Do you remember your first forex trade?

If you are like most people, you closed it the moment it showed a small profit.

You were probably thinking that you just made some free money. How cool is that?

It is precisely this feeling that hooks most people in.

At some point, you probably ran into your first big loss, and since then, you have been on a ceaseless quest for a winning strategy.

That’s where smart money concepts enter the picture.

After all, banks and large investors are rich, so they must know something. And guess what? They do.

But it’s nothing close to what you think.

In this guide we will tell you why smart money concepts are overrated, and we will explain the real reason “insiders” are more successful than retail traders.

Let’s get into it.

What are Smart Money Concepts in forex?

Smart Money Concepts (or SMC) are trading techniques that try to take advantage of institutional money flows.

The term “smart money” was first used by gamblers in reference to players who had unusually good track records in things like betting on the winning horse or predicting the outcome of a football game.

These were often the players who had insider knowledge or were exceptionally skilled at calculating the odds and making the right moves. In any case, they bet “smartly,” as opposed to the average person who relied on hints and instincts.

There is a clear analogy between successful traders and successful gamblers, so it’s not surprising that the term “smart money” was later adopted by the trading industry to be applied to money invested by hedge funds, banks, and other wealthy traders with in-depth market knowledge.

So, this is where SMC finds its roots, and its followers essentially try to observe what institutional traders are doing and place their trades accordingly.

That said, SMC is more than just a trading system–it is a unique way of looking at the market.

A complete philosophy if you wish, where conventional price formations have been slightly redefined and given a narrative, often involving a surreptitious entity pulling the strings in the background.

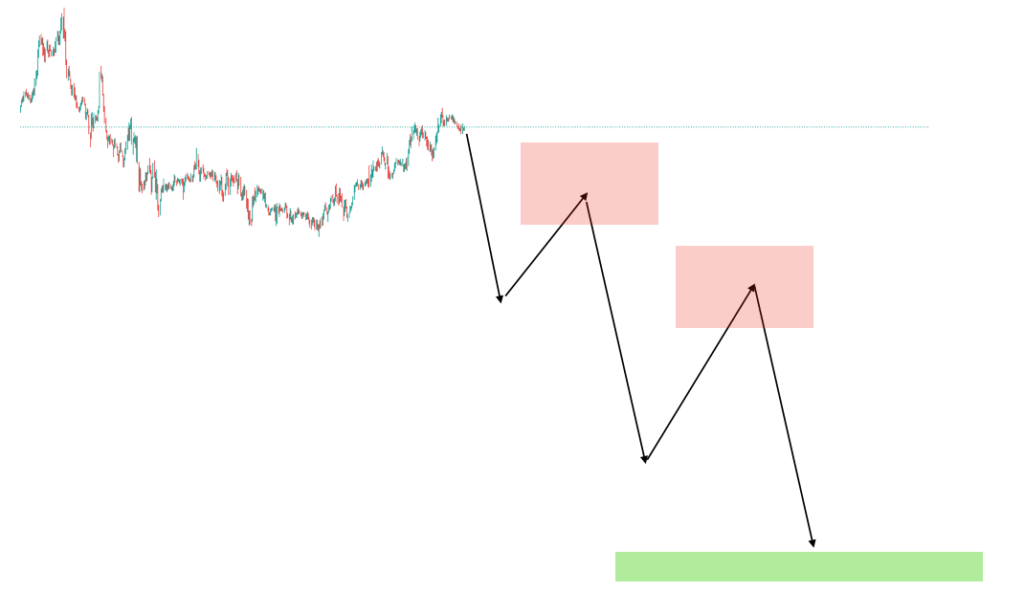

SMC trade idea posted on TradingView by Future_Trading

These changes might or might not turn traditional chart patterns more profitable, and the backstories might or might not be true. Everyone is free to have their own opinions on that, and we are not in the business of trying to discredit strategies that may work for some people.

Our focus is on bringing attention to broader issues with SMC, which most often stem from what traders expect from the strategy, rather than the strategy itself.

Why most people will fail with SMC

To its credit, SMC gives you a structure.

To put it another way, it comes with guidelines and a systematic approach to trading, which is the first step to success.

However, SMC has a fatal flaw that sets most people up for failure.

By its very nature, it makes you focus on the wrong thing.

The truth is, there are legitimate reasons why you have a hard time making money in forex, but if you think that it is because you don’t know some insider techniques, then you are probably wrong.

Making money is usually not a linear process, as some people think. Some days and weeks you may win most of your trades, but there are also periods when you are hit with plenty of losses.

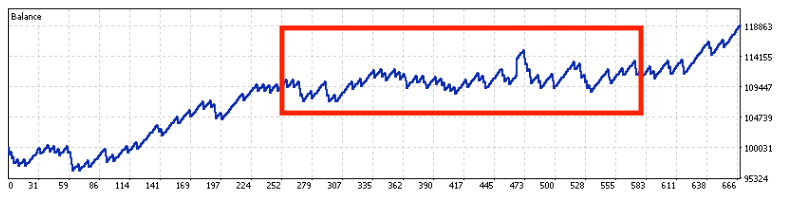

Just look at the performance of our Stochastic Oscillator Strategy:

You can see that trading the strategy is not particularly rewarding about half the time, despite the fact that it eventually generates profits (or at least did during the time we backtested it).

This is not a cause for concern. It’s normal even for professional traders to have ups and downs.

While it is a simple thing to understand conceptually, most people can’t internalize this well enough, and they fail to detach themselves from short-term performance swings and accept the realities of trading.

Instead, what usually happens is something like this:

People run into a series of losses, panic, and abandon their strategy.

Then go on to search for better strategies, only to be met with further disappointment as those new strategies also fail to live up to their expectations.

Does that sound familiar?

You have probably been through this yourself, and at some point, bumped into SMC trading with its obscure terms and techniques which sparked a light of hope.

You were probably thinking something like: “I have never heard about these things; this must have been the reason I was losing money.”

But is it? Keep on reading…

Can you make money trading Smart Money Concepts?

We have to admit, we are usually skeptical of things which are rooted in mysterious stuff or conspiracy theories.

That said, even if the underlying narrative is just halfway true, or god forbid, sheer humbug, you can absolutely make money with SMC.

This article belongs to ForexSpringBoard.com. Do NOT copy!

This is due to the simple fact that, as we already mentioned, trading performance is not linear. Just like you don’t make money all the time, you don’t lose money all the time either (even if it feels that way).

In other words, you can take any trading system, and if you trade it for long enough, you will have periods when the strategy makes money and periods when it loses money.

This will be true regardless of the end result, that is, your bottom line, after trading the strategy, say, for a year.

Since it is typically impossible to tell in advance how the winning/losing streaks will spread out, there will always be people who will find SMC concepts to be a revolutionary way of trading that finally made them successful, while others will be left disappointed and thinking it is a scam.

The reality is often neither, but simple math.

Some people will be lucky and experience a handful of winners right at the onset, while others will have a rougher start.

Naturally, these two groups of people will report back very different opinions on how profitable SMC really is.

You will be surprised how many long series of runs random data can have, so even if we assume that SMC is no better in forecasting market moves than flipping a coin, there will still be a few (albeit very lucky) people who can trade it profitably for years before the probabilities eventually catch up with them.

Nevertheless, you can’t realistically count on that, so you must instead figure out whether SMC is statistically profitable.

Put another way:

If you want to trade SMC, you need to determine the odds that SMC techniques have in terms of producing above-average returns.

You can’t just listen to people on the internet because: 1) They usually only want your money, and 2) Even if they are genuine, they rarely offer the kind of empirical support necessary to distinguish SMC trading from just another up-and-coming system you can try your luck with.

So basically, you either acknowledge that SMC isn’t worth your time and energy, or you run your own tests and see if it would have been profitable in the past.

Once you have enough data from your own tests, you will be able to guess whether or not you can make money with SMC (in the long-run) and under what circumstances.

We know that this is not the quick fix (and riches) you may have hoped for from SMC, but this is pretty much the only way one can potentially find success with the system.

We have a detailed guide on backtesting manual trading strategies, so that is an ideal place to start if you want to dive deeper.

Why insiders are more successful than retail traders

Retail forex traders have a tendency to believe that bank traders have a secret method they employ to profit from the market whenever they please.

In our experience, reality is a bit different.

On one hand, banks do have their strategies. On the other hand, these strategies are hardly risk free, and they rely much more on the skills and collective knowledge of the banks’ traders than on some combination of indicators or chart patterns.

Most retail traders are so focused on finding the right tool that they completely forget about the simple fact that the edge of professional traders might just come from understanding the market better than everyone else.

Just consider that the average trader of a bank has at least a bachelor’s degree in finance, data science, or something related, years of experience under their belt, and access to expensive data feeds as well as high-speed execution platforms.

On top of that, these people are literally paid to read economic data and spend their time spotting every conceivable relationship in the market.

Do you think it is a surprise that they do better than someone tossing in a trade from their phone during their lunch break?

Probably not.

The strategies bank traders have are often simpler than retail traders think and, above anything else, rely on their superior market knowledge.

For example, since they have time to read through every central bank report and watch the speeches of spokespersons, they likely have a better idea of the direction of interest rates than you currently have.

Now since they also happened to have studied some economics, they know that interest rate cuts have a negative impact on the exchange rate.

So, for example, if they know that data points to the possibility of an impending interest rate cut, they can begin to run models to estimate how far the exchange rate might fall after the announcement.

(Oh, did we forget to mention they also know statistics?)

After figuring out that a longer downtrend is plausible, they can then begin to think about ways to profit from this.

For example, they might devise a strategy to sell into every upward correction in the following week until the estimated exchange rate adjustment fully commences.

They might use technical indicators to time these trades, but their edge does not come from the indicator showing a sell signal. It comes from understanding the trading environment.

This is just a simple example, but we hope it helps you understand why most trading strategies like SMC are overrated.

The market is so fluid and ever-changing that trading systems need to be constantly adapted and optimized to remain competitive.

The likelihood of you finding something which works well indefinitely is almost non-existent.

Thus, you are probably better off learning about the market, remaining agile, and creating trading ideas which try to capitalize on whatever state the market is currently in.

After all, this is what makes smart money so smart.