Many trading strategies involve using swing highs and swing lows in one way or another.

Maybe you’ve been instructed to place your stop loss using these levels, or perhaps they play a role in the trading signal itself.

What’s often overlooked, however, is giving a clear definition for these terms and an exact method for finding them on the chart.

Thus, most people only have a rough idea of what swing highs and swing lows are, and almost everybody leaves too much room for subjectivity when it comes to identifying them.

In this guide, we will solve this problem.

We’ll show you how to identify swing highs and swing lows objectively.

You can take this knowledge with you, use it in whatever strategy you want, and make your trading more organized and effective.

The best part? Reading through the following sections only requires about 5 minutes of your time.

So, let’s get started.

What are swing highs and swing lows?

Before we get into identifying swing highs and swing lows, let’s define them quickly.

Most people will probably imagine a high or low price that stands out from the prices surrounding it.

That definition is actually quite good.

The swing high and swing low are the high and low points of a move that spans multiple candles.

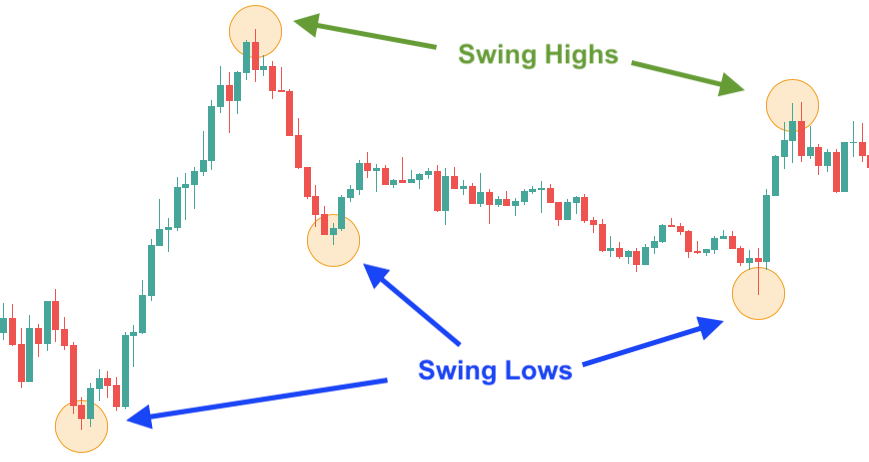

On the below chart, we’ve circled a few prices that can be considered swing highs and swing lows.

We chose these levels intuitively.

In other words, we didn’t have a rule that told us precisely which highs and lows to take into our analysis. We just picked those that seemed right.

If we wanted to codify a strategy or just tell a friend about it, we would run into a problem.

Even if you don’t intend to do any of these things, an objective method for determining which prices to use would undoubtedly benefit your trading consistency.

That brings us to…

How to identify swing highs and swing lows

Here is how to identify swing highs and swing lows:

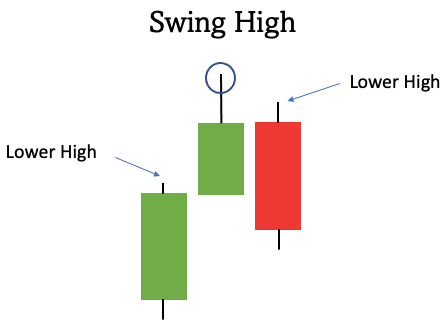

You must take the candle in question and examine the candles to its left and right.

A high is a swing high if it has a lower high on the right side and a lower high on the left side as well.

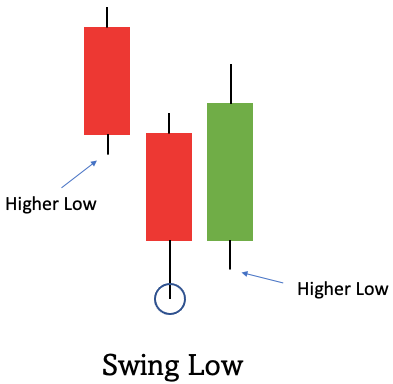

Conversely, a low is a swing low if it has a higher low on its right and a higher low on its left.

It’s that simple!

So, here are the rules once more:

Swing High:

Right side: Lower High

Left side: Lower High

Swing Low:

Right side: Higher Low

Left side: Higher Low

Okay, so now you know how to identify swing highs and swing lows. But we’re not quite done yet.

Going by the above definition works fine, but it will give you way too many swing prices. It makes sense to have some additional rules that will help in differentiating swing points based on their importance.

That’s what we’re going to do next.

Selecting the best swing highs and swing lows

So, how do you determine which swing highs and swing lows are important enough to be considered?

Well, a good way to do that is to look at how “isolated” the given price is.

The best swing prices are those that have room to the left – an idea we’ve already addressed in some of our other guides, such as when discussing kangaroo tails.

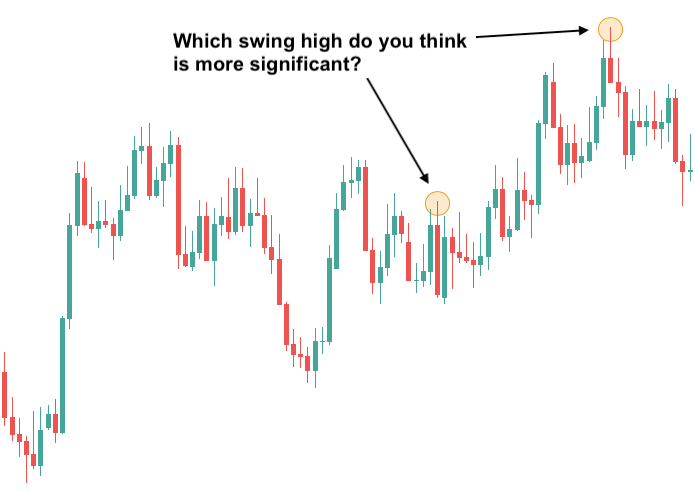

Let’s consider the example below:

This article belongs to ForexSpringBoard.com. Do NOT copy.

Both highs fulfill the criteria of a swing high, but the second one looks much more significant, and indeed it is.

Even without thinking about it, you will probably just skip the first candle and choose the second one.

The reason for this is that the first swing high is buried among many other candlesticks, whereas the second swing high has considerably more space to its left, catching your attention more.

So, again, you can see that the less price action there is to the left, the more significant the swing price.

This is an excellent insight that you can use to filter the swing prices on your chart based on their importance.

For example, you can come up with a rule that, let’s say, you only consider 5 candle swing points.

Then you would only mark swing prices that are at least 5 candle highs or lows. This will also help in deciding which prices to connect when it comes to drawing a trendline.

Conclusion

You have learned how to identify swing highs and swing lows.

Not only that, but you also have an objective system for selecting the best swing highs and swing lows.

We hope that this knowledge will help you to make better trades and become more successful in trading.