Every forex trader should understand how to cut losses and take profits.

That’s where stop-loss and take-profit orders enter the picture.

In this article, we will explain what both stop-loss and take-profit orders are in forex.

While there are no guarantees in trading, we can assure you that the time you spend learning these concepts will be well spent.

We’ll start with the basics and then go into the advantages and disadvantages of using stop-loss and take-profit orders. Finally, we’ll go over how to set stop-loss and take-profit orders the right way.

Let’s get started.

What are stop-loss and take-profit orders in Forex

People who want to open positions in the forex market must submit orders to their broker.

These orders are typically market orders, which instruct the broker to buy or sell at the current price.

However, this does not have to be the case. There are also so-called pending orders, which get their name from the fact that they only execute if certain conditions are met.

Both stop-loss and take-profit orders are pending orders.

A stop loss is a pending order that executes if the market moves against you.

It ensures that you exit at a small loss rather than letting the market drift further away from your entry price and risk losing your entire investment.

The take profit is a pending order that executes if the market moves in your favor.

It ensures that you pocket your profit from the trade before the market reverses and it evaporates.

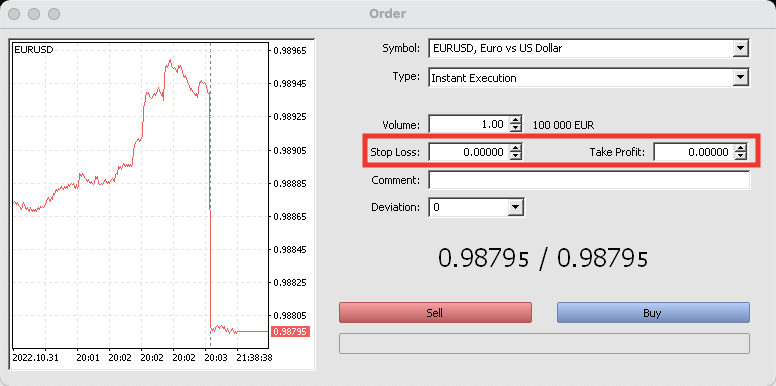

Trading platforms like MetaTrader make it easy to set stop-loss and take-profit orders. They exist as optional fields that you can enter or leave blank in the order window when you open your position.

This leads us to…

Should you use stop-loss and take-profit orders?

On the surface, using stop-loss and take-profit orders seems like a no-brainer.

That said, there’s actually some debate about their usefulness, and some traders don’t use them at all.

This is especially true for the stop loss, which is the source of most frustrations, and some are concerned that disclosing the stop to the broker will allow it to manipulate the market against the trader.

In this article, we try to preserve our impartiality and give you an objective overview of some of the advantages and disadvantages of using these tools.

It will help you decide if they are a good fit for you, so make sure to read the following sections.

Advantages of using stop-loss and take-profit orders

Let us begin with the stop loss.

The obvious benefit of using a stop loss is that it allows you to avoid huge losses.

Sure, you can always close a trade manually, but for one thing, you may not always be in front of a computer, and for another, you may find it difficult to make that decision.

People who do not use a stop loss frequently delay closing the losing position in the hope that the market will reverse direction.

While this does happen occasionally, it only exacerbates the problem by making you believe you did the right thing.

If your trade idea fails, you should strive to get out while the cost of the mistake is relatively low. Otherwise, you are risking dealing a huge blow to your account.

This article belongs to ForexSpringBoard.com. Do NOT copy.

A stop loss allows you to automate the closing of losing trades so that your emotions do not interfere.

Now what about the take profit?

After triggering this order, the market may continue to march forward, giving you the impression that you left money on the table by not holding on to your position longer.

This is misleading, for it is quite difficult to time the exact end of a trend.

People who become too greedy and delay realizing profits for too long frequently see their profits evaporate as the market trend shifts against them.

We are not suggesting that you close your trade as soon as it shows some profit. It’s a good idea to let your winners run as far as possible.

However, you should keep in mind that money is made at the exit, and it is difficult to make money if you never cash out and always just wait for the market to go even higher.

Choosing a price target at which you are happy to take a profit is a good practice, in our opinion.

The take-profit order ensures that you realize your profits at a predetermined level, which can be as close or as far away as you want, but it will be present and give you a sense of satisfaction when reached.

Disadvantages of using stop-loss and take-profit orders

Let’s now look at some of the disadvantages of using stop-loss and take-profit orders.

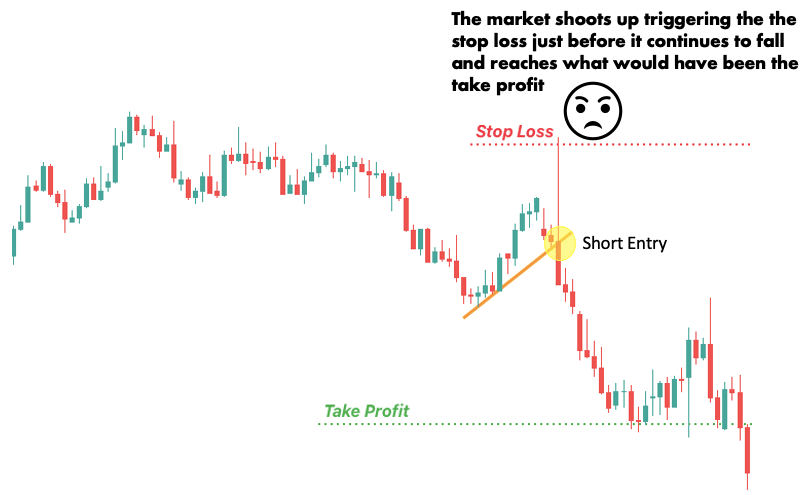

When you use a stop loss, you will almost certainly encounter situations in which the market stops you out and then reverses and reaches your profit target, causing you to lose money on an otherwise good set-up.

You may also be subject to what is known as stop-hunting, which occurs when other players deliberately push the market to a level where they expect many stop losses to be triggered.

(To see why someone would do that, you can read this article on stop-hunting.)

These are the two most common issues you will hear people complaining about when it comes to the stop loss.

Yet, there is a more serious but frequently overlooked problem. It is possible that the stop loss will not be executed at the level you specified during times of high market volatility.

This is because when the stop loss is triggered, the order is converted into a market order.

The broker receives the order and executes it; however, if the system is overloaded and markets move quickly, prices may have changed by the time the broker executes your order, causing you to lose more money than you intended, even with a stop loss.

Of course, not using a stop loss will not solve the problem (the same thing can happen if you close the trade manually), but we wanted to make you aware that using a stop loss will not completely eliminate the possibility of a larger loss.

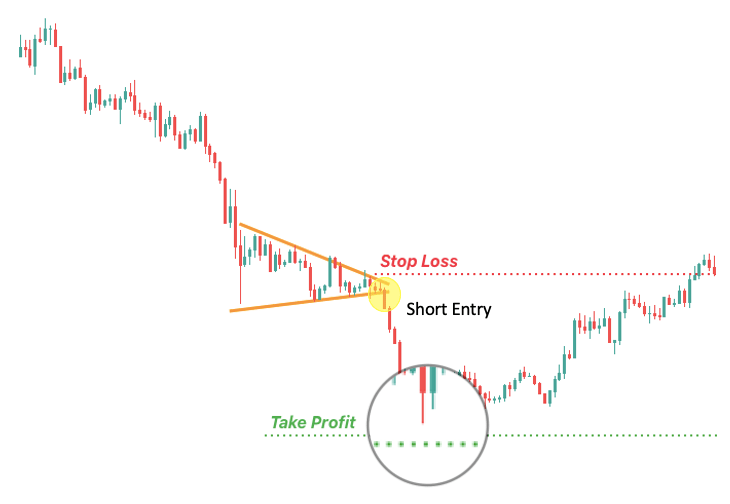

In terms of take profit, the same reason it is advantageous to have one in place can also be the reason it eventually backfires.

It compels you to take profit at a predetermined price. But what if the market fails to reach that price level?

There will be times when the market will reach 99% of your profit target before reversing and not triggering the take profit.

You will undoubtedly feel that sticking to that stupid take-profit level was a mistake and that you should have exited the trade while it was in the green.

Also, as we already mentioned, sometimes the take profit might mean that you get out of the trade earlier than you should.

If it is a persistent issue, it can turn into a serious disadvantage. But again, keep in mind that is difficult to predict when a trend will end.

It’s always easy to see what you would have done differently in retrospect, but you have to make decisions without knowing what the future holds.

(Backtesting can help you fine-tune your take-profit and stop-loss levels. You can learn how to do this by reading our guide.)

At the end of the day, both the stop loss and the take profit are tools that can make your job easier. Trading is just bound to be frustrating at sometimes, with or without these orders.

How to set stop-loss and take-profit levels?

People set stop-loss and take-profit levels in a variety of ways, but the key principles tend to be the same.

The stop loss must be set to a level where the trade idea fails. In other words, you should exit as soon as the market reaches a level that invalidates your idea.

As for the take profit, the idea is to maximize your winnings. This is as simple as it sounds, but it is no easy feat.

Let’s look at an example of how you might apply these principles!

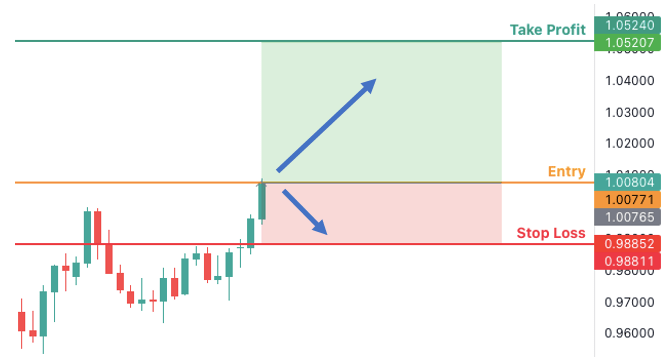

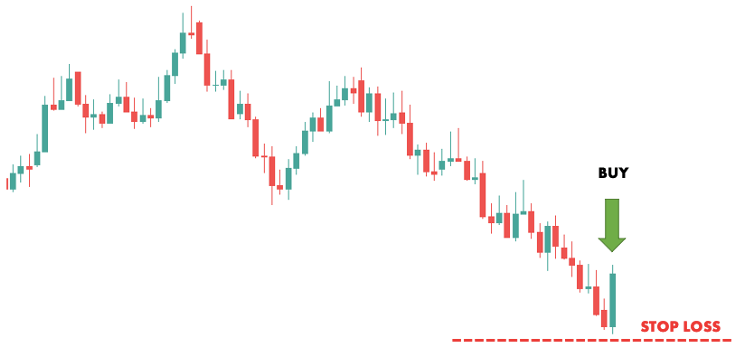

Assume you opened a buy trade after the bullish candlestick marked with the green arrow.

When looking for a place for your stop loss, you must understand that the market will most likely retrace slightly following the large bullish candle, so there must be enough leeway to avoid getting stopped out immediately.

A good stop level could be below the green candle’s low.

If the market slumps back to this level, the bullish move that made you open the trade is completely invalidated, so there is no reason to hold your position any longer.

In terms of take profit, what you must consider is that the further the TP is from the market, the less probable it is that it will be reached. So, maximizing your profit is not necessarily about targeting super far prices.

Unless you have a compelling reason to believe that a distant price will be reached, choose closer targets, which the market has a good chance of hitting.

Now, the trouble is that you never really know how likely it is that a price level will be reached; this is where uncertainty and speculation come into play.

What you can do is examine the price action and try to find locations on the chart that sort of stand out and where the price has previously changed direction.

(These are known as support and resistance levels, and we have an entire guide dedicated to them if you want to learn more.)

You can then place your take profit at one of these levels.

So, this is how you set stop-loss and take-profit levels. Of course, things can get more complicated when you design elaborate trading systems, but the basic ideas stay the same.

Frequently Asked Questions

A stop loss is the way of telling your broker where you wish to exit a losing trade. If you attach a stop loss to your trade, the broker will automatically close it if it moves against you and hits the stop loss price.

If you purchased the currency pair, you set your stop loss below the market price, but if you sold, you set it above. The stop-loss order is saved on the broker’s server, so even if you turn off your computer, it will still execute if the specified price is reached.

A take profit is the way of telling your broker where you wish to exit a winning trade. If you attach a take profit to your trade, the broker will automatically close it if it moves in your favor and hits the take-profit price.

If you purchased the currency pair, you set your take profit above the market price, but if you sold, you set it below. Take-profit orders, like stop-loss orders, are saved on the broker’s server and execute automatically without your presence.

Conclusion

By now, you know what stop-loss and take-profit orders are.

You also understand the benefits and drawbacks of employing these tools, as well as the fundamental concepts of using them in your trading.

It is up to you to determine whether they are a right fit for you.

If you’re just getting started, it’s a good idea to at least use a stop loss because you’re more likely to make mistakes.

We have a free PDF that you can download from our home page. It will give you more ideas on where to position your stop losses.