Every day, there are many people trading in the market, not knowing what they’re actually doing.

If this sounds like your situation, don’t hit the panic button yet.

Look on the bright side: At least you’re trying.

But if you want to make a living out of Forex trading, or even if you just want to support your income, you have to take the time to understand the mechanism of the market.

That said, there are certain things you need to learn sooner rather than later.

We’ve taken the time to identify and cover the top 3 topics that can be frustrating for beginner traders.

First, you will learn EVERYTHING about currency pairs.

Second, we will talk about the concept of leverage and margin while also discussing the elements of a Forex margin account.

Lastly, the basic Forex order types will be covered.

Are you ready?

Let’s do this.

Currency Pairs Explained

Forex trading is performed on currency pairs.

(That’s why it’s also called currency trading.)

Just for a minute, think about what happens when you buy stock.

You are “selling” your currency in exchange for one share of XY stock.

For example, you buy one Apple share for $150.

Forex trading works in a similar fashion, but you buy a currency and sell a different currency in exchange.

In other words, instead of an Apple share, the commodity now is a currency, but you’re also paying with a currency.

Hence the term foreign exchange.

The two currencies in the transaction make up a currency pair.

For example, EUR/USD, GBP/USD, USD/JPY are all currency pairs.

How to Read Currency Exchange Rates

The exchange rate of a currency pair shows the price of the first currency in terms of the second currency.

For instance, EUR/USD 1.2000 means that one euro is worth 1.2 U.S. dollars.

Okay, it’s not really professional so far, so let’s dig a little bit deeper.

The first listed currency of a currency pair is referred to as the base currency, and this is the commodity.

The second currency is called the quote currency, and this is the money.

Staying with our EUR/USD example, the euro is the commodity and you pay with dollars.

In case of a USD/JPY trade, the dollar is the commodity and you pay with yen.

Super-duper easy.

The Spread: Your Broker’s Cut

In practice, the full quotation, what Forex brokers offer, is made up of 2 prices.

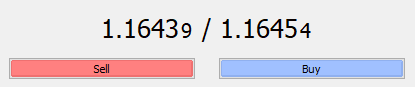

In the MetaTrader trading platform, for instance, you will see something like this:

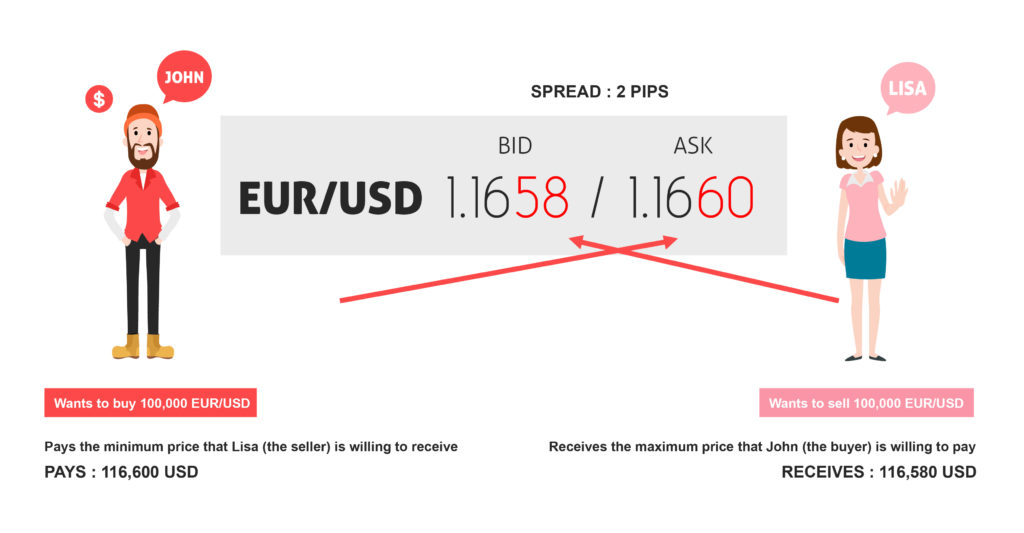

The bid price represents the maximum price a buyer is willing to pay for a currency.

It’s featured on the left side.

On the other hand, the ask price represents the minimum price a seller is willing to receive, and it’s shown on the right side.

Now, here’s the deal:

There is a small difference between the two prices, which is called the bid-ask spread.

This is the profit of your broker in return for their service.

You’ll pay the ask price, which is always higher, if you’re buying a currency pair, and you’ll receive the bid price, which is always lower, if you’re selling a currency pair.

The size of the spread varies from broker to broker and continuously changes throughout the day depending on the currency pair and market interest.

There’s nothing wrong with this; after all, you can’t expect your broker to work for free.

However, you have to be aware.

Sadly, many brokers are known for unfair pricing and fraudulence.

Because of it, choosing a reliable Forex broker is vital.

If you want to get transparent and outstanding trading service, we recommend XM.

(In the spirit of full transparency, note that we do receive payment if you choose to open a live account. This comes at no additional cost to you. Please understand that we recommend them because of the quality of their services, not because of the money we make if you decide to sign up)

Long and Short Positions

Each currency pair is a financial product that creates exposure to the movement of the value of how the two currencies in question interact with each other.

Wow.

In other words, when you open a position on a currency pair, your account value will rise and fall as the exchange rate of that currency pair changes.

That makes sense; you couldn’t make money otherwise.

But you couldn’t lose either, which is why you’re exposed to market risk.

The two main position types are the long and short positions.

In Forex trading, a long position refers to a market position in which you’ve bought a currency pair.

You can simply do that by clicking the “buy” button on your trading platform.

That tells your broker:

Buy the base currency and in exchange, sell the quote currency.

For example, when you go long on EUR/USD, you’re buying euros with dollars.

In this case, you’re looking for prices to move higher.

Remember, the EUR/USD exchange rate shows the price of a euro expressed in dollars. If it goes up, so does the value of your long position.

It’s because when you close your long position, your broker will sell your euros for dollars, and you will get more dollars back.

Simple as that.

As opposed to a long position, a short position refers to a market position in which you’ve sold a currency pair.

For example, when you go short on GBP/USD, you’re selling British pounds for dollars.

In this case, you’re looking for the exchange rate to move lower, so when you close your short position, your dollars will buy back more pounds.

Currency CFDs

You need to know something:

In our Forex Market Guide, we said when you’re trading with an online Forex broker, you’re participating in the spot market.

To be honest, that is just half-true.

As a retail client, your trades do not necessarily go out to the real market.

In fact, it’s more likely that you trade with your broker in the form of a currency Contract for Difference (CFD).

Let us explain:

A CFD is a financial product that allows the investor to speculate on rising or falling prices in an underlying asset (such as a currency pair) without actually owning it.

The price of a currency pair CFD is directly derived from the current spot price of the underlying Forex pair.

It’s like a clone of the real spot currency contract.

Here’s how it works:

When you open a trade with your Forex broker, you enter into a CFD contract.

Now, you’re indirectly exposed to market movements, your CFD will reflect any change in price, but you don’t actually own the physical Forex pair.

While the CFD is open, you will receive or pay interest after overnight trades, just like you would after any spot contract.

As you exit the trade, the CFD contract ends and you receive or pay the difference between the closing value and the opening value of the CFD.

Your final return will always be converted into the currency in which your account is denominated.

CFDs are traded on margin (we will talk about margin-based trading later in this guide).

It’s important that CFDs are not available in the United States, because of the strict local regulations.

In the rest of the world, they’re very popular, although recently, the European Securities and Market Authority also imposed some restrictions on them.

Position Sizes: Standard, Mini and Micro Lot.

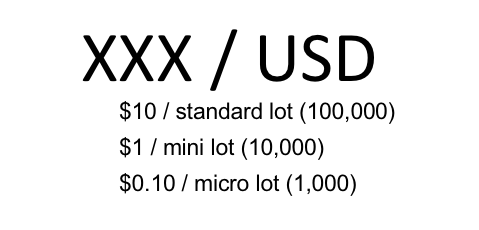

Forex trading is done in specific amounts that are called lots.

The standard lot size is 100,000 units where the “unit” stands for the first listed currency of a currency pair.

For example, when you open a long position on EUR/USD with the size of one lot, that means you buy 100,000 euros.

In addition to a standard lot, retail Forex brokers also offer a mini lot size, which means 10,000 units, and a micro lot size, which represents 1000 units of a currency.

(Some of them may even offer a nano lot size that is worth 100 units.)

What Is a Pip?

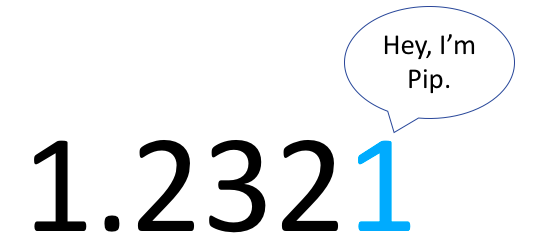

The smallest amount that the value of a currency pair can change is one percentage in point, or one pip.

Pips are used to measure currency movements.

In most cases, currency pairs are quoted in four decimal points, which means a 0.0001 price change represents one pip change.

There’re two things you need to be aware of:

First, Japanese Yen pairs are exceptions because they go out to two decimal places.

Second, most Forex brokers tend to provide fractional pip pricing.

This simply means they quote currency pairs to 5thor 3rddecimal places, where the last decimal place is called a pipette and it is worth 1/10thof a pip.

This is just a way of providing more accurate prices, so it’s kind of a good thing.

Question: What is the value of one pip?

Well, this is not that easy to answer, because it depends on things such as the traded currency pair as well as your account denomination.

Without going into boring calculations, let’s see what you can do.

First, if you have a USD-based trading account, there’s a fix pip value for every pair where the USD is listed as the second (quote) currency.

Otherwise, here’s a great tool you can use to calculate pip values on other currency pairs and account denominations.

Types of Currency Pairs: Majors, Crosses & Exotics

There are many currencies all around the world, but needless to say, they are not equally important.

At least, not from a global perspective.

The U.S. dollar has the most dominant role because it is the primary currency used by countries to settle international transactions and other obligations.

In fact, it was on one side of about 88% of all trades in April 2016, according to the Triennial Central Bank Survey.

Obviously, there are several other important currencies that hold an integral part in the world’s economy.

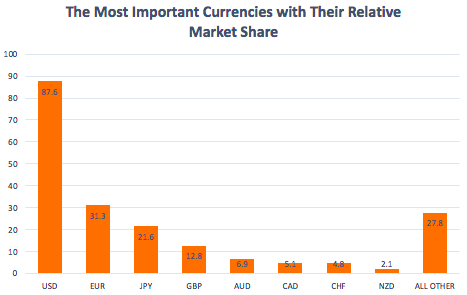

In the graph below, you can see the 8 major currencies with their relative market share from the global Forex trading volume.

(As two currencies are involved in each transaction, the sum of shares in individual currencies will total 200%)

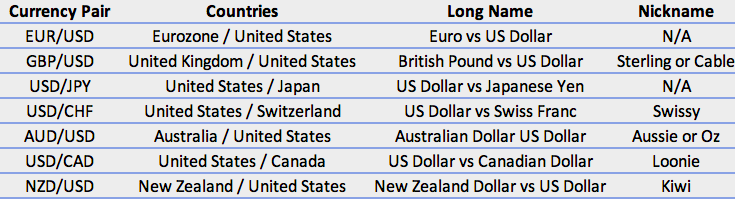

Major Currency Pairs

When you hear traders talking about major currency pairs, they think about currency pairs that are comprised of one major currency and the USD.

There’re two great things about majors.

First, these are the most actively traded pairs. And with that, you will find plenty of trading opportunities when looking at the chart of these pairs.

Second, the high involvement allows Forex brokers to charge smaller transaction costs in the form of tighter spreads.

The following table lists the major currency pairs and their frequently used nicknames.

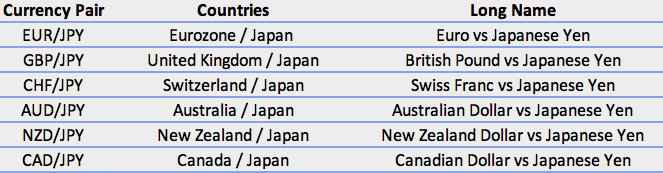

Cross Currency Pairs

Those currency pairs that don’t have the U.S. dollar in their componence are called cross currency pairs or minor currency pairs.

It used to be that if you wanted to exchange your currency into a different one, you would first have to exchange your currencies into U.S. dollars, and only then could you convert your dollars into the desired currency.

Not anymore.

With the introduction of currency crosses, everything has become much easier.

Now, you can open directly targeted positions to take advantage of news or other events.

Cross currency pairs are somewhat less traded, but they are still pretty active and relative cheap.

Some of the key cross currency pairs are presented below in groupings:

Euro Crosses

Yen Crosses

British Pound Crosses

Other Crosses

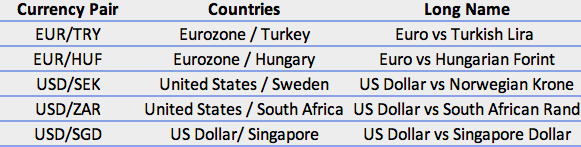

Exotic Currency Pairs

Finally, we have exotic currency pairs.

Exotic currency pairs are made-up of a major currency and the currency of an emerging or a strong but not as important economy from a global perspective.

Some examples are:

Compared to other currency pairs, exotic pairs are the least active and as a result, they are usually expensive to trade.

With all that, the question is:

Does it make sense to trade exotic currency pairs?

The choice is yours, of course. But our take is: probably not.

Here’s why:

They are way too susceptible to regional affairs.

When you live in a country whose currency falls into this category, that’s might be OK. You have more practical information throughout local news and circumstances, and you might be able to make money out of it.

But otherwise, you will have to sacrifice a serious amount of time to properly understand what’s going on there.

Bottom line? Unless you have a compelling reason to do so, we don’t recommend trading exotic pairs for most people.

Forex Margin and Leverage Explained

Here’s the exact breakdown:

Forex trading accounts are margin accounts, where trading is based on leverage.

In essence, margin accounts are used by traders to borrow with the purpose of buying positions or selling short.

This means that when you open a trade, you don’t have to come up with the entire position size yourself; you just need a small portion as collateral.

This small portion is called margin.

The only reason for having funds in your margin account is to ensure sufficient collateral.

Typically, margin accounts have a leverage ratio that defines how much your collateral can be leveraged.

For example, a leverage ratio of 50:1 means you can trade a position size as large as $50,000 with only a $1,000 deposit. The remaining $49,000 is provided by the broker.

Your margin account’s leverage ratio has an inverted relationship with your margin requirements.

Staying with our previous example, we could simply say the margin requirement is 2%.

You’re only required to put down $1000 as a good faith deposit to open a leveraged position worth $50,000.

Keep in mind that margin requirements may change depending on the traded currency pair.

Elements of a Forex Margin Account

There are some elements of each Forex margin account you need to know about.

In MetaTrader, you will see these at the bottom of your screen, like this:

IMAGE

Let’s dive in.

Account Balance

This is pretty straightforward; it is the size of your margin account.

If you have opened an account with $3000, then your account balance is $3000.

Open positions do not affect the value of your account balance.

However, when you close a position, the negative or positive amount will be added to or deducted from your account balance and the new balance will be displayed.

Account Equity

Your account equity shows the current value of your margin account.

It consists of your account balance plus the floating profit/loss of your open positions.

Logically, when you don’t have any open positions, your balance and equity are the same.

Once a position is open and fluctuates in value, so does your equity.

For example, if you have an account balance of $3000 and two open positions worth $1,500 together, then your account equity is $4,500.

Maintenance Margin

This is the minimum amount required to maintain your open positions.

As you already know, you have to put down a certain amount of margin deposit each time you open a leveraged position.

As you open more trades, these are added together.

The maintenance margin shows how much of your equity is currently held as margin against the open positions.

Each time you close an open position, the respective margin deposit will be released.

Let’s take an example:

You opened a trading account with $10,000 and your margin requirement is 2%.

You decide to open a trading position worth $100,000 on USD/JPY.

In this case, your maintenance margin will be $2000.

A couple days later, you open another position on the same currency pair, this time with half the position size.

Now, your maintenance margin goes up to $3000.

A day later, you decide to close your first position.

Your maintenance margin goes back to $1000.

Simple as that.

(Note: On MetaTrader, it will be simply featured as “margin”; we just use this term for the sake of a better illustration.)

Free Margin

Free margin is the money not currently held as maintenance margin.

Consequently, it can be used to take more trades.

For example, if your equity is $10,000 and your maintenance margin is $1,000, then your free margin will be $9,000.

This amount will increase if your open positions move in your direction, and it will decrease otherwise.

Margin Level

The margin level is the ratio of the equity to the maintenance margin expressed in percentages.

For example, when the equity is $15,000 and the maintenance margin is $3,000, the margin level will be 15,000/3000 x 100 or 500%.

It’s very important, because Forex brokers use your margin level in order to determine whether you can take any new positions or not.

When your margin level reaches 100%, it means your account equity is equal to your maintenance margin.

In other words, you’ve run out of free margin you could use as collateral, so you can’t open any new positions.

Margin Call

Typically, when your margin level reaches 100%, you will get a margin call.

The exact margin call level may be different from broker to broker, but it means one thing:

You’ll run out of money soon.

It’s a warning from your broker to deposit more money or to close your losing positions.

Stop-Out Level

Okay, so you’ve received a margin call but decided to do nothing.

What happens?

Well, there will be a point where your broker’s system will automatically start closing your positions beginning with the one that shows the largest loss.

This is referred to as the stop-out level, and it is typically set to a 20% margin.

The idea is simple:

You no longer have the money to cover your losing positions, and your broker wants to protect both themselves and you from negative account balances.

The Basic Forex Order Types: Market & Pending Orders

If you don’t know, the term “order” refers to your instructions to your broker that describe how you will enter or exit a trade.

And when it comes to Forex trading, you have a wide variety of options to make and control your trades.

Although, not all brokers provide the same Forex order types; there are some basic ones you will find everywhere.

In the last part of this guide, we’re going to concentrate on these.

Market Order

Market orders are the default and the most common way of executing orders.

A market order tells your broker:

Buy or sell a currency pair immediately at the best available price.

So, if you want to open a trade right now, you can use a market order.

Keep in mind that if the market is extremely active, then your order might be executed at a less favorable rate.

This is called slippage, and it refers to the expected price of a trade and the price at which the trade is actually executed.

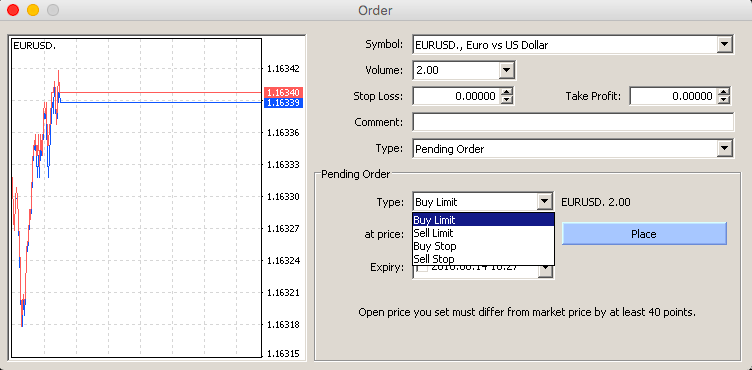

Pending Orders

You can use pending orders to catch market movements when you’re not in front of your computer.

When you open a pending order, you basically tell your broker to buy or sell a currency pair at a pre-defined price in the future.

That said, the order will only be executed when certain conditions are fulfilled.

Not sooner and not later.

Below on the MetaTrader 4 trading platform’s order box, you can see that pending orders have 4 subcategories.

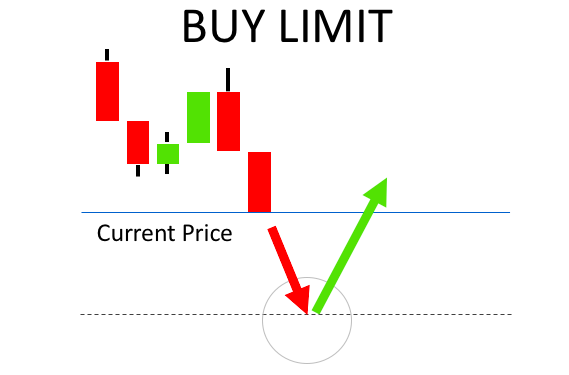

Buy Limit & Sell Limit

You can use a buy limit order to buy below the market.

Let’s see an example:

EUR/USD has been falling for weeks and is currently trading at 1.1785.

You think that at 1.1700, there is strong support and the price will stop falling at that point.

In fact, you believe the price will start to move up.

Because you’re not sure when the price will eventually reach there, you place a buy limit order to ensure you don’t miss the trade.

Your broker will automatically execute a buy order at the best available price once EUR/USD hits 1.1700.

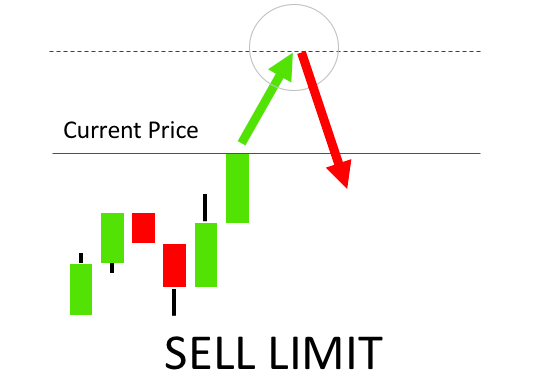

As opposed to buy-limit orders, sell-limit orders are used to sell above the market.

You think that the uptrend will fail at a certain point, so you tell your broker to sell the currency pair as soon as the price gets there.

Buy Stop & Sell Stop

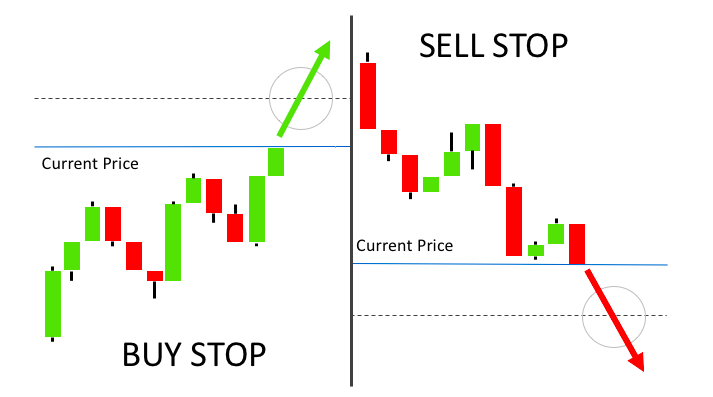

You can use a buy–stop order to buy above the market.

Simply put, it may come in handy at times when you believe the price will touch the order level and go up after that.

For instance, when you find the current spread is too big, but the uptrend is strong, you might consider placing a buy-stop order.

A sell–stop order, on the other hand, has the exact opposite function.

It’s placed below the current market price to open a short position when you believe the price will touch the order level and further fall after that.

What Is a Stop Loss and Take Profit?

Both of them are pending orders, but unlike “traditional” orders, they can’t live on their own.

That is to say, they need to be attached to another order (market or pending).

Now, to be clear, the stop loss is way more important.

A stop loss is used in part of risk management.

When a currency pair falls or rises to the stop-loss level, depending on the direction of your trade, the S/L order is executed, and it will close the trade to limit your loss.

The take profit does the exact opposite.

When the currency pair falls or rises to your take-profit level, the T/P order is executed, and the position is closed for a gain.