“If your account is in dollars and you trade a currency pair with the dollar as the second currency, the value of 1 pip is 10 dollars at one standard lot.”

Blah. Boring.

You’ve probably heard this explanation a million times.

But has anyone ever told you why? And what happens in all the other cases?

If you want to fully understand how pips work, you’ve come to the right place. We will explain everything in plain English and provide numerous examples to help you fully grasp the topic.

We have to warn you that this guide involves some math and more complex concepts.

(Sorry, but that’s necessary to properly explain pips.)

Don’t worry if you don’t understand everything right away.

Take your time, re-read what you need to, and work through the examples.

In this way, you will quickly become conversant in pips.

Let’s get started!

What is a pip in forex?

Let’s start with the basics.

The term “pip” is an acronym for “percentage in point” or “price interest point.” It is the unit of measurement traders use to express how much currency pairs move.

The pip is the 4th decimal point for most currency pairs. For instance, a move in the value of NZD/USD from 0.6162 to 0.6163 is one pip.

The pip used to be the smallest unit that a currency pair could move but today’s quotations are even more precise. Most go out to the 5th decimal place, which represents a fraction of a pip.

Moving from 0.6162 to 0.61625, for example, is a half-pip move.

Now, if you look closely at the above image, you’ll notice that the Japanese yen pairs are outliers. These pairs were traditionally quoted to the 2nd decimal place.

Consequently, whenever the JPY is involved in a pair, the pip is the 2nd decimal, while the fractional pip is the 3rd.

Now that we know what a pip is, it is time to talk about how much 1 pip is in terms of money.

How much is 1 pip in forex?

This question is more complex than it looks like at first sight.

The truth is: It is impossible to tell the value of 1 pip without knowing your deposit currency, the traded currency pair, and the position size.

This explains why most websites simply link to a pip value calculator or give you a generic answer like:

If you trade a currency pair in which the USD is in the second position, and your account is in dollars, the value of 1 pip is:

- 10 USD @ 1 standard lot (100,000 units of currency)

- 1 USD @ 1 mini lot (10,000 units of currency)

- 0.1 USD @ 1 micro lot (1,000 units of currency)

The pip values above are 100% accurate and this is a good starting point for most people, but you’re probably wondering how these values came to be and what happens if some of the variables are different.

So, let’s dive deeper.

Understanding the value of 1 pip

To understand how pips work, it is important to understand a few simple things about the way forex trading works.

So, bear with us for the next few minutes.

You might already know this stuff, but a quick refresher never hurts. It will quickly become clear how the information we will now share relates to pip values.

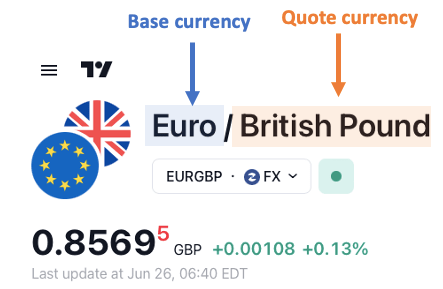

Naturally, each forex quote involves two currencies.

The first currency is the so-called base currency, while the second currency is the quote currency.

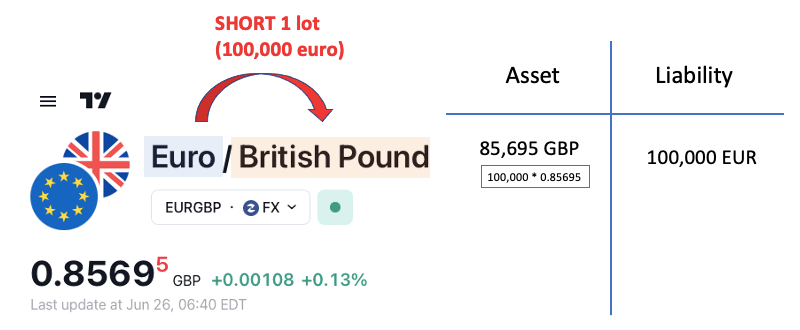

The exchange rate shows how much quote currency we must pay for one unit of the base currency. In the above example, 1 euro costs 0.85695 British pounds.

Buying or selling currency pairs always relate to the base currency.

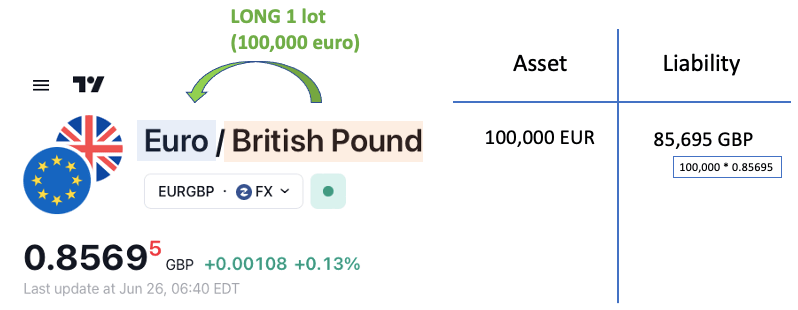

When you buy the currency pair, you establish a LONG position, which means you purchase the base currency with the quote currency.

When you sell the currency pair, you establish a SHORT position, which means you sell the base currency and exchange it to the quote currency.

This article belongs to ForexSpringBoard.com. Do NOT Copy.

Forex trading takes place in a special quantity called “lot.” One standard lot is always 100,000 units of the base currency.

Furthermore, forex trading is done on a margin basis, which means your deposit serves as collateral for opening leveraged trades. This is covered in a separate guide.

When you have a LONG position on a pair, your trading account has an asset in the form of the base currency you purchased and a liability in the form of the quote currency you borrowed to complete the transaction.

You want your asset to go up in value, so when you close the position (sell the purchased base currency and buy back the borrowed quote currency) you can pay off your liability and keep the difference as profit.

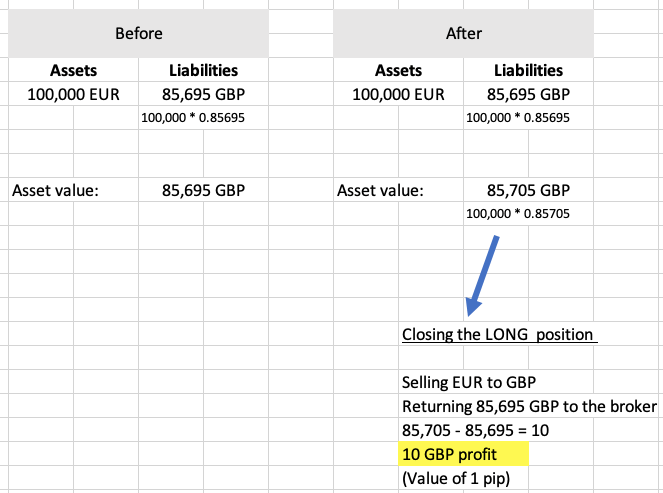

Let’s assume the exchange rate increases from 0.85695 to 0.85705. This is precisely 1 pip.

The following illustrates how the value of your assets and liabilities changes.

In a nutshell, the value of your liabilities did NOT change. You borrowed 85,695 GBP and this is what you owe to the broker, no matter what.

The nominal value of your assets also remained the same 100,000 euro, but it did increase in value relative to the pound.

It is now worth 85,705 GBP, which is 10 pounds more than what you owe to the broker.

So, these 10 pounds will be your profit when you close the trade. They will get added to your account balance in GBP or get converted to your account currency if it is not the pound.

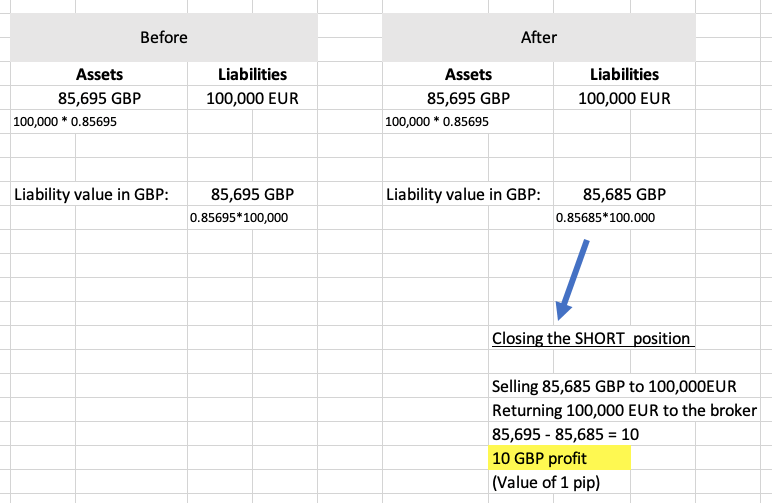

Short positions work very similarly. Only the order of transactions is reversed.

When you have a long SHORT position, you borrow the base currency and sell it for the quote currency.

You have an asset, the quote currency you just bought, and a liability, the borrowed base currency.

You want the exchange rate to go down so that when you decide to close the position, you can buy back the base currency at a cheaper price and keep your remaining quote currency as profit.

Let’s say the exchange rate goes down by 1 pip (0.85695 -> 0.85685).

You can see that the drop in the exchange rate increased the value of your GBP asset relative to the euro, so when you repurchase the previously sold euro and close the position by paying off the liability, you have 10 pounds left as profit.

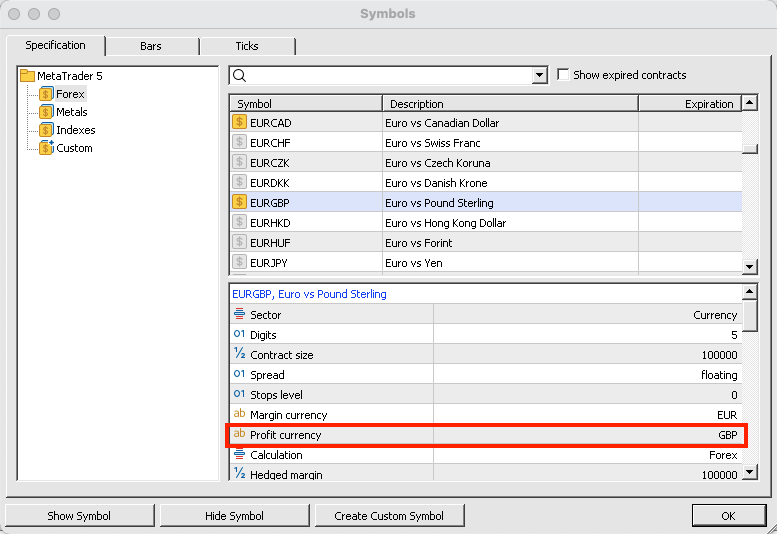

The first takeaway from this section is that the pip value is always denominated in the quote currency.

When closing a long position, you sell the entire one lot you purchased from the base currency, return the quote currency loan, and keep whatever quote currency you left as profit.

In a short position, you sell the quote currency you purchased, and repay the entire one lot of base currency which you borrowed and sold. The remaining quote currency is your profit.

You can verify this in MetaTrader. Just go to the specification of the currency pair and take a look at the profit currency. It will always be the second currency in the quotation AKA the quote currency:

The second takeaway is that the pip is usually 10 units per standard lot because 1 pip represents a 0.0001 change in the rate (save JPY), and 100,000 * 0.0001 will always equal 10 units of currency.

These 10 units will be automatically exchanged to the account currency if it is different from the quote currency.

If this was too much information and you feel confused, don’t worry. We will now look at even more examples on calculating pip values.

How to calculate pips in forex

The preceding section provided an overview of the math and logic involved in calculating pip values.

Now we would like to show you some more examples of how to calculate pips in various situations.

At the end of each example, we will compare our values to those of a pip value calculator to ensure that we did everything correctly.

Feel free to grab a spreadsheet and join us in the calculations!

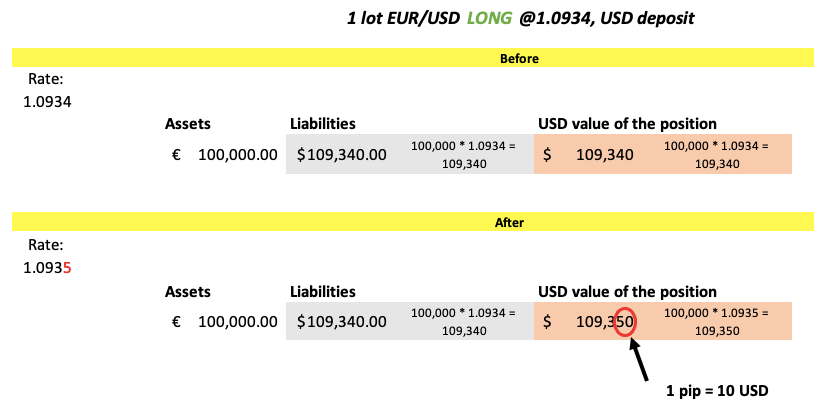

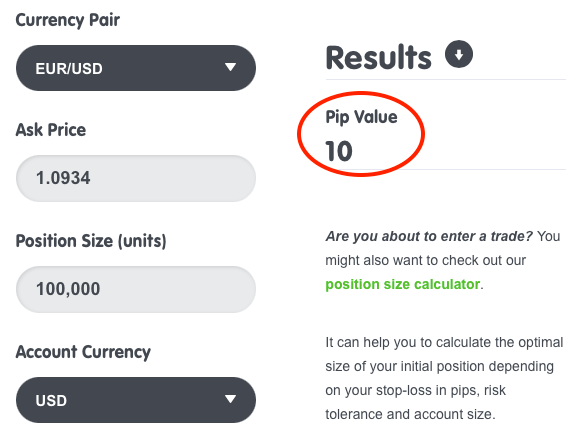

Example 1: 1 lot EUR/USD LONG @1.0934, USD account currency

Let’s break it down:

The first day, we borrow 109,340 dollars from the broker to purchase 100,000 euros. In other words, we acquire a euro asset and a dollar liability.

The second day, the exchange rate increases by 1 pip.

This has no effect on the nominal value of our assets and liabilities. We still have 100,000 euros and owe 109,340 dollars.

That said, our euro is now worth 10 dollars more!

If we close the long position, we simply sell our euros on the market, return the 109,340 dollars to the broker, and keep 10 dollars as profit.

Because our account currency is the dollar, it will simply be added to our balance. No conversion is needed. So, we can see that the value of 1 pip in this case is 10 dollars.

The BabyPips pip value calculator is telling us the same thing:

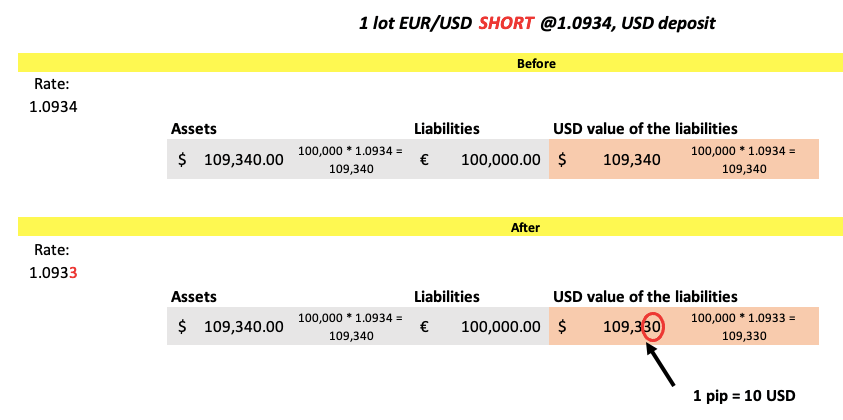

Example 2: 1 lot EUR/USD SHORT @1.0934, USD account currency

Let’s see what the previous example would look like if it was a short position.

Spoiler alert: Everything is pretty much the same. Every forex trade involves a buy and a sale. Here, we only flip the order of the transactions.

Instead of buying euros with dollars, and then selling the euros for more dollars, we first sell euros to dollars, and then buy the euro back at a cheaper price.

So, we are interested in knowing how the dollar value of the euro denominated liability changes throughout the position.

Again, this is because it is the euro that we will eventually have to return to the broker.

We want it to be worth fewer dollars so that we can buy it back for fewer dollars than we received after selling it and pocket the difference.

As you can see, the pip value remains the same, at 10 dollars. The direction of the trade has no bearing on it.

If you scroll up to the previous example, where we included a screenshot of the pip value calculator’s result, you will notice that the direction of the trade is not an input parameter in the calculation, and the value shown is equally valid for long and short positions.

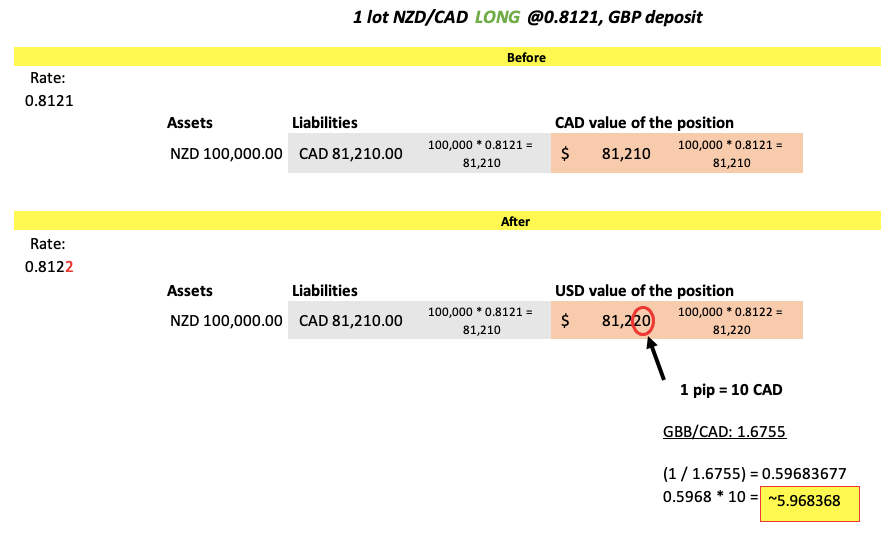

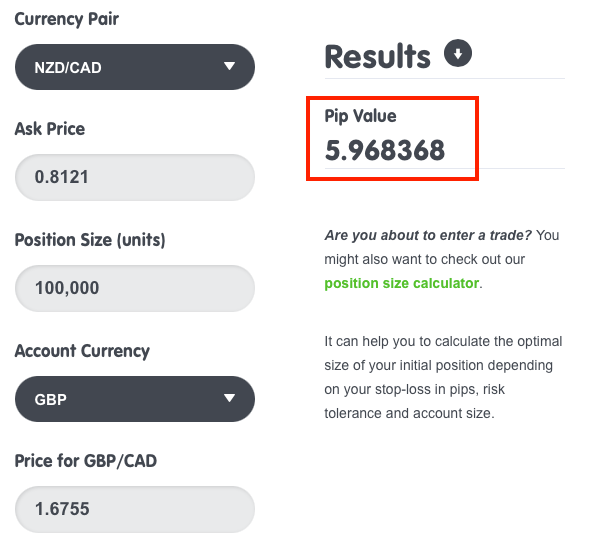

Example 3: 1 lot NZD/CAD LONG @0.8121, GBP account currency

In this third example, we spiced things up a bit!

The currency pair is the NZD/CAD, while the deposit currency is the GBP.

The real twist is not the different currency pair (it has no effect on the calculation), but the fact that the deposit currency is not the same as the quote currency.

The profit and loss for the NZD/CAD is in CAD, but we have GBP in our account.

This means that when the 1 pip change occurs, it generates 10 CAD value, which must be translated to GBP before it can be added to our account.

The currency pair that tells us the relationship between these two currencies is the GBP/CAD. So, we will need to use this rate to convert our CAD to GBP.

What’s important to notice, however, is that the GBP/CAD expresses the value of the British pound in terms of Canadian dollars.

We need the inverse of this because we have CAD and want to know how much GBP it is worth. That’s why we take the inverse of the GBP/CAD rate and multiply it by 10 CAD.

This gives us 5.968368 as the value of 1 pip in GBP – the same as the value that the online calculator gives if we feed it the same parameters.

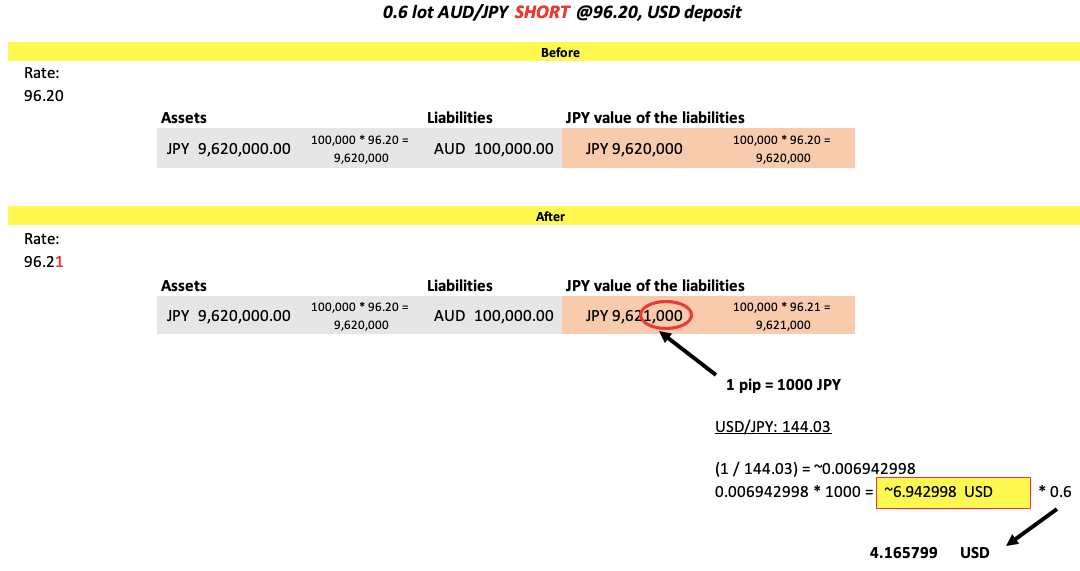

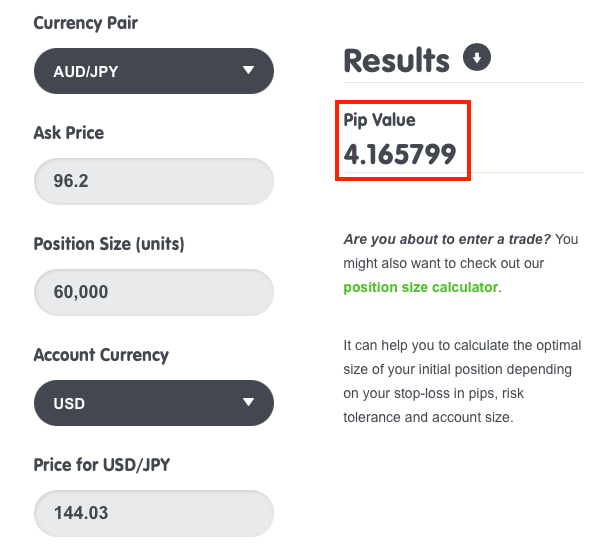

Example 4: 0.6 lot AUD/JPY SHORT @96.20, USD account currency

Finally, we will look at an example involving the JPY, with a position size of 0.6 lot.

Much of the calculation follows the same logic outlined earlier, so we will not go over everything again.

What’s interesting is that the pip value in the case of the JPY is 1000 units, not the usual 10.

You might also notice that we calculate with a 1 lot position size and make an adjustment only at the end of the calculation.

This is probably the easiest way to do it, though it is possible to calculate with 60,000 units and then omit the multiplication at the end.

In either case, you’ll get 4.165799.

Conclusion

This guide might have been a little more difficult to follow, but we hope it has helped you understand how pips work.

The example calculations we presented covered many of the possible scenarios and explained what to do in each case to compute the value of 1 pip.

Although you can always use an online pip calculator, we believe that understanding what is going on behind the scenes is always a good thing.

If you want to learn more useful stuff like this, check out our other free articles.