Some brokers offer leverage of 1:30, 1:50, or 1:100. Heck, some brokers will even let you have leverage ratios in the hundreds!

How do you know which is the best?

The higher the better, right? But is high leverage safe?

Are there any dangers?

Leverage is an important concept in forex, so we are sure you have plenty of burning questions.

Therefore, we decided to write this guide, which explains everything there is to know about forex leverage.

Here’s a table of contents for your convenience. If you don’t want to read the entire guide, you can skip to specific topics.

- What is leverage?

- Why is leverage so high in forex?

- Is it risky for brokers to offer high leverage?

- Do you have to pay back leverage?

- How does leverage benefit the broker?

- High leverage vs. low leverage

- When to use leverage in trading

- How to calculate how much leverage you need

- What is the best leverage ratio to choose when opening a trading account?

- What is the best leverage to trade with?

- Why leverage is sometimes dangerous

Let’s get started.

What is leverage?

Essentially, leverage is a free short-term credit allowance. It lets you trade more money than you have in your account.

The term “leverage” frequently appears with “margin.” A lot of people have a hard time understanding how they relate to each other.

So here it is:

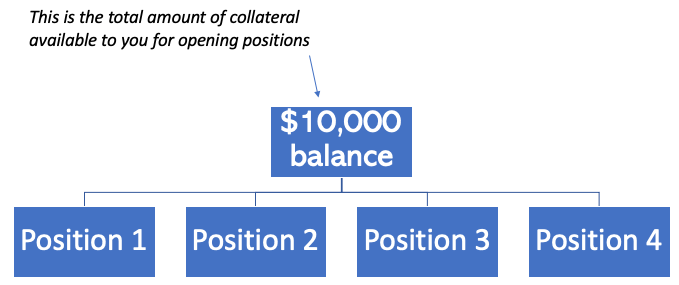

Forex trading accounts are margin accounts. This means that the money in your balance serves as collateral that you can use to open various positions.

Each currency pair has a margin requirement.

It specifies how much of the position size the broker requires as collateral for opening a position on the given currency pair.

Margin requirements are expressed as a percentage, and when you open a position, the corresponding dollar amount will be locked from your balance as collateral for the postion.

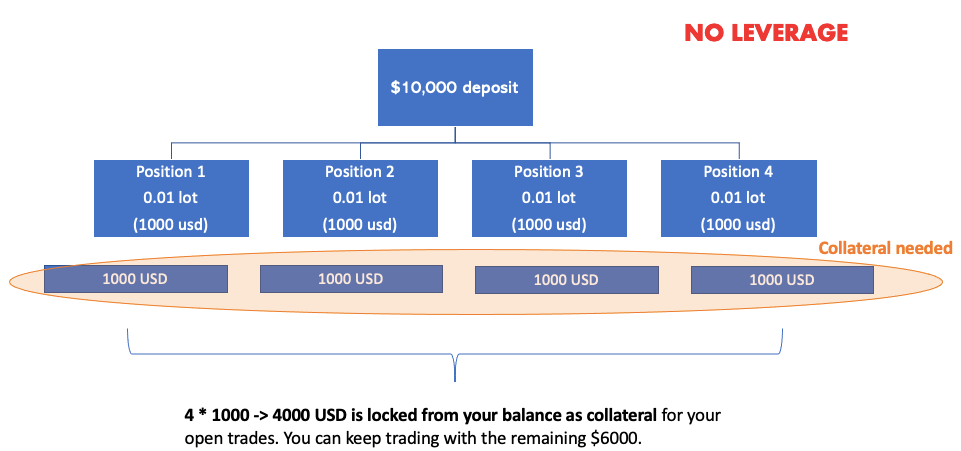

So if your account has no leverage, the margin requirement will be 100% meaning you have to come up with the entire position size, regardless the traded pair.

However, if you have leverage, the margin requirement will be smaller.

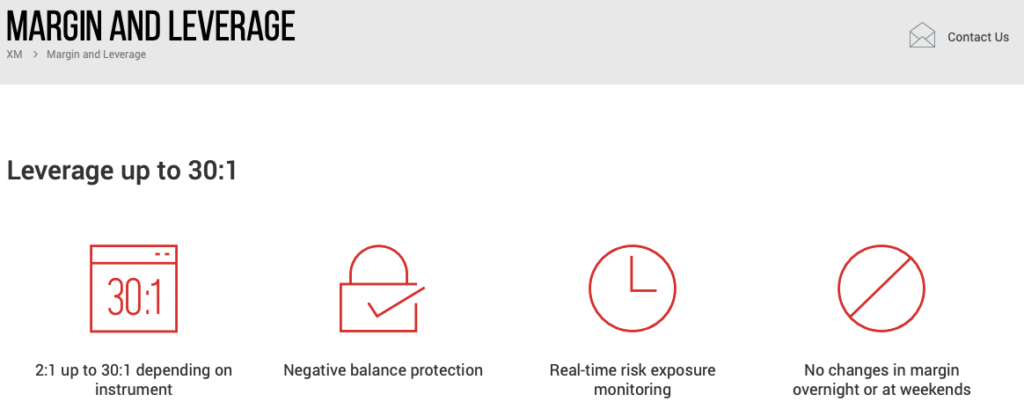

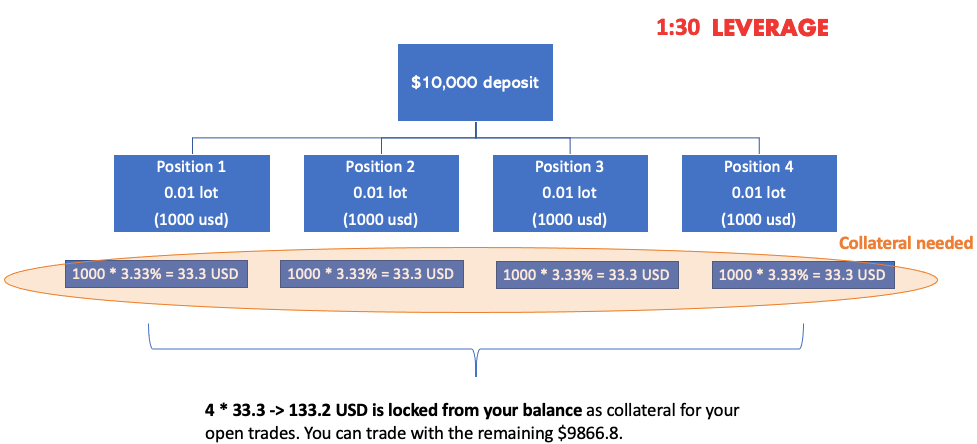

For example, this forex broker provides 1:30 leverage for major pairs.

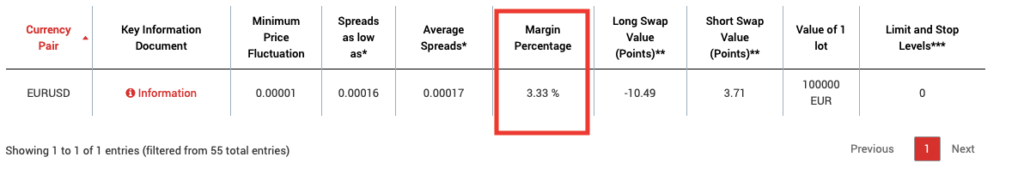

If we look at the asset descriptions, we can also see that the margin requirement for EUR/USD is 3.33%.

This is because, due to the 1:30 leverage, you need to provide only 1/30th of the position size.

In forex, margin is essentially another way of expressing leverage. You can say that for every dollar, you can move 30 dollars (1:30 leverage) or that you need to deposit only 1/30th of a position (3.33% margin).

Both mean the same thing.

To continue with our example, if you want to open 4 positions ($1000 each), you don’t need $4,000. You need only 3.33% of it, or 133.2 dollars.

This is equivalent to using 30x leverage.

(Your 133.2 dollars is levered up to 30 times.)

The broker will open the 4 positions and the 133.2 dollars will be locked from your total margin as collateral for the duration of the positions.

You won’t be able to use this amount to open new trades, but you will be able to trade with whatever “free margin” you have left ($9,866.8 in this case).

Furthermore, when you close a position, the corresponding margin is released, so if you close position 1 from the example, the locked 33.3 dollars will be released and you will only have 99.9 dollars locked as margin for the open trades.

We hope it wasn’t too complicated, but don’t worry if you don’t understand everything right away.

You can read this section once or twice more until you fully understand what leverage and margin are and how they relate to each other.

Why is leverage high in forex?

Forex brokers are known for providing very high leverage to their clients.

Some countries have restrictions but even then the leverage remains fairly high compared to other assets such as stocks.

Why is this the case?

Traditionally, forex was reserved for banks. Although the internet opened participation to retail traders, many of the established norms and traditions date back to the interbank era.

This article belongs to ForexSpringBoard.com. Do NOT copy.

For example, the standard contract is for 100,000 units of currency. This reflects both institutional needs and the fact that currencies move in smaller increments.

On a normal day, the EUR/USD might move from 1.2012 to 1.2070, which translates to 58 pips or $580 at a position size of 100,000 euros.

A bank that can trade this with hundreds of millions of euros can certainly make a decent profit but most retail traders will likely not be able to do so.

So retail forex brokers had to find a way to make trading attractive to normal people. Indeed, they did.

They got into the habit of extending excessively high leverage to their clients. They also introduced smaller lot sizes (mini and micro lots).

Is it risky for brokers to offer high leverage?

A lot of beginner traders don’t understand why would anyone in their right mind would throw a bunch of cash at strangers.

(AKA why do brokers offer leverage?)

This fails to take into account the fact that margin-based trading takes much of that risk off the broker’s shoulders and places it on yours.

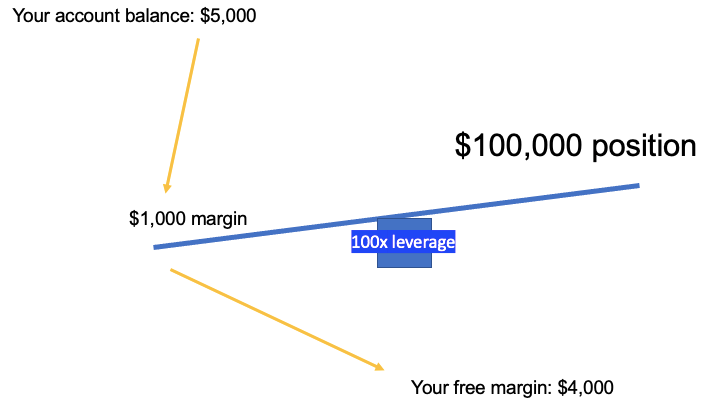

To illustrate, let’s say you want to trade a $100,000 position size but you don’t have the money, so you resort to leverage.

In this case, it’s enough if you can deposit a small portion of the $100,000 portion as collateral (margin). The broker simply hands you the rest, and voila! The position is open.

Here’s a simple sketch of this process:

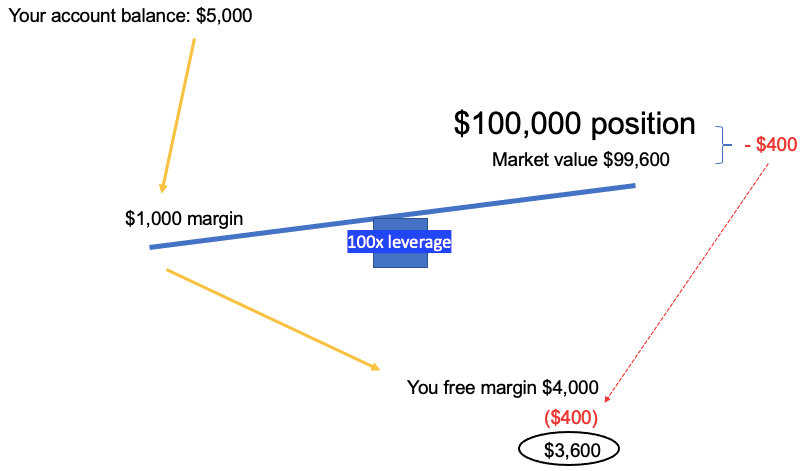

Now say the position goes against you. It is no longer worth $100,000. Perhaps it is just $99,600.

Does the broker take the loss? Nope.

The loss will be absorbed by your free margin as you can see below:

And what if you run out of free margin?

Remember, you had to come up with collateral to open the position.

When your losses are so significant that the only money you have left is the locked collateral, the broker will require you to deposit more (known as a margin call) and then close your position if you don’t comply.

The larger your position in relation to your deposited money, the faster an adverse price move results in a loss large enough to trigger a margin call.

At the end of the day, it is you who bear the risk, as you can keep the position open only up to the point where you can cover all the accumulated losses.

That, by the way, addresses another frequently asked question: whether you must repay leverage.

Do you have to pay back leverage?

In a way, yes, because you are ultimately responsible for the losses.

But don’t worry, you won’t be on the hook for hundreds of thousands of dollars.

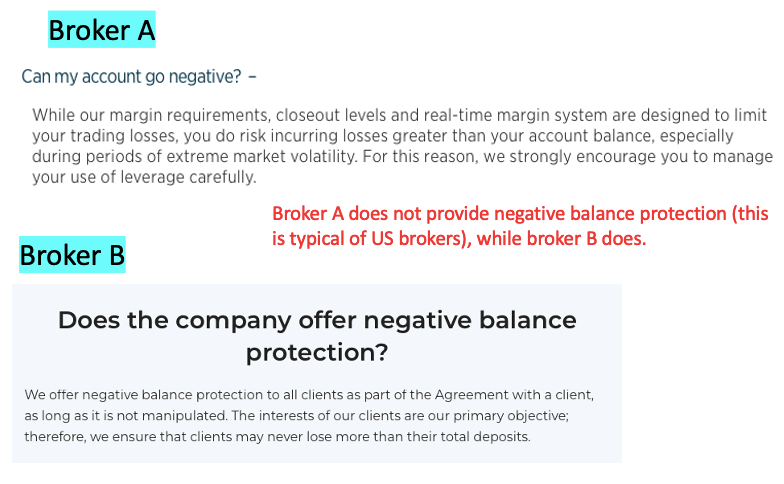

What can happen, however, in some extremely rare black swan events, that the market drops so hard that, despite the margin call procedure, the broker’s system becomes so overloaded that your account falls below zero by the time your leveraged position is liquidated.

So, if you want to be absolutely sure, check to see if your broker offers negative balance protection (many do), so that you don’t incur unexpected losses even in these cases.

But again, it is rare for traders to see their account dip below zero.

How does leverage benefit the broker?

It’s easy to see why brokers are tempted to give you as much leverage as possible.

As we have already discussed, there is almost no risk in giving you access to leverage. There is a lot to gain, however, because you will be able to make larger positions, which means more commission revenues.

Many brokers are also market makers, meaning they trade against you and profit directly from your losses.

Giving leverage to retail clients is such a lucrative business that many countries had to impose restrictions to protect small investors.

While many people are upset about these limits they do have some merit because the great majority of retail traders would simply gamble their money away faster if they had access to even higher leverage.

That said, some leverage is essential for most traders to be flexible in their approach and use various trading strategies.

The following section will illustrate this perfectly.

High leverage vs. low leverage

The question of high leverage vs. low leverage comes up rather frequently.

Some people want the biggest leverage possible and will actively seek the “most generous” broker or trade with offshore firms that are less constrained in their ability to provide leverage.

Others are more reserved, pointing out why leverage is dangerous and why you should avoid high leverage or any leverage at all.

Our position is that some trading styles need high leverage while others do not. The key is to always be conscious of your risks and use leverage only to the extent that it benefits your strategy.

To drive home this argument, let us give you a bit more context.

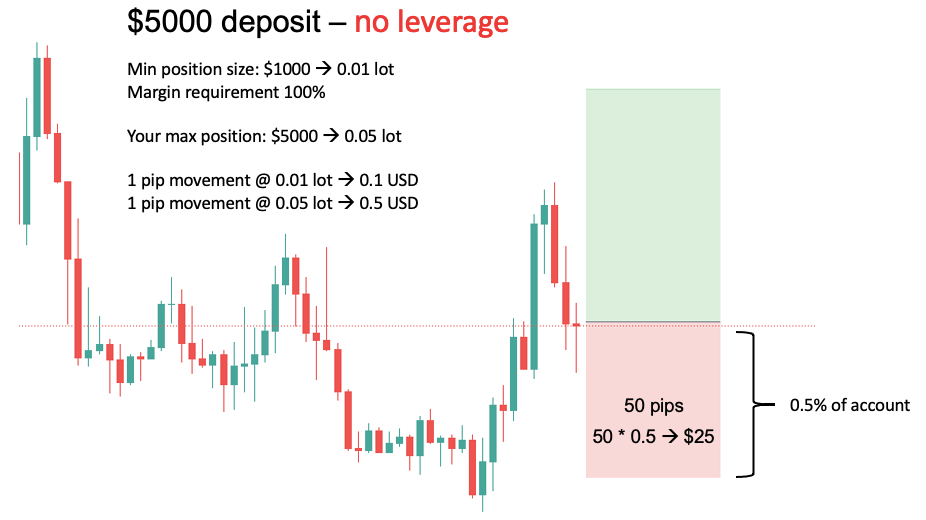

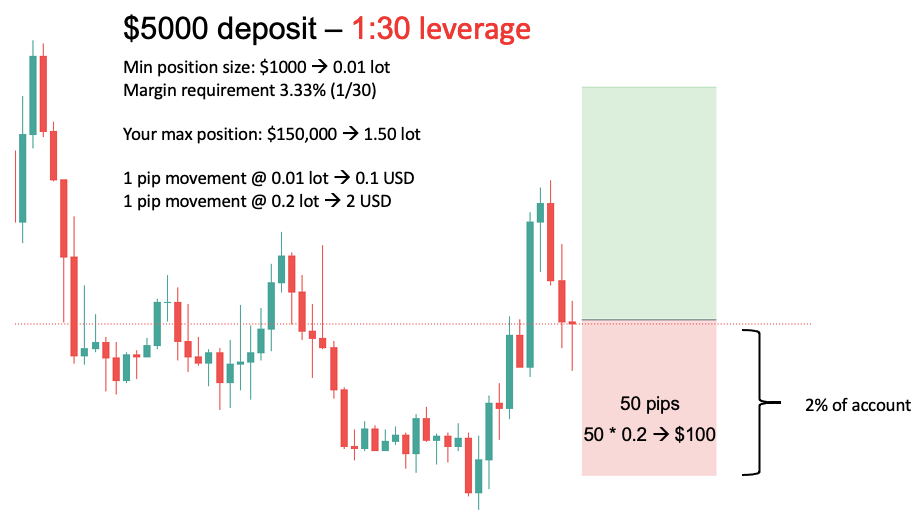

Let’s say you have $5,000 to trade.

Because the smallest position size that retail brokers allow is for 0.01 lot or 1000 units of currency, theoretically you can open a position even without leverage.

More specifically, you can open a maximum of 0.05 lots. If you open this position size, each pip movement equals 0.5 dollars earned or lost.

(This is true only for currency pairs in which the USD is in the second place such as the EUR/USD, GBP/USD, etc. Also, in reality, you wouldn’t be able to open 0.05 lots because you would immediately get margin called, but let’s keep things simple for this example.)

Now, whether or not this is good depends on two things:

- How much money you want to risk per trade

- The distance between your entry price and stop loss

The first one can be a flat number such as 100 dollars but more commonly it is a percentage of your account size, say, 2%.

The distance between the entry price and stop loss is a number of pips. For example, it can be 50 pips.

Given that each pip equals 0.5 dollar at your maximum position size, you can easily calculate that if your 50-pip stop loss is reached, you will stand to lose $25.

That’s 4 times less than your intended risk of 2% or $100.

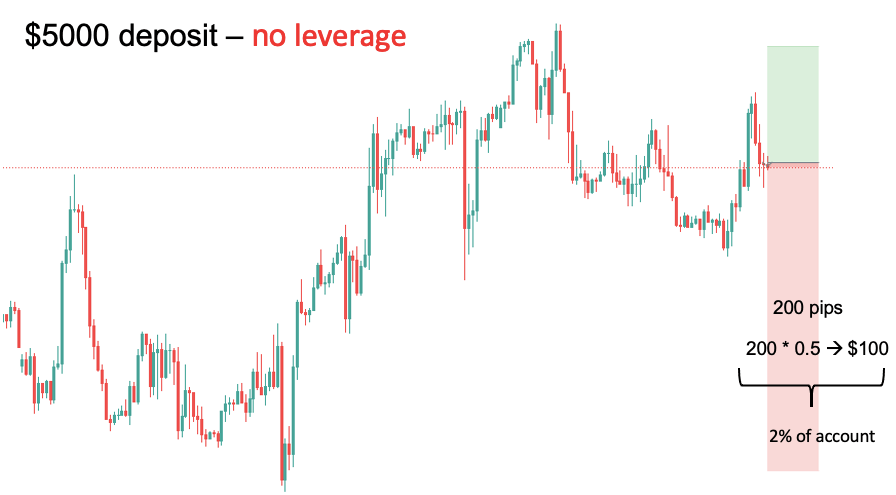

So, without leverage, your maximum risk is limited to $25 or 0.5% if you trade a position with a stop loss of 50 pips.

Because you are already utilizing your entire account balance, the only way to achieve a higher percentage of risk per trade is to increase the stop distance.

To risk 2% of your account, you would need to set a stop loss of 200 pips.

In a nutshell, with a $5000 deposit and no leverage, it is simply impossible to have a stop loss of 50 pips and risk 2% of your account.

The situation is very different when you have leverage. In this case, you are required to cover only a small portion of the position.

This gives you a lot more freedom in terms of trading style and risk management.

For example, if you have 1:30 leverage, you are required to put down only 1/30th of each position size as collateral.

In this case, there is no need to use a 200-pip stop loss; you can easily open the trade you want with the original 50-pip stop loss.

This is because you can simply select a larger position size, which will magnify the pip value and ensure that 50 pips equals 2% of your account.

In particular, you will open a position size of 0.2 lots or 20,000 units of currency. This will ensure that each pip is worth $2 or 100 dollars at 50 pips.

You can do this because, with leverage, your broker requires only 20,000 * (1/30) ~$666. This is known as margin, and it will be deducted from your $5000 deposit as collateral for the duration of the position.

You can see that, with leverage, you have more freedom to select your time horizon and size your positions accordingly.

So whether high leverage vs. low leverage is the right choice for you is a matter of your trading style and how much money you can deposit.

When to use leverage in trading

You must use leverage whenever you don’t have enough money to cover the margin requirements of your desired position.

Sometimes you will be okay with 1:30 leverage, as in the example above. But sometimes your stop loss will be even closer, so you will need a larger position size and more leverage.

Simply put, most forex traders need some form of leverage but how much leverage they need can vary.

If you know your trading style (read this guide if you don’t), you already have a good idea of the types of trades you’ll make.

That makes determining whether or not you need leverage (and how much you need) fairly simple.

Continue reading to find out how.

How to calculate how much leverage you need

You must know the approximate stop distance on your trades and how much of your account you want to risk per trade.

Then you can determine how large a position size is required and whether your deposit is sufficient to cover it – and, if not, how much leverage you need.

Let’s look at an example.

Let’s say you have $1000 in your account. You expect to keep a 20-pip stop loss on most of your trades and risk 1% of your account balance per trade

In this case, you need a position size where 20 pips equals 1% of $1000, or 10 dollars.

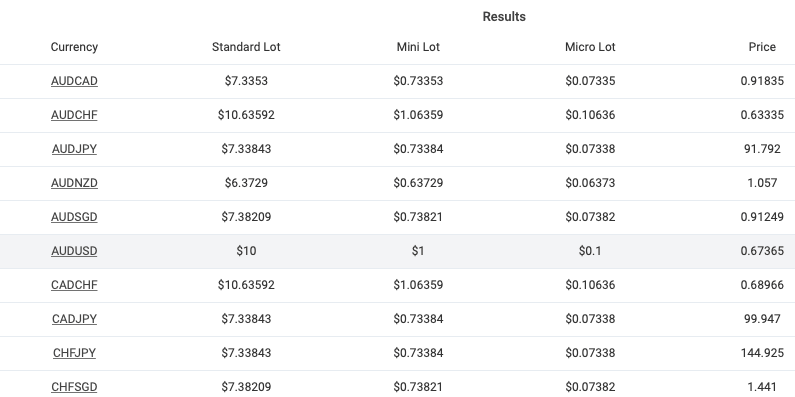

You must look at the currency pair and see how much one pip is worth at the smallest lot size possible. You can use a pip value calculator such as this one.

On the AUD/USD, the smallest pip value is $0.1 at one micro lot, or 1000 units of currency. So if your 20-pip stop loss is hit, this position size will cost you 2 dollars.

That’s five times less than you’d like to risk. As a result, you would need to open a position 5x larger (5000 USD), meaning you need leverage of 1:5.

This is how to calculate how much leverage you need.

Anything with leverage of 1:5 or higher will be good in this example. However, if your leverage is only 1:5, your entire account will be locked as margin and you will be unable to open new trades.

So you will probably want higher leverage.

With 1:30, for example, only about 166 dollars will be locked as collateral for the position. This will allow you to open additional trades with your remaining balance.

Let’s look at another example, with different numbers.

Assume you have a $500 account, want to risk 2% or $10, and want to keep stop losses of about 5 pips wide. Also, you trade only EUR/USD.

The smallest possible position size is 0.01 lot (1000 units of currency) where 1 pip movement is worth 0.1 dollars. So at 5 pips stop, you risk only 0.5 dollars, which is 20 times less than you would like.

It’s worth noting that you already need to use leverage at this point because you have only $500, whereas even the smallest position size requires double that. So you’ve already got 1:2 leverage.

You now need even more leverage to achieve your 10-dollar risk. A 20x larger position size, or 0.2 lot, where one pip equals 2 dollars and 5 pips equals $10.

So 0.2 lot equals 20,000 units of currency, and because you have only 500, you’ll need 20,000 / 500 = 1:40 leverage, at a minimum.

In reality, your ideal leverage will be closer to 1:100 or even more so that you can open multiple positions.

What is the best leverage ratio to choose when opening a trading account?

You should choose the highest possible ratio.

The highest available leverage will give you the most flexibility.

You might never utilize your maximum leverage, or anything close to it, but having the possibility will not hurt you in and of itself.

With a high leverage ratio, you can concentrate on risk management rather than worrying about whether or not the trade will be rejected due to a lack of funds.

Of course, if you are concerned that, with large leverage, you will be tempted to gamble with your account, use a smaller leverage, one that is only slightly higher than what you need for your strategy to work.

In any event, it doesn’t hurt to have some discipline if you want to be a trader.

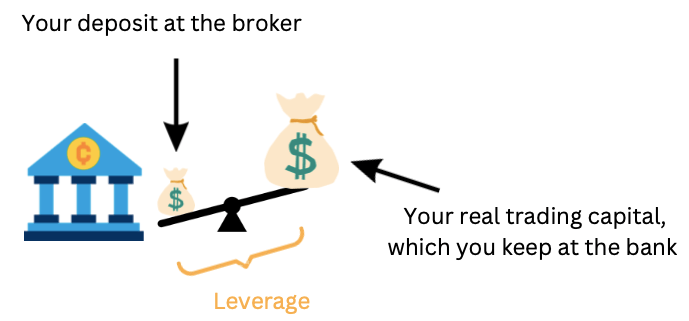

Choosing the highest leverage ratio has another benefit: You don’t have to keep all your money at the broker.

The broker is usually not a bank. It can go under more easily and it might or might not have a compensation scheme in place.

Even if it has, you will almost certainly have to go through a lot of legal hurdles before you see any of your money again.

So it can be a good idea to simply deposit a small fraction of your trading money and use leverage to move position sizes that correspond to your real capital.

You can always deposit money on the go should the need arise but this way, the bulk of your money will be at your bank, safeguarded from the volatile business of forex brokers.

What is the best leverage to trade with?

There is no universal best leverage to trade with. It comes down to how much money you want to risk per trade.

To that end, it is generally not advised to take large risks, as they will almost certainly result in a large loss at some point.

What seems to be a sweet spot is about 1 or 2% of your account per trade. If you trade less frequently and hold positions for long periods, you might risk more, such as 5%.

Once you know your desired risk, you can look at your account size and stop distances and figure out how much leverage you need.

We already discussed this; if you need a refresher, just scroll up and read the section “How to calculate how much leverage you need”.

Once you’ve determined the leverage that corresponds to your desired risk, you will know the best leverage to trade with for your situation.

Why leverage is sometimes dangerous

Leverage can be very dangerous when you don’t manage your risks.

The thing is, to participate in the market, you will probably need some leverage.

That’s okay.

However, problems arise when you engage in trades with uncontrolled risk.

Again, everything comes down to risk per trade, as we have seen before, and not so much to leverage itself.

If you have a working understanding of what risk per trade is good for you, then you will always take trades with proper leverage.

For example, if you know you’re going to risk 1% of your account per trade, you’ll always take a position size corresponding to that amount, whether you’re using 1:10 or 1:100 leverage.

It doesn’t really matter because the risk is understood and controlled. Leverage is needed simply for opening the position.

However, leverage becomes dangerous when you don’t think about risk management and just open trades on a whim.

In this case, if you had no access to leverage, your position sizes would be constrained much more and the probability of a quick large loss would be lower.

With leverage, on the other hand, you can make large trades and blow up your account in a matter of minutes because no risk controls are in place.

Conclusion

Leverage is a useful tool in forex that allows you to participate in a business that would otherwise be very capital intensive.

There is nothing wrong with using leverage as long as you take precautions to limit your risk.

Set a stop loss and determine the number of pips between it and your entry price.

Then you must open a position with a size corresponding to an acceptable loss if the market moves against you by that many pips.

Allowing trading positions (with or without leverage) to spiral out of control is a recipe for disaster.