Learning something new isn’t always easy.

The way the Forex market works often seems overwhelmingly difficult and something only finance experts can understand.

Fortunately, it’s not as complicated as you might think.

The problem that beginner Forex traders typically have is the absence of an in-depth, comprehensive and clear article that explains everything from the very basics.

To address this issue, we put together this guide for you.

Let’s see what you will learn today:

First, we are going to talk about the concept and features of the Forex market.

Then, we will discuss the different financial instruments that make up the market and its most important participants.

Finally, you will learn how a trading day looks as we discuss the different Forex market sessions.

These are not what you’re searching for? Then we probably got you covered here: Forex Trading: The Ultimate Guide.

What Is the Forex Market?

The definition of the foreign exchange market is a decentralized market where currencies are traded and their rates are determined.

If it sounds like another language, don’t worry.

We’ll explain.

Decentralization means that instead of one physical marketplace, like the New York Stock Exchange or other exchanges, Forex operates electronically through financial centers all around the world.

Here’s the best part:

These financial centers are located in different time zones, which makes it possible for traders to buy and sell currencies 24 hours a day, 5 days a week.

Simply, if you want to open a trade at midnight, there will always be a trading center somewhere that is open to receive your order.

Question: Can you make money trading Forex from home?

Definitely.

The Forex market is a very liquid market, meaning you can get in and out whenever you want, and the amount of currency you can buy is only limited by your capital.

How is that possible? Well, the numbers don’t lie.

According to the most recent Triennial Central Bank Survey, foreign exchange trading volume averaged $5.1 trillion per day in April 2016, making the Forex market by far the largest financial market in the world.

Needless to say, that’s a HUGE amount of money that circulates through a MANY traders.

A few decades ago, however, Forex trading wasn’t as widely available.

Before the 1990s, currency trading was limited to financial institutions and some extremely wealthy individuals.

Luckily, advances in electronic trading have now made it available to retail traders to participate indirectly through brokers or banks.

Different Financial Instruments

For those who don’t know what a financial instrument is, it’s a document that has monetary value or represents a legally enforceable agreement regarding a right to payment of money.

For example, contracts, shares, and checks are all financial instruments.

Why are we bothering you with such an awkward term?

It is because you need to know that a variety of financial instruments are used to perform currency transactions.

All these collectively comprise the thing we know as the Forex market.

So:

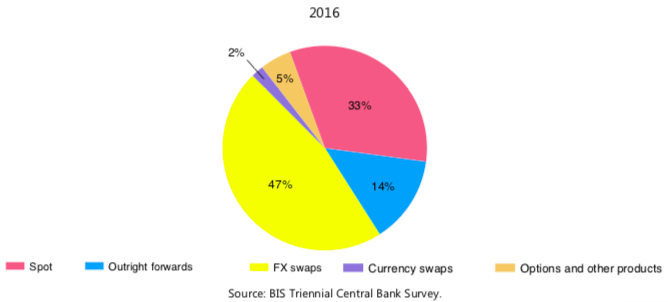

First of all, take a look at the graph below to see how that $5.1 trillion worth of trading volume spreads across different instrument categories on an average trading day.

If you’re not sure what those terms mean, no worries.

Just keep reading…

Spot Market Contracts

To most people, trading Forex means trading on the spot market.

It is because, when trading with an online Forex broker, you’re participating in the spot market, whether you know it or not.

If you’ve been thinking about registering a trading account for a while, we recommend XM.

(In the spirit of full transparency, note that we do receive payment if you choose to open a live account. This comes at no additional cost to you. Please understand that we recommend them because of the quality of their services, not because of the money we make if you decide to sign up)

So, what is the spot market?

Basically, it’s the place where you can trade contracts that promise immediate delivery. In other words, you can buy or sell currencies now, as in “on the spot.”

When it comes to “immediate delivery,” Mr. Market has a slightly different definition for that.

The term refers to the nearest settlement date on which a transaction can be made. And that usually takes two business days.

Yes, we know what you’re thinking.

You came to the Forex market to make money from price fluctuations, not to take delivery of a random country’s random currency.

Fortunately, you don’t have to be afraid of that.

There is a process called rollover that is done by Forex brokers every day at 5 PM New York time in order to extend the settlement period by one day.

In essence, they will close your existing trading positions and re-open them at the same time.

So, you can hold your positions for as long as you wish, or at least as long as you have enough capital to cover your potential losses.

Since every Forex trade involves borrowing one country’s currency to buy another, you will also receive or pay the interest rate differential between the two currencies.

That is to say, if you bought a higher yielding currency with your borrowed lower yielding currency, then you will earn interest.

Conversely, you will need to pay interest if the currency you borrowed has a higher interest rate than the currency you purchased.

Outright Forwards

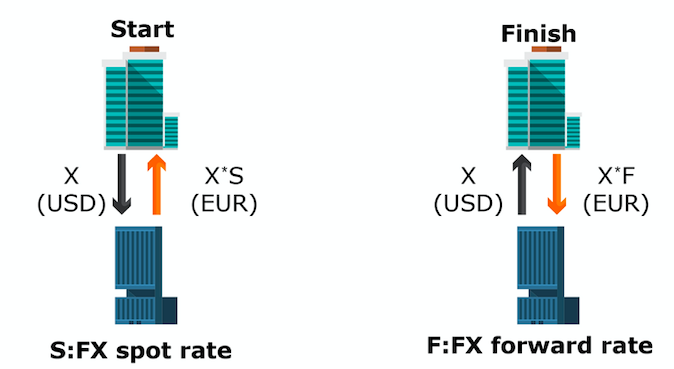

An outright forward contract locks in an exchange rate for a certain date in the future and a specific amount.

Basically, it’s just a fancier expression for a forward currency contract, which refers to any currency contract that is longer than spot.

The great thing about forwards, is they protect from adverse price changes.

In other words, everything is agreed on the day the transaction is made, so the company is no longer influenced by the movements of the Forex market.

We said “company” because these contracts are most often used by businesses who need to buy goods or services in a different currency or to borrow from foreign organizations.

Let’s take an example.

A German company that buys materials from a Canadian business is required to pay half of the Canadian dollar amount now and the other half a couple months later.

The first half can be done on the spot market; however, there is a risk that the Canadian dollar will appreciate against the euro by the time the second payment is due.

Is there a possible solution?

Yes.

An outright forward purchase of Canadian dollars.

FX Swaps

We probably don’t need to tell you that FX swaps are dominating the Forex market.

If yes, just scroll back to the graph and take a glance at it again.

Question: Why are FX swaps so popular?

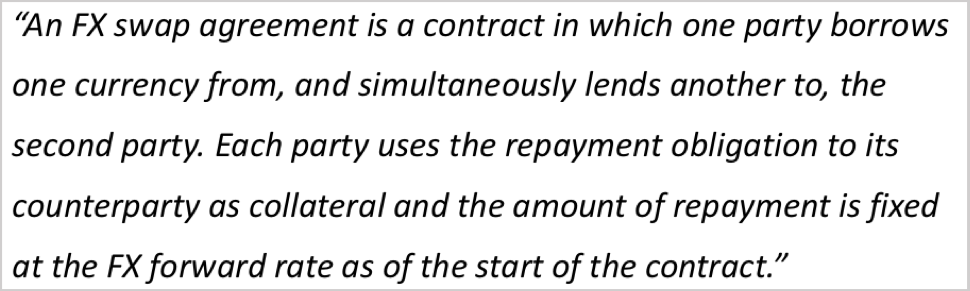

Before we give you the answer, let’s see how the Bank of International Settlements defines an FX swap agreement.

Sounds terrible, doesn’t it?

What they literally are saying is that an FX swap allows you to use the funds you have in one currency to fund your expenses in a different currency, without acquiring foreign exchange risk.

It’s like a Forex swiss army knife for importers, exporters and financial institutions who need to raise foreign currencies.

And believe us, there are a lot of them.

With that, it probably makes sense now why FX swaps are so popular…

Let’s see a simple example of how these instruments work:

Company A has U.S. dollars and requires euros in 2 months’ time.

Company B has euros and requires U.S. dollars in 2 months’ time.

Since both companies already have funds in the currency the other needs, they both benefit from a swap transaction.

So, here’s the deal:

Company A sells X amount of dollars to company B at the current spot rate and simultaneously receives the equivalent in euros. They both agree to buy back their original currency in 2 months’ time at a fixed forward rate.

Cool, exchange rate risk is eliminated.

Currency Swaps

These are very similar to the previously discussed FX swaps.

However, there are certain differences.

In case of a currency swap, both participating companies effectively take out a loan from their domestic markets. Then, the loans are swapped.

Think about it:

As a business, you will typically have a competitive advantage in your own country.

However, when you wish to expand your operations into a foreign territory, you will face extremely high interest rates.

That’s when you can reach out to a local business who has a similar problem in your domestic country to enter into a currency swap transaction.

It’s like replacing an expensive loan with a cheaper one.

During the contract term, you will only have to satisfy the interest rate payments incurred by the other party under its agreement with its local bank.

Similarly, they will pay the interest rate for the loan that you take out in your home country.

Currency swaps are therefore commonly employed by financial institutions and multinational corporations for funding long-term foreign currency investments.

Options and Other Products

Let’s see our last contenders.

Traditionally, currency options give you a right to buy or sell a currency at a fixed price on a fixed date.

OR

At a fixed price up to a fixed date.

The “fixed date” is called the expiration date.

It’s important, because you don’t have to use your option if you don’t want to.

That’s the reason why it’s called an option …

Simply, an option that is not exercised expires worthless.

In other words, you will lose the money you paid for it, but that’s really the worst thing that can happen.

When it comes to options, there are two kinds of contracts:

The first is the call option contract, which gives the buyer the right to purchase a currency.

The second is the put option contract, which does the exact opposite.

Options are frequently used for speculation and risk-management by all sorts of market participants.

Finally, what about other products?

These are instruments that are either too complex to fit into the standard instrument categories or it would be impractical to force them into one.

For example, differential swaps.

Forex Market Participants

The Forex market essentially works because there are many market participants buying and selling currencies.

Let’s face it: Most people trading online have no idea of whom they are competing with.

If it sounds like your situation, don’t worry; we’re here to help.

Let’s get into it.

Central Banks

Central banks are mainly independent organizations, entrusted by their respective governments to fulfill a range of functions including monetary policy decisions, issuance of banknotes and banking supervision.

In essence, the term monetary policy refers to the actions a central bank is supposed to take in order to control its country’s money supply.

Probably, central banks are the only market participants who are not interested in making money in the Forex market.

Instead, the main objective of central banks is to preserve the value of their country’s currency and to encourage economic growth.

Not all heroes wear capes.

From the wide range of monetary policy tools central banks have in their pockets, interest rate decisions are something that Forex traders must definitely keep an eye on

Simply put, interest is the cost of borrowing money.

By effectively managing interest rates, central banks can address the domestic economy’s problems and keep the prices of goods and services relative at the same level.

Here’s how:

Typically, when inflation is a problem, central banks will increase interest rates.

In this case, the cost of borrowing increases, which makes it hard for businesses to develop, and it may discourage people to buy expensive assets.

With moderate access to money, the whole economic activity decelerates.

However, the high rates are attractive for both domestic and foreign investors because it means they’ll get more return investing in that country.

To be able to do that, first they need to buy that country’s currency.

The result?

The currency of that country will turn into a steady uptrend.

Pretty cool, right?

As inflation pressures ease, central banks tend to cut interest rates.

This encourages lending, reduces the cost of mortgages and in general, helps the economy to grow.

On the downside, interest rate cuts could cause faster inflation, but it’s a good opportunity for Forex traders to profit from the arising downtrend in the nation’s currency.

Check out our Forex Market Analysis Guide if you want to learn more about different fundamentals that can affect the Forex market.

Banks and Retail Forex Brokers

Next to central banks, “normal” banks also have a large involvement in Forex transactions.

Traditionally, they either manage the money of retail clients and businesses or aid companies in their financing and investment process.

Nowadays, as bank merger after bank merger has transformed famous names into massive financial conglomerates, many banks have trading operations in both areas.

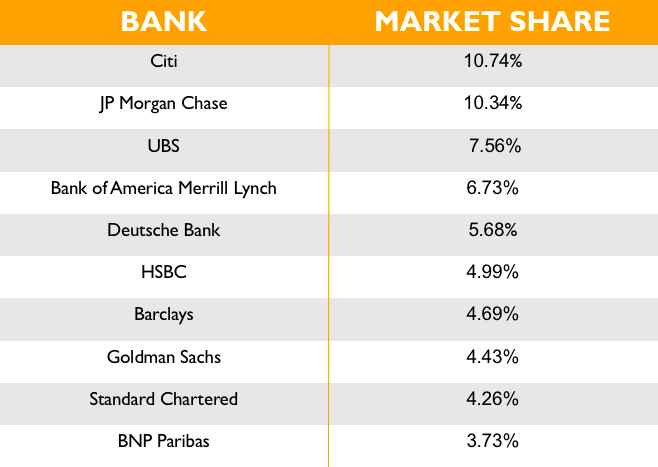

A small number of the large international banks has the main role in the FX market paradigm.

JP Morgan Chase, Deutsche Bank, Citigroup, you name it…

With a vast number of clients and branches in different countries, most of the total Forex volume is transacted through these banks.

There’s even a term for this global network where all the banks and financial institutions trade currencies between themselves.

It’s called the interbank market.

According to the results of the Euromoney Foreign Exchange Survey, here are 2017’s 10 biggest players in the Forex interbank market.

These banks generate income in many ways.

For example, they follow the old-fashioned “gathering deposits to make loans” way.

Some of them also manage money, trade on their own behalf and give investment banking advice to companies.

Great, but how do retail Forex brokers fit into the scene?

Retail Forex brokers are financial institutions that have access to the interbank market through one or more important banks that they have brokerage agreements with.

They provide retail traders like you with access to a trading platform that allows you to trade in the Forex market.

Hedgers (International Businesses)

In the Forex market, hedging techniques are initialized to limit or eliminate the probability of loss from adverse price movements on one position.

It’s like getting insurance on your trade without buying insurance policies.

Sounds good, doesn’t it?

Although hedging can be done in a number of different ways, the idea is simple.

To hedge a trading position, you need to open a second position that is expected to perform in the opposite direction than the first and therefore counterbalance the risk.

Boom.

Nowadays, hedgers come in all shapes and sizes; even small traders can hedge as part of their trading strategy.

However, more traditional hedgers in the Forex market are international businesses who naturally gain undesired exposure to the value of currencies.

Let’s see an example.

Imagine that a German motor vehicle manufacturer just won a large order from an American agency that’s building a fleet for its overseas business.

Because of the fierce competition, this manufacturer wanted to make its bid more attractive by agreeing to be paid in U.S. dollars.

Now there’s a problem.

Given the fact that they have to finance their production costs in euros, an exchange rate risk arises that the USD will weaken against the EUR.

In that case, the agreed USD amount would be worth less in EUR, threatening their profit on the deal.

Obviously, they can’t let that happen.

So, as a possible solution, they can head over to the spot Forex market and buy EUR against USD.

If the USD weakens against the EUR, the value of the market position will increase, compensating for the lower value of the USD they’ll receive.

If the opposite happens, the loss on the hedge is offset by the agreed currency conversion.

Speculators

This one is simple.

The definition of a speculator is a market participant who is involved in the Forex market for one reason: to benefit from the continuous price movements.

Most likely, you belong to this category.

The good thing with speculation is that although you can lose a lot of money if you do it wrong, you can make even more if you learn to do it right.

There are regular people out there who started with as little as $1,000 and turned their small initial stakes into a six- to seven-figure fortune.

If you don’t believe us, just grab a copy from the Millionaire Traders book, and read as these traders share their stories and the many lessons they have learned through their experience.

(NOTE: We get a small commission if you make a purchase.)

Besides the possibility of hitting it big, speculation is important because it adds capital and liquidity to the Forex market.

OK. If speculation is so great, there must be companies who specialize in that.

Yes, you got that right!

These companies are called hedge funds, and they’re almost entirely speculative in nature.

They are largely unregulated funds that employ different strategies and an investment technique called leveraged trading.

This means that based on real assets under management, hedge funds create so-called margin agreements with big banks that allow them to invest with borrowed money.

For instance, a hedge fund with a managed $50 million can leverage those assets and have trading limits anywhere between $250 million and $1 billion.

Hedge funds are typically exclusive to extremely wealthy clients.

Forex Trading Sessions

In this final part, we’ll help you get the basics down regarding Forex trading sessions.

So, if you’re not sure how a Forex trading day looks, this part will get you on the right track.

Before we start, here’s a Forex time zone converter that you can use to see how Forex market hours look like at your location.

Let’s dive in.

The Asian (Tokyo) Session

At the start of the new trading week, the Asian markets are generally the first to see action.

They begin to open at Monday morning local time, which depending on where you live, corresponds to early Sunday afternoon in North America and Sunday evening in Europe.

The main activity through the session comes from the Tokyo capital markets, but there are many other countries with important exchanges (for example, Australia, New Zealand, etc.) that are conducting their trading activity during this period.

For obvious reasons, currencies of Asian nations tend to be more active during these hours.

The Australian dollar, the New Zealand dollar and the Japanese yen are traded the most.

In fact, the JPY is the third most traded currency across the entire Forex market, reflecting Japan’s important role in the global economy.

Despite all this, the Asian session is characterized by moderate trading activity mainly driven by news and data reports from local economies.

This is mainly due to the fact that American and European traders aren’t involved yet.

In terms of trading volume, the frequently cited BIS survey points out that 21% percent of all daily transactions are processed by the three largest Asian financial centers.

These are: Tokyo, Hong Kong SAR and Singapore.

Although most traders will find that the Asian session is not very suitable for their trading style, it has an important quality:

It often sets the tone for the rest of the day.

It is simply because many traders from other parts of the world will look at its outcome to help decide what trading strategies to use in other sessions.

Okay, let’s move on.

The European (London) Session

When Asian traders are starting to finish, European traders are just beginning their day.

Needless to say, there are numerous important economic centers all around Europe.

Among all of them, it’s currently London that defines the parameters of the European session.

Trading in the U.K.’s capital starts Monday morning local time, which is Monday before dawn in most part of North America and around Monday afternoon in Asia.

Why is London so important?

Well, it has an enviable level of global reach and influence in terms of its finance industry.

In addition, as it is now, the United Kingdom has about 37% market share of the total daily FX volume.

That’s HUGE.

And when we supplement that with the 8% volume of the Euro area, and the 2% volume of Switzerland, it turns out that Europe accounts for roughly half of the total daily market turnover.

The best thing?

During the European afternoon, the U.S. market also opens, so activity in the Forex market is literally skyrocketing.

For you as a trader, it’s good for two main reasons:

First, there will be plenty of opportunities in the market.

That is to say, every currency can be easily traded, with usually the EUR and GBP moving the most.

Second, Forex brokers tend to charge lower transaction costs during extremely active hours.

In addition to all these, most Forex trends begin to develop in this session.

Okay.

Before we move onto North America, there’s an interesting tendency:

The market activity notably slows down for a little around the middle of the European session.

Why?

Most of the traders and brokers leave their trading desks to have lunch with their customers.

That is the way to live, isn’t it?

Shortly before the New York opening, they return to their offices to prepare for the new session.

North American (New York) Session

Just like all the other sessions, the North American session starts Monday morning local time. Simultaneously, it’s Monday evening in Asia, but Europe is only halfway through their trading day.

As you might think, the dominant western participant is the United States.

Precisely, they account for 19% of the daily Forex turnover.

Besides the U.S., trading activity comes from Canada, Mexico and several countries from South America.

(Unfortunately, the BIS didn’t publish relevant data for their trading activity.)

The North American morning is when most of the U.S. economic data is released.

Why is this important?

Well, it’s no secret that the USD has a primary role in the world’s economy.

And with that, it usually has a strong effect across the entire Forex market.

Moving on, around the middle of the North American session, European financial centers begin to finish their trading operations for the day.

Should you care about that?

Heck yes!

In fact, it’s possible that the trends that formed during the London session reverse as European traders might close their positions for profit. (It’s done with an inverse transaction.)

Once European markets close, the activity generally dies down during the U.S. afternoon.

By the time the North American session closes, the first representatives of the Asian session, namely Wellington and Sydney, have reopened and a new trading day has begun.