exciting.

In the following, you’ll learn about:

You can use the links above to navigate between sections, though we recommend that you carefully read them all so that you can make an informed decision.Day Trading

Buying and selling securities during the same day is one of the most popular trading styles in the forex market.

Technical analysis makes it easy for people to come up with different strategies without immersing themselves in fundamentals such as GDP, employment numbers, interest rates, and more.

In practice, day traders rely heavily on active markets. They like currency pairs that bounce around a lot so that the possibility exists of making short-term gains.

Keep in mind that forex transactions occur all over the world, so there’s no formal end of the trading day. As a day trader, you want to be flat before the New York market closes or simply before you go to sleep.

Currency pairs

Most day traders trade the major currency pairs, as these move decently during the day and have tight spreads. The latter is important for minimizing commissions.

There are slightly different opinions with respect to a definitive list of major currencies, though usually we have the traditional “four majors”:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

And the three most-traded “commodity currencies” against the US dollar:

- AUD/USD

- USD/CAD

- NZD/USD

Advantages of day trading

Beyond the exciting features (i.e., watching every movement of the market and making fast money), there are plenty of factors that can make day trading a great choice.

Take overnight risks, for example. There are none. At the end of the day, you know whether you won or lost. You can go to bed with the calming thought that the market can’t hurt you while you’re sleeping.

Aside from that, day traders frequently enjoy low dollar risk per position, as small moves need tight stops. And what about freedom? Day traders make their own work hours without a boss standing behind their backs.

Disadvantages of day trading

Now we get to the drawbacks. It’s all well and good to make money from your home but how exactly does that play out in reality?

A serious issue with day trading is its time commitment. Once you have your strategy, you must stay glued to your computer screens all day long. Then, on the weekends, you have to analyze yourself and make improvements.

Day trading is not only time-consuming but also stressful. You have to watch your account value fluctuate up and down while dealing with the ever-present temptation of overtrading and deviating from your plan.

(That’s one of the many reasons why most people fail as day traders.)

Sound challenging? Day trading is not always full of action. In fact, it can be boring. Sometimes you have to sit tight for a long time when nothing meaningful happens.

Also, don’t expect to make huge gains per trade. You will miss out on large movesbecause you must close your positions within a short period.

Who should be a day trader?

Lots of people day-trade. However, that doesn’t necessarily mean that you should be a day trader. It’s not just a blind decision you make; some factors must be taken into consideration.

Without a doubt, the first thing you must consider is your personality.

Do you feel comfortable in a fast-moving environment? Can you remain calm in stressful situations? Are you disciplined enough to stay focused throughout the day? These are the questions you should be asking yourself.

Then comes time. You must have time to monitor the market throughout the day.

If you have a full-time job, day trading is most likely not for you. You can’t focus and think clearly when you’re surrounded by other tasks. Your workplace performance will suffer and so will your trading account.

This brings us to the next point: Money.

And, no, we’re not talking about trading capital. If you want to trade, it’s only natural that you need money for trading.

What we mean is having a safety net of savings so that you’re not going flat broke in the beginning when you can easily rack up trading losses without having a regular income to rely on.Okay, that’s day trading. Now it’s time to talk about position trading.

Position Trading

The motive behind a position trade is to capture as big of a portion of a trend as possible. Unlike day trading, position trading involves holding a trade for a long period of time – often months or even years.

This makes position trading very similar to investing, though position traders can also benefit from falling prices.

The key is to have a firm understanding of the economic data that may affect the supply and demand of currencies. Technical analysis is used only for finding optimal trade entries and exits.

Currency pairs

Position traders can trade everything.

Of course, that doesn’t mean they wouldn’t narrow down their attention to only a few pairs. They do. It’s just that they don’t have to worry about spreads or finding the most active pairs.

Sounds awesome, right?

Well, it is. But, ultimately, you are in charge of following the situations of the underlying economies. Thus, it makes sense to choose pairs with which you are familiar.

For instance, trading your local currency against other currencies is a safe bet. One could even argue that you have a competitive advantage here because you can spot trends and developments that are not immediately apparent from a global perspective.

Advantages of position trading

Among all the trading styles that this guide discusses, position trading has, by far, the lowest time and stress factor.

Day traders spend hours in front of the charts every day but position traders don’t have to worry about daily price fluctuations. There is also the added benefit of avoiding high transaction costs.

What about catching the largest trends? You know, the massive monthly or even yearly trends like this one:

Generally, other trading styles are incapable of that. Then you have position trading, which allows you to make a boatload of money off these movements – if you do it right.

In fact, you can lose only by making the wrong bet. It may sound obvious but ask a day trader how many times he or she traded in the right direction but was stopped out prematurely by random market noise.

It happens all the time when you work with tight stops. Position traders are much less likely to suffer from this.

Disadvantages of position trading

Now that we’ve covered how great position trading can be, it’s time to look at its less-bright side.

If we could state only one thing that drives most people away from this trading style, it would be capital requirements.

No matter how patient, disciplined, and knowledgeable you are, wide stops mean an increased risk per trade. If you don’t have enough capital, you will get margin called.

If that weren’t bad enough, there’s the opportunity cost. It’s an economics concept that says each time you choose to do something, you lose out on other alternatives.

In the case of position trading, your opportunity cost is that your capital will be tied up for a long time, which means you might miss out on better opportunities to make money.

By the way, did we mention economics?

You’re better to be an expert in it. It’s kind of long and extensive but you must understand how fundamentals affect the forex market.

We don’t want to discourage you but it’s only fair to mention one more serious drawback to this style: slow self-development.

It’s common sense: The more experience someone has, the better it is. By the third time you make the same mistake, you’ve gotten the message. But what if you make only a few trades a year? In that case, the learning curve is quite long.

Who should be a position trader?

If you don’t like the adrenaline rush that comes with actively participating in the market, position trading might be an ideal choice for you. It saves you from emotional ups and downs while leaving you with more time in your hands.

You should have extensive knowledge of the markets. Thus, a degree in business or a related subject can be a great advantage. This will allow you to do things based on your observations rather than to just go along with the thoughts of others.

This is what is called independent thinking.

Independent thinkers often make great position traders because they are the first to recognize new trends and have the courage to go against the crowd when needed.Swing Trading

Swing trading is the sweet spot between day trading and position trading. It involves holding positions from a couple of days to up to several weeks.

The primary goal is to catch an upward or downward “swing” in the price and close the position as the movement is over.

In terms of analysis, both fundamentals and technical analysis are used but taking action based on the chart is arguably more common.

Most swing traders look for ranging markets, where there are many short movements up and down but the price remains in a channel.

This approach is popular because the risk-to-reward ratio is normally very favorable.

(If you’re interested in channel trading and want to learn two channel trading strategies, check out this guide.)

Currency pairs

Swing trading is the most ambiguous trading style. It’s open to broad interpretation and swing trading strategies come in all shapes and sizes.

Put simply: There’s a great versatility here.

In general, the longer you hold your trades, the less important spreads become, and you can get away with trading more sluggish pairs.

Some popular swing trading pairs are:

- USD/JPY

- NZD/USD

- EUR/USD

- AUD/USD

- GBP/CAD

- USD/CAD

Advantages of swing trading

Even if you don’t have the budget of a position trader, you can still take advantage of larger timeframes by being a swing trader. Larger time frames are more reliable, which means that swing trading isn’t very vulnerable to false signals.

Another major win is that swing trading allows you to analyze the market in a more relaxed manner. You don’t have to hurry like a day trader, nor do you have to spend your entire day in front of computers.

The best part?

If you were about to go down the rabbit hole of learning economics, you might be relieved to find that you don’t need that for swing trading.

Of course, it’s not going to hurt. However, in most cases, it’s enough to simply have an economic calendar in which you can look up the release date of economic events. That way, you can lower your risks or stay out of the market when necessary.

Disadvantages of swing trading

Opening your trades and letting them purr along without your oversight is too great a risk to take. Any swing trader will tell you that you must work hard to manage your positions.

Depending on your strategy, you will need one or two hours for analysis and continuous access to a computer during the day. That way, you’re prepared and you can jump in if anything bad seems to happen.

We talked about economic calendars as a way to reduce risk but there’s no way to rule out all the uncertainty. Considering the prolonged holding periods and relatively close stops, you can see that swing traders are especially vulnerable to shocks and unexpected news.

Who should be a swing trader?

If you want to be an active trader while holding down a full-time job, swing trading is your best choice.

You need some flexibility during the day to find potential trades and check up on your positions but it’s less demanding than day trading.

Because you don’t hold positions for years, there’s the possibility of withdrawing your profits regularly, which is great if your primary goal is to supplement your income (although, you might consider letting your account compound).

In terms of your personality, you must be highly organized. Otherwise, you will have a hard time striking a balance between work, trading, and family time.Scalping

Scalping is an extreme form of day trading but it’s so popular that we decided to discuss it as a separate trading style.

Scalpers open many positions throughout the day but close them within a few seconds or minutes – almost immediately after the trade shows a profit or begins to move in the wrong direction.

This works only with the most active markets. Otherwise, you’ll have a hard time jumping in and out of trades and beating the spread.

Similar to traditional day trading or swing trading (and unlike position trading), you see mainly frequent smaller wins. They’re not super-big killer trades; instead, you get quick bursts of small gains.

In other words, there’s a high win rate but the profits are roughly equal to, or slightly bigger than, the losses.

Currency pairs

Scalpers trade the major currency pairs just like day traders do. In particular, we would argue that EUR/USD is the most popular choice.

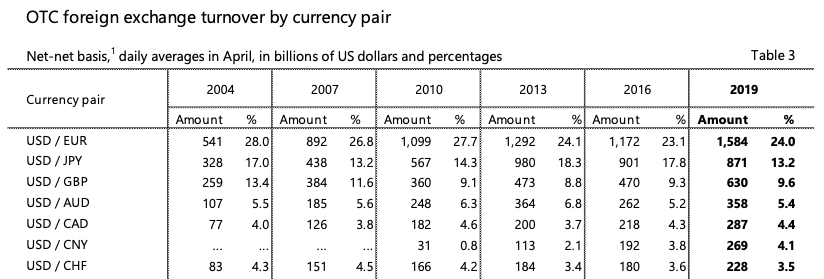

Just take a look at the recent Triennial Central Banks survey:

The EUR/USD (or USD/EUR, as listed here) is the most important currency pair. It has almost twice the volume of the second most traded pair and almost triple the volume of the third most traded pair.

Quite huge!

Now, remember that scalpers depend on high market activity. In this sense, the EUR/USD offers the best environments.

Advantages of scalping

Scalping carries the advantages of day trading, though with some unique benefits.

Those of you who have a hard time dealing with losses will love the fact that scalpers have a high win rate and long streaks of positive days due to the small losses.

Sure, the gains are small, too, but let’s be honest: It feels good to see wins all over your trading journal.

Another benefit is that scalping techniques involve no discretional elements. Therefore, it’s easy to automatize them without modifying the original strategy.

(If you can’t code, you can always hire someone from places like Fiverr to do it for you.)

Finally, because we listed the long learning curve as a disadvantage of position trading, it’s only fair that we do the opposite here. You can quickly gain experience because you spend a lot of time with charts.

Disadvantages of scalping

Basically, you spend hours in front of a screen to pick up breadcrumbs. That’s not to say that small gains can’t add up; it’s just the question of whether or not it’s worth it.

Think about it this way:

You’re sacrificing a large chunk of your time and energy looking for small gains. At the end of the month, you might make more than if you had done swing trading, for example. However, the effort you put in and the marginal gains might be disproportionate.

Even with trading robots, you can’t just make money on autopilot. You still have to manage them smartly; otherwise, things can quickly go wrong.

Also, your trading costs can be amplified due to a large number of trades. Not only that, the constant stimulus can turn out to be addictive for some people.

Who should be a scalper?

Scalping is for people who genuinely enjoy the buzz of the market – people who are excited about seeing the ticks moving up and down and who love hunting for trading opportunities.

If you heard that scalpers make a lot of money or have seen promising YouTube videos and think that you should give it a shot, forget it.

It’s the most demanding trading style and you’re not going to do well if you’re in it only for the money. Enthusiasm for trading, a fast reaction time, and a great deal of discipline are “musts.”

On top of that, you need to spend several hours with your charts, typically at peak hours when the market is most active. Depending on your location, this can be during inconvenient times, such as the middle of the night. Make sure you are aware of the exact circumstances.

How to Choose the Best Trading Style for Yourself

Although we touched on who should choose a particular trading style, it’s not always a straightforward decision. This choice influences everything you do as a trader, so it’s only natural that you will want to think through it carefully.

Because it’s so important that you get this right, we wanted to give you some additional help. We found that the best trading style has three characteristics:

- #1 It fits your personality.

- #2 It fits your circumstances.

- #3 It fits your goals.

You need all three, though the order is important.

Let us elaborate.

#1 It fits your personality

The key is that people have different emotional tolerances and do best with a trading style that gives them the right amount of stimulus.

Consider this example from Forbes contributor Brett Steenbarger:

A common pattern in failed marriages is that one partner seeks action and excitement while the other needs stability and security.

In other words, what is rewarding to one party is threatening and frustrating to the other. We can probably agree that this is not the strongest foundation for a relationship.

If you have low emotional tolerance but your positions give you more ups and downs than you can tolerate, chances are you will lose control and let your emotions interfere.

On the other hand, if you would like action but you limit yourself to slow markets and conservative risk management, you will become annoyed and fall into overtrading.

Take some time to evaluate yourself. After you do, you should be able to cross off one or two trading styles from the list. Then you can proceed to the next point.

#2 It fits your circumstances

Once you know which trading styles work with your personality, you must investigate whether they fit your circumstances.

Your circumstances are things like:

- The time you can spend on trading

- The amount of trading capital you have

- Whether or not you have a day job

- Your time zone

And so forth.

For example, you might think that you would like day trading; however, if you have a full-time job, it’s not the best style for you. Similarly, you might not want to be a scalper if the peak market hours fall in the middle of the night in your country.

You probably get the point, so let’s move on to the last characteristic.

#3 It fits your goals

Most people think only about this part. Scalpers make a lot of money, so they decide to be scalpers.

It doesn’t work like that.

Your goals are important but they should be realistic. That’s why you need to meet the other two criteria first.

Apart from that, there isn’t much to say here.

You might want to support your income, replace it, or just beat returns from the bank (which isn’t very hard nowadays…)

Whatever your goal is, examine it in light of your personality and circumstances and make sure it’s sensible. It’s better to make some compromises than to pursue something you are unlikely to achieve.

Conclusion

If you’re like most people, you probably didn’t put any thought into your trading style.

Maybe you do day trading because people on YouTube make good money at it. Or you go with position trading because famous traders such as Warren Buffet do the same.

Either way, there’s no real logic to it.

If you follow a trading style you don’t like very much, you’ll end up deviating from your strategy. You’ll make losses on losses — and your confidence will plummet.

It doesn’t matter which style you choose. The style simply needs to be the most suitable one for your personality and circumstances. We hope that this guide has helped you make an informed decision.

FAQ

Day trading is buying and selling securities during the same day. The goal is to earn a small profit on each trade without being exposed to the risk of holding positions overnight.

Position trading is comparable to investing, with the difference being that you can take advantage of falling prices. It requires patience but allows you to benefit from the biggest trends in the market.

Swing trading falls between day trading and position trading. You do not focus on intraday fluctuations, nor do you want to catch large trends. Instead, you trade medium-term price swings on charts like the 4-hour or daily.

Scalping is an extreme form of day trading. Basically, you open many positions throughout the day but close them almost immediately after they show a tiny profit or begin moving in the wrong direction.