If you want to be a successful forex trader, you must develop certain traits.

But with so many things to pay attention to in this area, it can be tough to determine exactly what these traits are. On top of that, knowing is not enough; you also need a solid plan to form new habits and work on your trading attitude.

That’s why you must read this guide.

We’re going to examine the most important traits of successful traders. Each point contains a step-by-step action plan that you can start implementing right now.

This guide is useful to everyone, but traders who are struggling to see results will benefit from it the most.

So, without further ado, let’s get into it.

Winning Attitude

Your attitude is important.

In fact, according to a research from Stanford University, having a positive attitude might be even more important than being blessed with a high IQ.

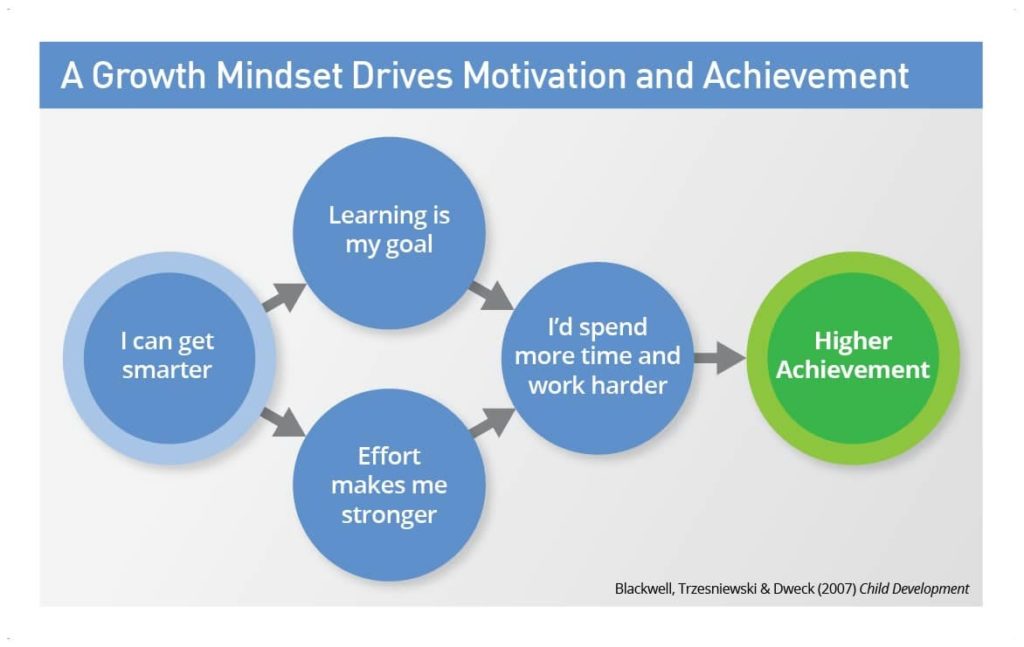

After studying the behavior of thousands of children, psychologist Carol Dweck found that human attitude can be divided into two categories: a fixed mindset or a growth mindset.

People with a growth mindset tend to outperform those with a fixed mindset, even when they have a lower IQ, because they embrace challenges and treat them as opportunities to learn something new.

With that in mind, not having the right attitude is a huge blow to your trading business.

Fortunately, there are steps you can take to build it.

Step 1: Make sure you’re passionate about trading.

There are many opportunities out there to earn money online.

Starting a web shop, designing webpages, or doing search engine optimization are just a few of the legitimate businesses you can do from home.

Unless you don’t feel that you truly enjoy learning about trading, there’s really no reason to push it. You’ll probably lose a lot of money and end up quitting anyway.

In case you’re wondering, we’ve listed some signs that trading is for you. Don’t worry if you don’t identify with all of them, but this list should give you some idea.

You’re excited about it

Are you eating, breathing, and dreaming about markets?

Although going to extremes isn’t a good thing, it’s a clear sign that trading is something you care about.

You’re a risk-taker

Taking the right risks could be a game-changer. It could mean the difference between living everyday life and living an extraordinary life.

But not everybody loves to take risks. Do you?

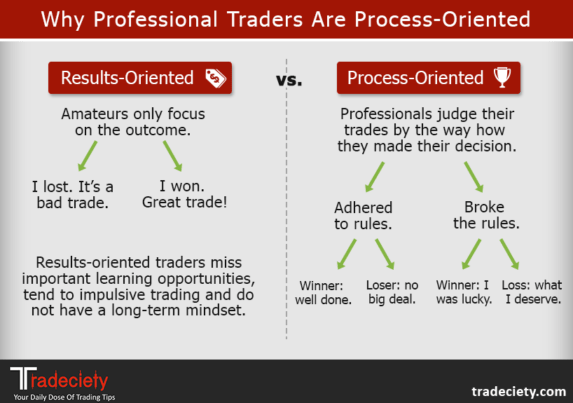

You’re process-oriented

Professional traders tend to have an inner drive to improve themselves. They’re focused on doing everything correctly and on improving their trading skills.

If that’s something to which you can easily relate, you might have an ideal personality for trading.

You’re okay with working alone

Let’s face it: Trading for a living can be a lonely job.

If you prefer working in a large office that facilitates engagement and communication, trading might not be for you.

You prefer active trading

There’s a difference between trading and investing.

Some people enjoy sitting in front of their computer and hunting for trading opportunities. They have an active mindset; they love taking action.

On the other hand, some people would rather buy the right stocks or invest in ETFs, then occasionally check on their portfolios. They have a passive mindset.

There’s nothing wrong with having a passive mindset, but if that’s your situation, then stocks, investment funds, or copy trading might be better options for you.

Step 2: Think positively

This is easier said than done, but it can do a lot for you.

Establishing a routine of positive thinking is one of the best ways to drive results and live a happy life.

You’re going to make mistakes; that’s inevitable. However, instead of regret and self-criticism, think about what you’re going to do next time—turn your failure into a valuable lesson.

You also need supportive and like-minded people around you. Aim to cultivate a positive environment. For example, you can ask yourself: Who are the three most negative people I spend time with?

You can’t let others drag you down.

After all, the results you get are the perfect representation of your level of development and what you must learn to do better.

Discipline

Discipline is excellent because it brings stability and structure into your life. Not surprisingly, it’s one of the most important traits of a successful trader.

Without discipline in everyday life, people would do whatever they wanted. For just a minute, imagine how chaotic it would be.

When it comes to trading, following well-defined rules is equally important. Too many traders have ambiguous strategies and engage in emotional trades, which leads nowhere.

It’s impossible to create an edge over the market if you don’t have clear rules and can’t control your behavior.

With that in mind, let’s see how you can develop a disciplined trading attitude.

Step 1: Define your goals

Goals are essential, as you must have a clear direction in which you are heading. It’s like setting out on a major journey; you wouldn’t go without knowing your destination.

You might want to achieve many things—anything from building wealth to traveling to accumulating a number of sports cars.

What differentiates goals from dreams is a clear plan of action.

Visualizing your goals is important, but it’s far from enough. You could be sitting at home all day wondering about something, but that wouldn’t change much. Goals require actions.

Start by writing down precisely what you want to accomplish.

It might seem unnecessary when you can simply memorize things, but there are scientific reasons why it works. In fact, according to Dr. Gail Matthews, you’re 42 percent more likely to achieve your goals if you write them down.

That’s a pretty good starting edge.

Once you have written down your goals, you must create a plan of action for achieving them. This brings us to step #2…

Step 2: Create a trading plan

A disciplined attitude requires a consistent approach. Your trading behavior must be defined by a set of rules and guidelines that you follow consistently. That’s why you need a trading plan.

For your trading plan to be effective and help you reach your goals, it must cover three main aspects:

- Trading Strategy(ies)

- Money Management

- Trading Psychology

We’ll go into more detail on each of these below.

Trading strategy – Your edge over the market.

A trading strategy is a collection of rules that determine how you’ll enter and exit the forex market. It ensures that you always act in your best interest and trade only the statistically profitable set-ups.

Of course, creating a strategy takes a lot of time and effort. So, if you’re strapped for time, don’t worry. We’ve put together a PDF guide which you can download for free.

(It’s also an excellent chance to subscribe to our weekly educational materials if you happen to be missing out.)

Money management – Survival comes first.

Your trading strategy gives you a slight edge over the market. However, that alone doesn’t guarantee anything; you can still destroy your trading account in no time.

That’s why you must have a solid money management plan in place. Above anything, you must avoid risks that can put you out of business.

This is so important, you should read it again.

With a sensible trading strategy, there are only two ways you can wipe out your trading account:

- By taking too much risk per trade.

- By holding on to losing trades.

If you want to be trading for a long time, you’ve got to be smart. Your risk must be low, around 1% per trade, and your losing trades should be closed as soon as possible.

Trading psychology – Control your emotions.

To be successful in forex, you must be calm and objective in all circumstances. How do you plan to do that?

Start by backtesting your trading plan. Test drive your strategy on past prices by following proper money management. When you know what results your system can produce in the long term, you’re more likely to stick to it.

Then, you must take some time to answer questions like:

- How many consecutive losses can I mentally tolerate before I have to take off a couple of days?

- What will I do to maintain a healthy work-life balance?

- Will I listen to music or do I prefer to trade in quietness?

- How frequently will I trade?

- …

You’ve got the hang of it.

The point is to write down everything you must do in different situations.

When trading a live account, you want to function like a robot. That’s how you can stay away from the emotional roller coaster that most traders can’t stop riding.

Step 3: Backtest your system

Let’s get back to talking about backtesting.

Backtesting has almost become a cliché, but it’s still worth mentioning over and over again because this advice is the foundation of a successful trading business.

Simply put: You must trust in what you’re doing.

Backtesting your system can help ensure you’re not wasting any time following something that doesn’t work.

This will boost your confidence and you’ll be less likely to deviate from your plan, even in uncomfortable situations.

If you want to keep things cheap, we recommend using TradingView’s market replay feature.

On the other hand, if you have an extra few hundred dollars, this professional backtesting software will save you time and it has amazing features you won’t find in budget solutions.

(Please note that we get a commission if you purchase through our link. This helps us produce amazing content for free.)

Step 4: Be flexible

Once your trading plan is ready to use, you must follow it.

However, the forex market is constantly changing. What used to work well a year ago might not work now.

A disciplined trading approach means you must obey your rules. It doesn’t mean you shouldn’t tweak them if they no longer make sense.

We’re not saying you must modify your plan every time you have a losing trade. Just make sure you know what to expect from your system and be on alert when things appear to go wrong.

Taking Responsibility

Being a successful forex trader means being able to take on responsibility.

Remember, there are no rules when it comes to trading. You must create those rules.

When you trade without rules, it’s very easy to take credit for the profitable trades. After all, you don’t just open a position out of the blue; there are always some methods.

Unfortunately, it’s also quite easy to sidestep taking responsibility for trades that didn’t go as planned.

There are so many influences on forex rates that something unexpected always happens. It’s simply more convenient to blame the market or your broker for your losses.

This approach sucks because you never end up learning from your mistakes.

Ideally, you must spend nearly as much time analyzing yourself and your performance as you do analyzing charts. This starts with your taking responsibility for the outcomes of your actions.

Let’s see what steps you must take:

Step 1: Accept the uncertainty of the market

The truth is, any trade can be a loss. Even the best possible set-up on earth can turn against you and cause you to lose money.

Even worse, there’s about a 50% chance that this will happen.

You can create a strategy that overcomes random probabilities and earns you money in the long run. However, you can still experience a series of bad results here and there.

This is something you must accept. It’s part of the process.

Step 2: Stop blaming

Let’s be honest:

What causes you the most trouble isn’t the uncertain environment but, rather, your tendency to deviate from the trading plan.

If you’ve been blaming your circumstances, your broker, your colleague, the economy, or the bad NFP report … you’re doing it wrong.

Blaming keeps you in victim mode and deprives you of the possibility of improvement.

Your primary focus must be to identify what went wrong so you can learn from the situation and become a better trader.

Step 3: Treat trading as a business

Trading isn’t just a hobby.

Although it’s different from traditional brick and mortar businesses, it’s still a business.

There’s a huge deal of planning and experimenting, plus you must put your capital at risk. If this weren’t enough, you must also make all sorts of important decisions every day.

This is what CEOs do.

Even if you’re not trading full-time, you must think about your trading as a real business of which you’re in charge.

Accountability

As the sole leader of your business, you are 100% accountable for any failures, as well as any successes, that you may have.

Now, the difference between responsibility and accountability might not be immediately apparent. The key difference is that responsibility can be shared while accountability cannot.

In other words, if you’re accountable, you’re not only responsible for something but also being answerable for your actions.

This will help you evaluate and enhance your performance.

Enough talking. Let’s see what you need to do.

Step 1: Create a trading journal

A trading journal is a document in which you enter your trading data to monitor your performance and behavior. It’ll show you where your weaknesses and strengths are.

That is, if you accurately track your trades all the time.

There’s no need to buy expensive software; you can use the free LibreOffice, or Microsoft Excel if you already have an Office subscription.

Simply create a new document and start entering your trades into the spreadsheet. There are no universal rules about what you should include, as every trader has a different system.

Along with basics order details, write down anything you feel will help you. Here are some ideas to get you started:

- Order ID (Who knows? It may come handy…)

- Currency pair

- Position (Long/Short)

- Type (Market order, limit order, etc.)

- Size

- Open price

- Open date

- Take profit

- Stop-loss

- Risk-to-reward ratio

- Close price

- Close date

- Result

- Why you entered the position (Example: There was a breakout from an important zone, which made me pay close attention. The price then retested the zone and printed a strong bullish candle which triggered my “retest” strategy.)

- Why you exited the position (Example: The price reached the TP.)

- The thoughts, hopes, and concerns you had before opening the trade and while the trade was open

Once you create the template, you can spice up the boring numbers with a bit of design:

Include screenshots from charts before and after the trade. This will help you better analyze your trading data.

Step 2: Tell a friend about your trades

It’s proven that when you’re accountable to someone for doing what you said you’d do, you’re more likely to succeed.

The American Society of Training and Development found that people are 65 percent more likely to meet a goal after committing to another person.

This number increases to 95 percent when they regularly review their progression with their partner.

This is how powerful social expectations are.

If you’re not taking advantage of this, you’re missing out on a huge opportunity.

So, pick a trustworthy friend and explain your trading plan. Describe the trades you can take, your risks, your money management rules, everything.

Then, every time you get together, spend a couple of minutes going over your trades.

Even if they aren’t really into trading, your friend will see whether you’ve deviated from the plan. The desire to avoid embarrassment alone is enough motivation to get you to commit to it and get it done.

Conclusion

If you want to master the traits of successful traders, remember that you need a winning attitude. This is the basis of everything.

That way, you’ll find it easier to form and maintain the kind of discipline that a successful trading business requires.

You must also recognize the power behind taking responsibility for your decisions.

It’s natural that you’d rather blame others, but focusing on what you can’t control won’t get you anywhere. Taking responsibility will. It empowers you and encourages personal growth.

Because trading is quite lonely, it’s hard to be accountable for your responsibilities. That’s why it’s good to involve a friend and keep them updated on your progress.

(It will increase your chances of success by 65%.)

We hope this step-by-step guide to developing the traits of successful traders has been helpful and inspiring.

Follow these steps to replicate the success that other traders have achieved.