What powerful technical analysis tools can help you trade trends or spot reversals? You guessed it: forex wedge patterns.

Landing the perfect forex wedge strategy—and knowing how to recognize all the different variations of the pattern—is no mean feat.

We’re sharing everything you need to know about forex wedge patterns in this ultimate guide.

Table of Contents:

- What is a Wedge in Forex? (Quick Overview)

- A Closer Look at the Wedge Pattern Concept

- How to Trade Rising Wedge Forex Patterns (Strategies for Bears)

- How to Trade Falling Wedge Forex Patterns (Strategies for Bulls)

- Special Cases in Trading Rising Wedge and Falling Wedge Forex Patterns

- Broadening Wedge Patterns (Ascending and Descending Broadening Wedges)

Let’s dive in.

What is a Wedge in Forex? (Quick Overview)

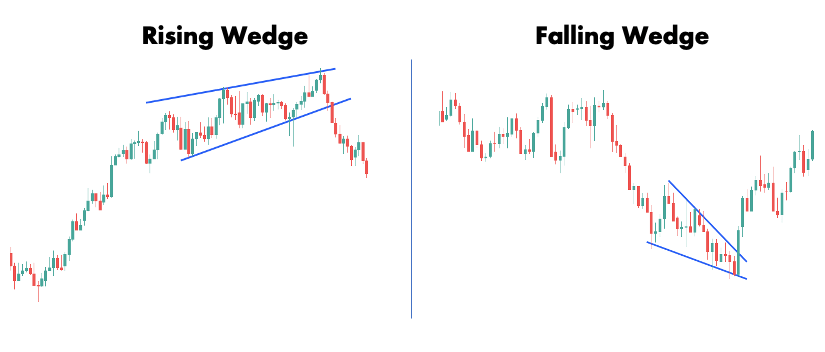

Wedge patterns in forex are chart patterns that form when market activity converges in a range that slants up or down, depending on the wedge type.

If you’ve read any of our previous postings on chart patterns, you’ll notice that they all have a bullish and bearish variant. Wedge patterns aren’t any different, however the terminology isn’t the same.

The right prefixes for these patterns are “rising” and “falling.” People also use “ascending” and “descending,” which are both acceptable.

The rising wedge is not bullish, and the descending wedge is not bearish, despite what your instincts may tell you. In fact, it’s the polar opposite.

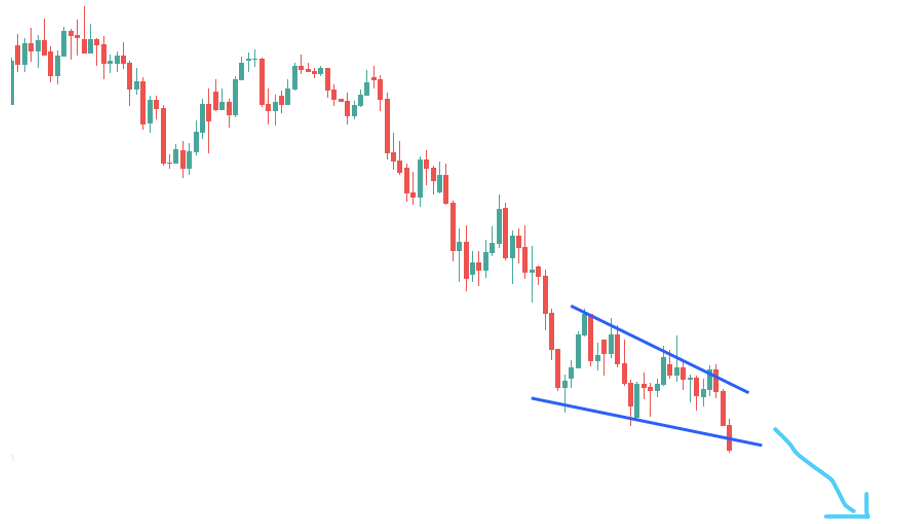

The rising wedge is a bearish pattern that occurs when the price is consolidating in a range that slants up. Traders anticipate a downward breakthrough from the pattern, implying that the downtrend will continue or the uptrend will reverse.

The falling wedge is a bullish pattern that occurs when the price is consolidating in a range that slants down. Traders anticipate an upward breakthrough from the pattern, implying that the uptrend will continue or the downtrend will reverse.

Before showing you how to trade wedge patterns in forex, we’re going to elaborate a bit more on the concept behind these patterns.

A Closer Look at the Wedge Pattern Concept

So, what is a wedge pattern in trading exactly? Wedge patterns indicate volatility compression.

It may appear difficult, but the premise is straightforward: because volatility measures how much a market moves in a given timeframe, volatility compression indicates that the range of motion is narrowing.

The beautiful thing about volatility compression is that it always results in a breakout, which is usually followed by a strong trend.

This is why forex wedge patterns can be powerful: they help you align yourself with the market and catch large price moves.

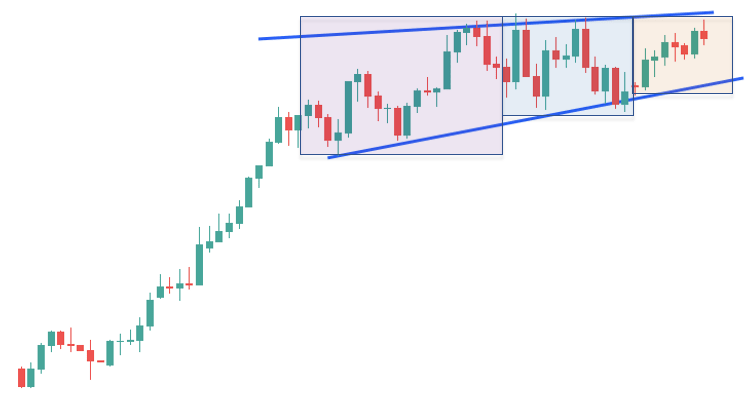

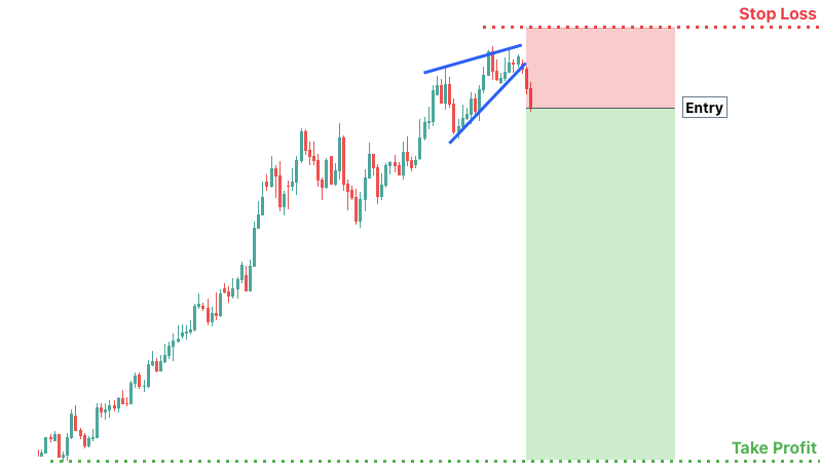

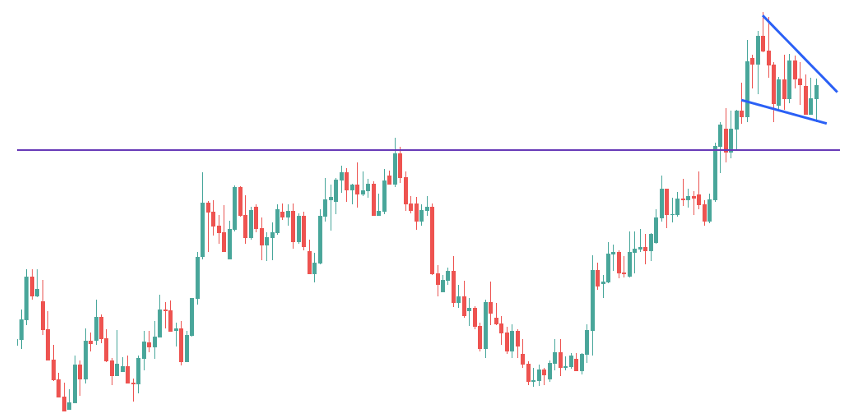

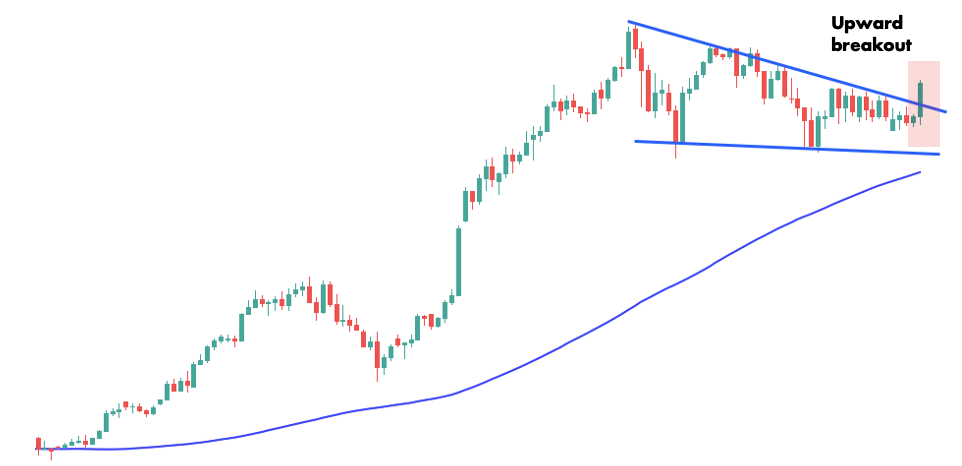

In the chart below, you can see how the ascending wedge was followed by a big downswing.

Stay tuned because we’ll be showing you a lot more examples and tactics for trading wedge patterns in forex.

How to Trade Rising Wedge Forex Patterns (Strategies for Bears)

Smart traders know that forex wedge patterns can present a wealth of trading opportunities.

Here are three basic strategies for trading rising wedge forex patterns depending on your trading style:

- Scalping strategy: grab a few pips from panicking traders

- Swing trading strategy: ride the downtrend

- Position trading strategy: use the rising wedge to catch a major market reversal

We’re breaking down all the techniques in this post (so keep scrolling!).

Scalping Strategy: Grab a Few Pips from Panicking Traders

You know how the saying goes, failing to plan is planning to fail. So, before you start chasing candles, be sure you have a plan.

Rising wedge forex patterns can provide numerous possibilities to grab a few pips in a systematic and controlled manner.

For this strategy, you’ll need a short-term chart, such as the 5-minute or even the 1-minute.

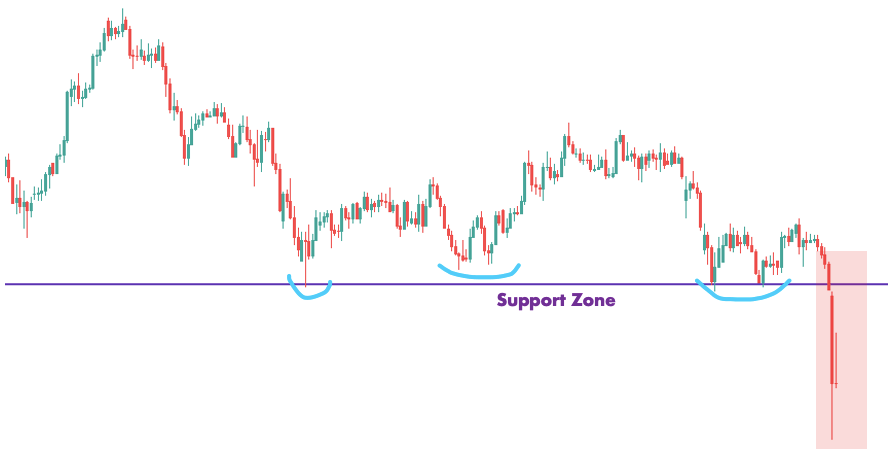

You want to ensure that your chosen currency pair (stick with significant pairs like EUR/USD, GBP/USD, and so on) reaches a key support zone.

We have a separate guide that explains the principles of support and resistance if you don’t know what a support zone is. In short, a support is essentially a price zone below where the price has a difficult time falling.

You’ll know a price has reached a support zone when you see that the market hangs around an area where it has often turned around in the past.

From there, wait until the support zone fails to hold.

This content belongs to ForexSpringBoard.com. Do not copy.

Even a little breach of the support can trigger a sharp drop as breakout traders enter a short position. However, selling at this point might be risky because lower prices may attract new buyers, causing the price to rise above support.

This is where the rising wedge forex pattern comes into play.

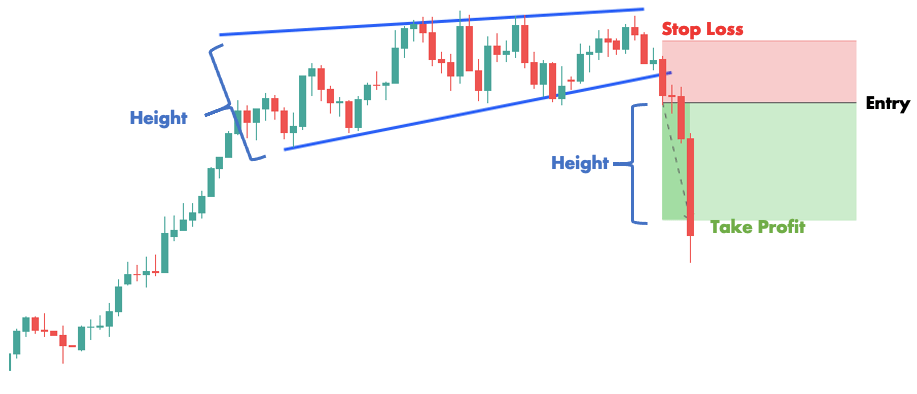

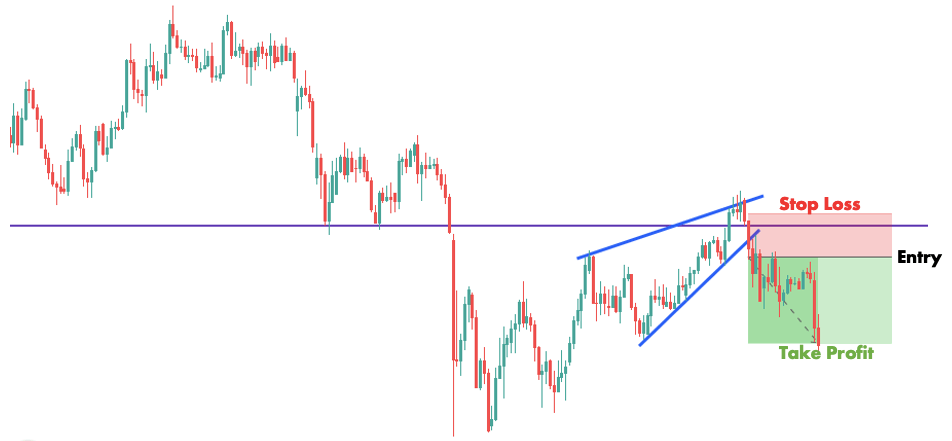

Once you’ve got a solid drop below support, wait until the market begins to rise, creating a rising wedge formation. The fact that the wedge does not extend above the support is crucial.

Next, you’ll want to look for a faltering upward momentum around support (which now functions as resistance) and an eventual breakout from the wedge to the downside. Put 1% of your account balance in a short position when this happens.

A downward breakout from the pattern indicates that buyers are unable to keep the market from plunging further. This can cause panic selling, allowing you to profit handsomely.

Your stop loss should be above the resistance and your profit objective should be a few pips below.

Swing Trading Strategy: Ride the Downtrend

If scalping isn’t your thing, swing trading might be a better option.

We’ll teach you a basic strategy that traders employ all the time with rising wedge forex patterns.

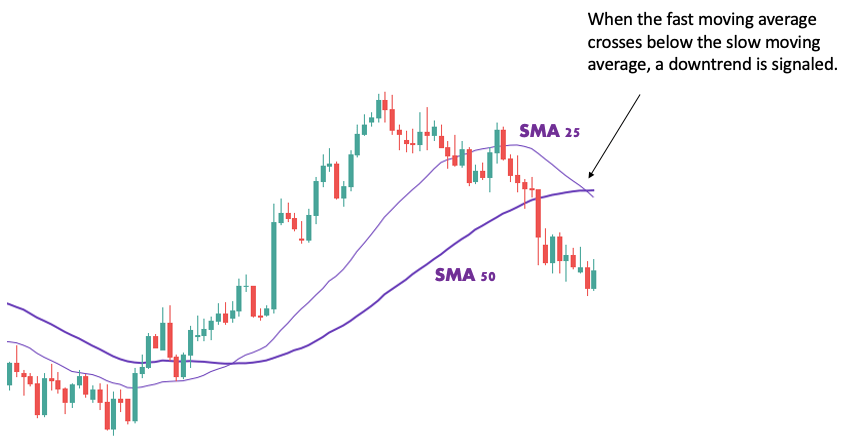

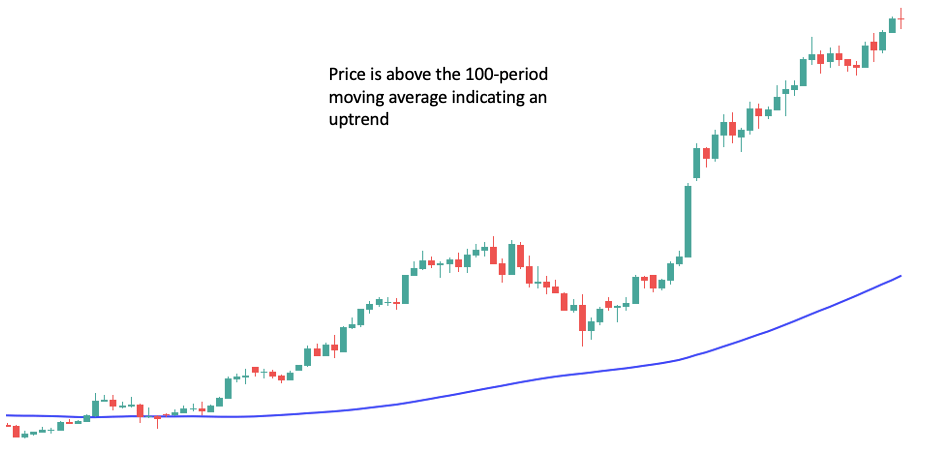

To utilize this strategy, go to a mid-level chart, such as an hourly or 4-hour chart, and make sure the market is downtrending.

How you define a downtrend is entirely up to you. You can use a basic eyeball test, search for alternating lower highs and lower lows, or utilize a technical indicator.

Once you’ve determined that the market is in a decline, wait until it enters a consolidation phase.

From here, the strategy is similar to what we’ve already described.

Look for circumstances where the consolidation takes the form of a rising wedge forex pattern and wait for it to break downward.

Open a trade with no more than 1% of your money at risk once the breakout candlestick has closed.

Because this is a swing trading technique, you can use a greater stop loss and set your profit goal further out to catch a larger chunk of the trend.

The currency pair you choose is less crucial in this case, but try to stick with more active pairs because they are less expensive to trade and provide more opportunities.

Position Trading Strategy: Use the Rising Wedge to Catch a Major Market Reversal

Follow these steps to catch a major market reversal and hold your position for months (or even years) using the rising wedge forex pattern:

First, open a daily chart of the currency pair you wish to trade. Transaction costs won’t have a significant impact on your bottom line because your holding time is long, so you can trade practically any pair.

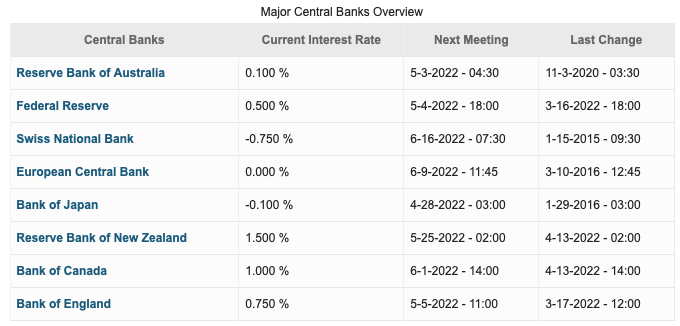

Although it isn’t required, you may decide to choose currency pairs based on the interest rate differential between them.

(Source: FXStreet – THE WORLD INTEREST RATES TABLE)

This is because you always pay interest on the currency you short and gain interest on the currency you long when you hold a forex trade overnight.

Because a forex trade involves buying and selling currencies at the same time, when your position is rolled over to the next trading day, you will either pay or receive interest.

The money acquired or paid in this manner adds up over time, making interest rate differentials difficult to overlook if you intend to retain a position for the long run.

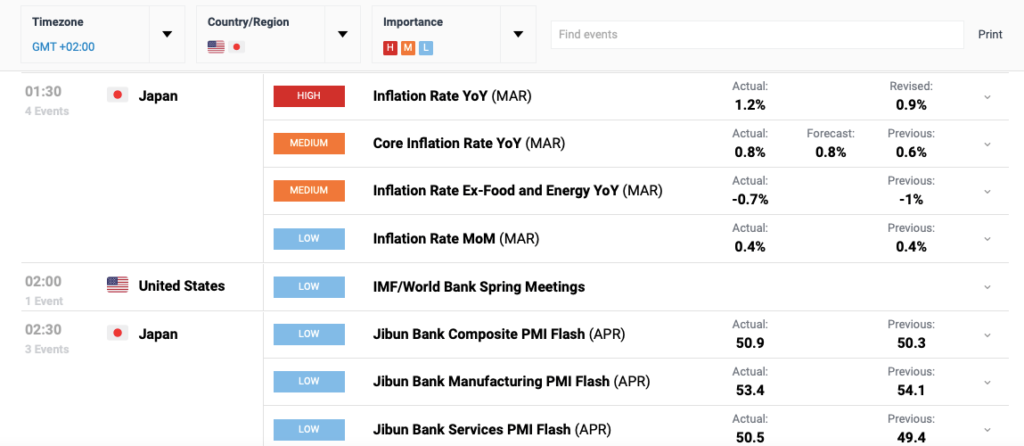

After you’ve chosen your currency pair, the next stage is to keep an eye on the currencies’ fundamentals.

(Source: DailyFX – Economic Calendar)

If you’re trading the USD/JPY, for example, you should keep an eye on the US and Japanese economies.

- What are the interest rates?

- What are the expectations for growth?

- What does the job market look like?

- Is there inflation?

- How is the balance of trade?

The last step is finding a trade trigger. Look for circumstances where a rising wedge forex pattern develops in an uptrend and the robust economy’s prospects are fading.

Then, when the wedge breaks to the downside, go short.

For example, in the case of the USD/JPY, a robust but declining US economy combined with a faltering upswing (where a rising wedge forms and the price eventually breaks out to the downside) is the best trade scenario.

Your might place your stop loss above the wedge, and your take profit can be placed well below. The actual distance will be determined by your estimate of what price the fundamentals justify.

How to Trade Forex Falling Wedge Patterns (Strategies for Bulls)

Because the forex falling wedge is a bullish formation, these patterns will present opportunities to buy the currency pair rather than sell it.

Apart from that, trading the falling wedge is very similar to trading the rising wedge.

We’ll look at the same methods that we looked at with the rising wedge and see how they apply to a bullish scenario.

- Scalping strategy: grab a few pips from euphoria-driven markets

- Swing trading strategy: wait for a consolidation and rides the trend

- Position trading strategy: use the falling wedge to catch a major market reversal

Let’s get started.

Scalping Strategy: Grab a Few Pips from Euphoria-Driven Markets

Much like fear, greed is a powerful emotion.

Traders are prone to being too enthused, and as a result, markets frequently experience periods of exorbitant growth. These circumstances can provide excellent scalping opportunities, among other things.

To begin, open a short-term chart, such as the 5-minute or even 1-minute chart, of a major currency pair (EUR/USD, GBP/USD, etc.).

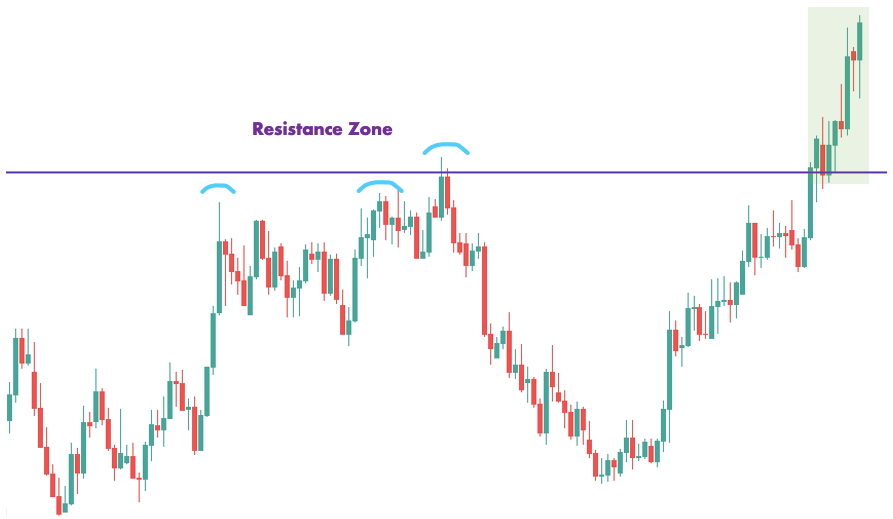

Then wait for an upward trend. The uptrend should break past a resistance zone and transform into a parabolic blow-off.

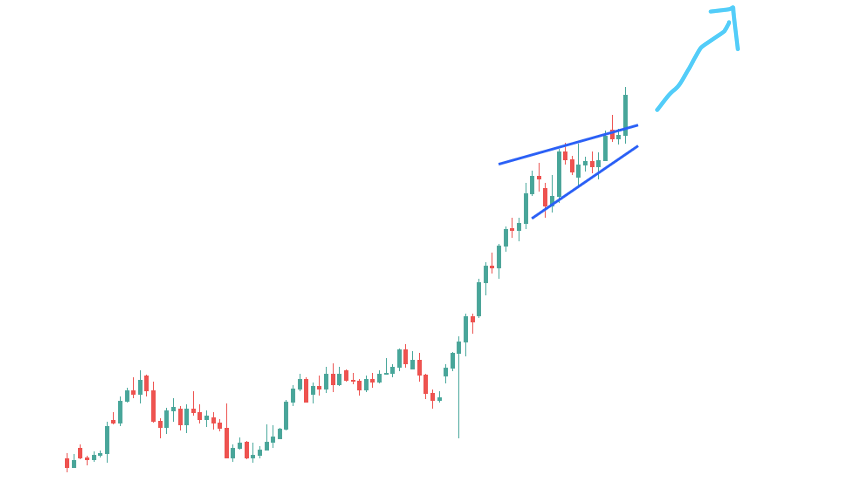

From there, keep an eye out for the forex falling wedge pattern. The formation of a falling wedge during an upswing usually indicates that the trend will continue.

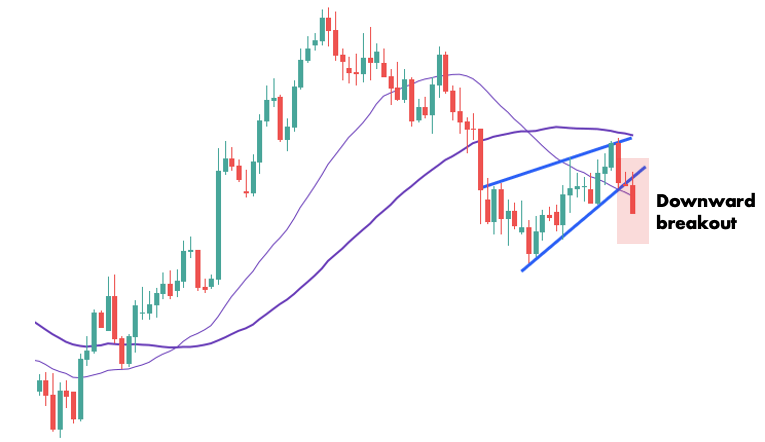

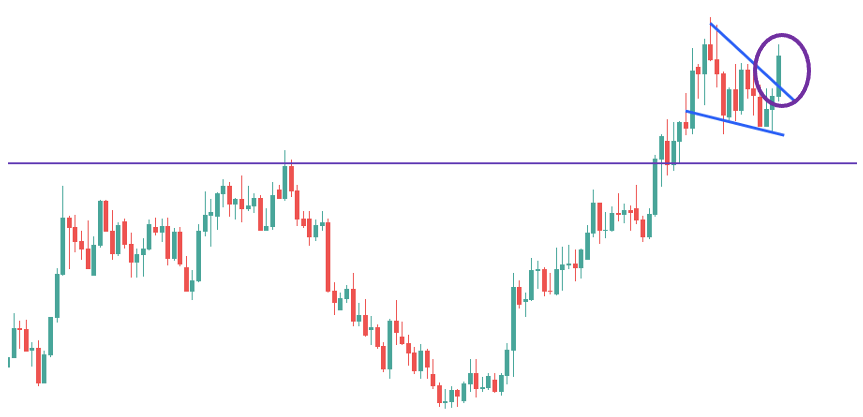

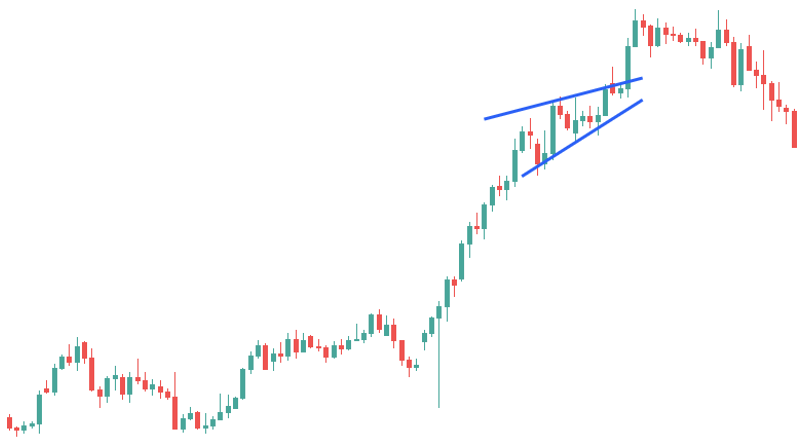

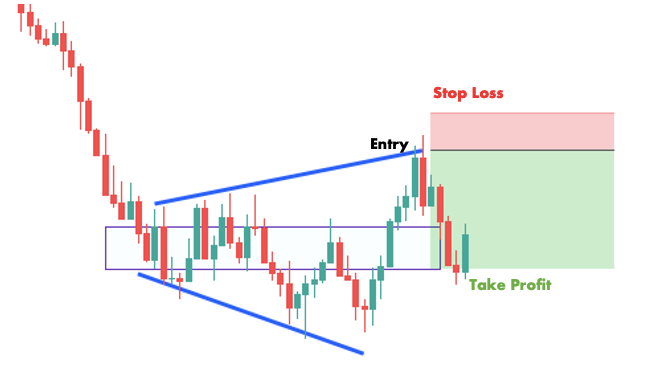

Let’s take a look at the chart below.

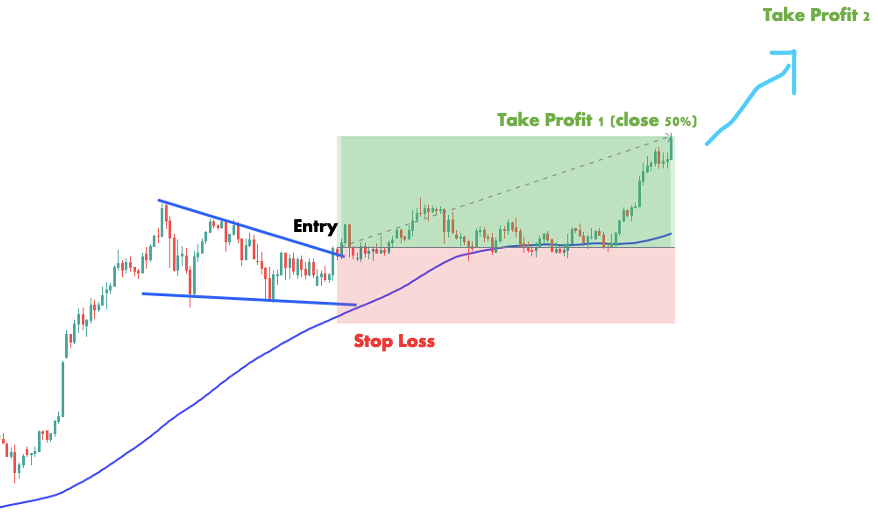

The falling wedge pattern occurs as the price consolidates after a big advance.

Consolidations after a rally are dangerous in the sense that the market might be overbought and hence more vulnerable to a reversal. This is especially true when the consolidation occurs near resistance.

However, it’s also possible that the rally hasn’t achieved its full potential, and that the short reversal will be followed by a new move higher.

This is precisely what you bet on with this strategy. So, all you have to do now is wait for the price to break out to the upside from the falling wedge forex pattern.

This confirms the pattern and increases the likelihood of another leg up.

You may want to set your stop loss below the support level (remember that failed resistance becomes support) and your profit objective a few pips above it.

Swing Trading Strategy: Ride the Uptrend

“The trend is your friend until it ends” is a popular phrase seen on trading forums and even media giants like Forbes.

Trend trading tactics carry the danger of trend reversal. On the other hand, using the falling wedge forex pattern to trade trends is a terrific strategy to increase your chances of trend trading success.

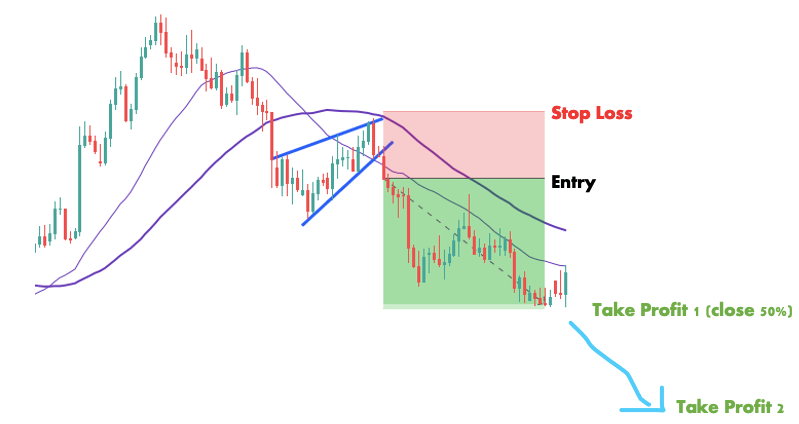

Check if the market is in an uptrend on a mid-level chart, such as the hourly or 4-hour chart.

As previously stated, it is entirely up to you to determine whether the market is trending. You have several alternatives, ranging from a basic eyeball test to price movement analysis and technical indicators.

Once you’ve determined that the market is in an uptrend, wait until the price begins consolidating.

The goal is to locate circumstances in which the consolidation takes the form of a forex falling wedge pattern with an upward breakout.

This is comparable to the scalping strategy.

The main distinction is that you’re not aiming to profit from a breakout move right away. Rather, your goal is to join the trend and ride it for a longer period of time.

As a result, you can utilize a greater stop loss and set your profit goal further out to capture a larger price move.

Position Trading Strategy: Use the Falling Wedge to Catch a Major Market Reversal

The falling wedge, like the rising wedge, can assist you in establishing long-term positions.

Open the charts of the currency pairs you’re interested in trading on a longer timescale, such as daily or weekly.

Since the fundamentals in the forex market influence long-term trends, it is critical that you select currency pairs whose fundamentals you are familiar with.

In essence, you’ll utilize fundamental analysis to discover trading opportunities and only employ technical analysis to time your trades.

The same principles apply as you’ve seen with the rising wedge.

Generate trade ideas elsewhere and then wait for the forex falling wedge pattern to assist you in determining the best entry level, stop loss, and take profit levels.

Let’s imagine the EUR/NZD market has been decreasing for some time because interest rates in New Zealand have been improving compared to the eurozone.

If you feel the European Central Bank will begin a series of rate hikes, wait for a falling wedge pattern to appear on the chart and then go long when the price breaks out to the upside.

This is an excellent time to enter a trade because, if the ECB meets your predictions, the falling market might turn into an extended uptrend as it adjusts to the new circumstances.

Depending on how far you think the price will go, you can put your stop loss below the wedge and your take profit somewhere above it.

Special Cases in Trading Rising Wedge and Falling Wedge Forex Patterns

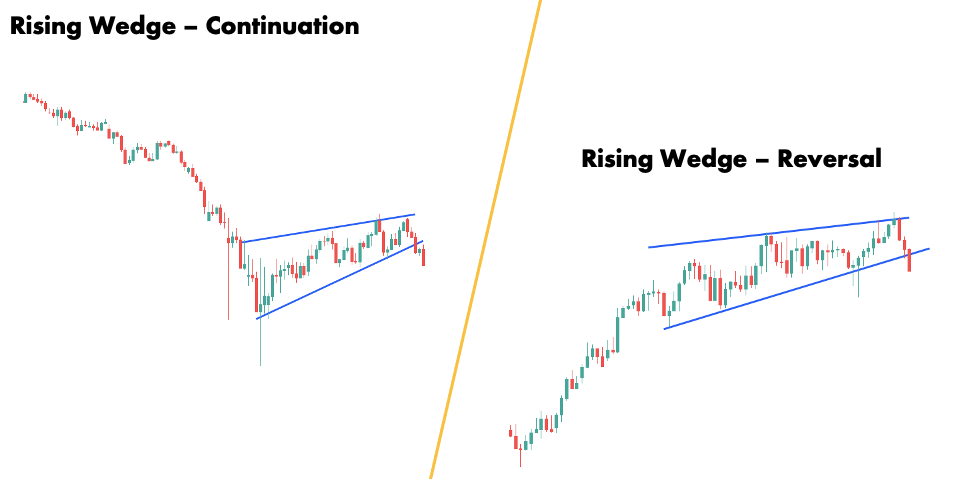

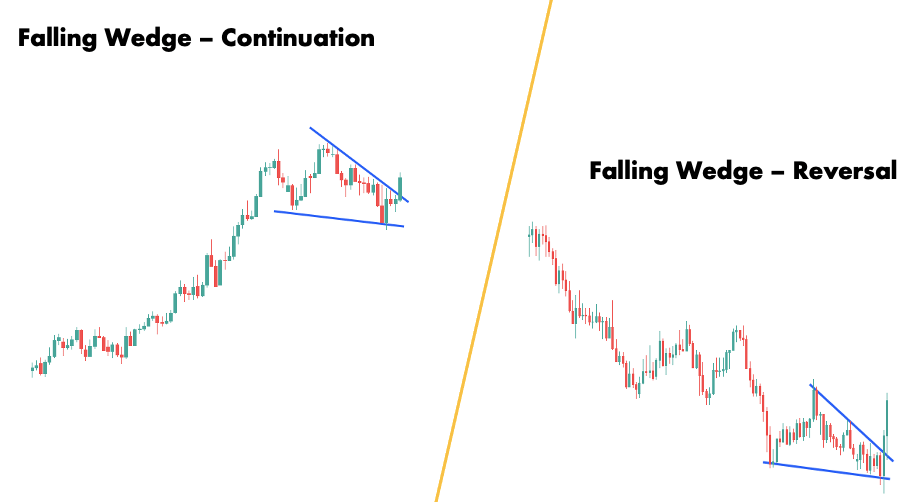

By now you know what rising and falling wedges are.

In case you need a quick recap:

- The rising wedge is a bearish pattern that signals the continuation of the downward trend or the reversal of an upward trend.

- The falling wedge is a bullish pattern that signals the continuation of the upward trend or the reversal of the downward trend.

When trading forex wedge patterns, keep these guidelines in mind. That said, there’s a special case for both patterns when the conventional bias flips.

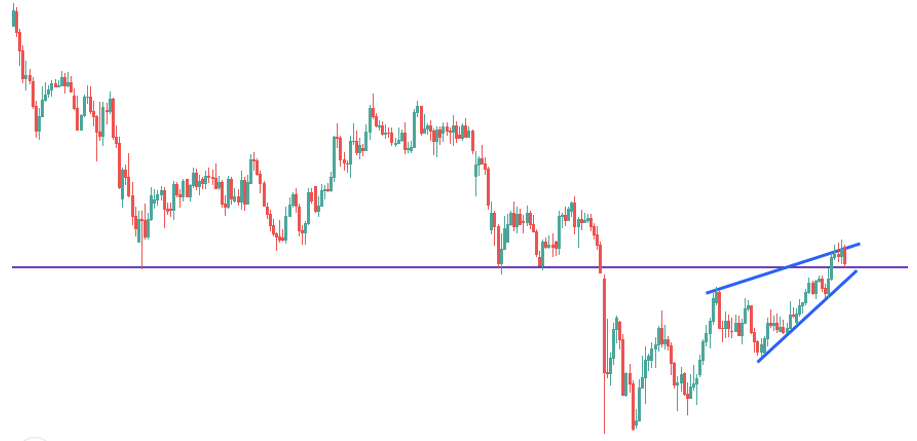

In other words, the rising wedge transforms into a bullish continuation pattern while the descending wedge transforms into a bearish continuation pattern.

What exactly are we talking about?

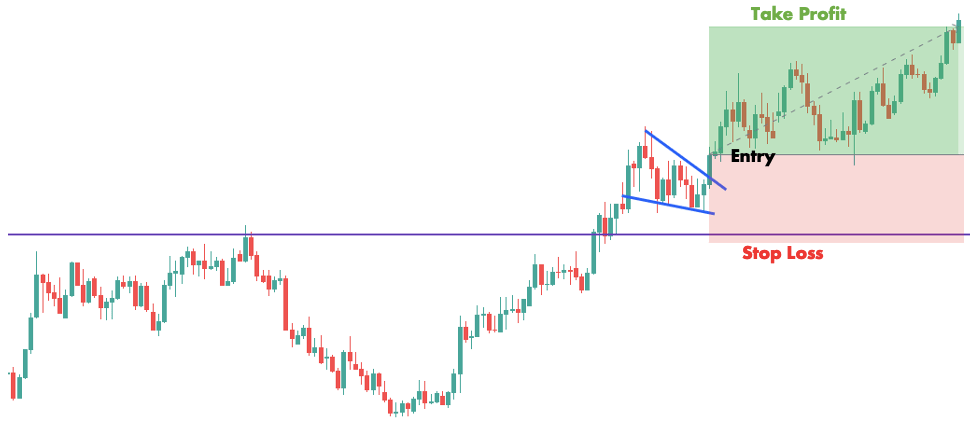

When it comes to the rising wedge forex pattern, pay attention when the wedge breaks upward in an uptrend. This means that the bull market will continue.

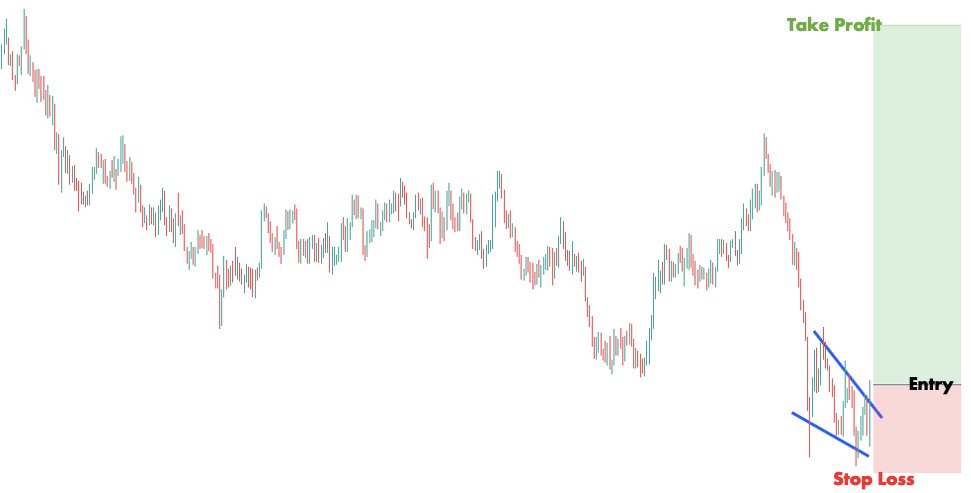

The situation is the opposite with the falling wedge forex pattern. When the price breaks out of the wedge to the downside in a downtrend, be extremely cautious. This shows that there is room for further weakness.

While these unique wedge patterns might provide excellent day-trading opportunities, use caution while trading them.

This is due to the fact that they occur when the market experiences a short-term craze in which the trend becomes extremely overextended and vulnerable to a quick reversal.

As you can see in the chart above, the market plummeted back when the price increase came to a halt.

This is due to the fact that rapid run-ups are frequently followed by profit taking and short selling at the same time, putting the market under a lot of downward pressure.

Broadening Wedge Patterns (Ascending and Descending Broadening Wedge Patterns)

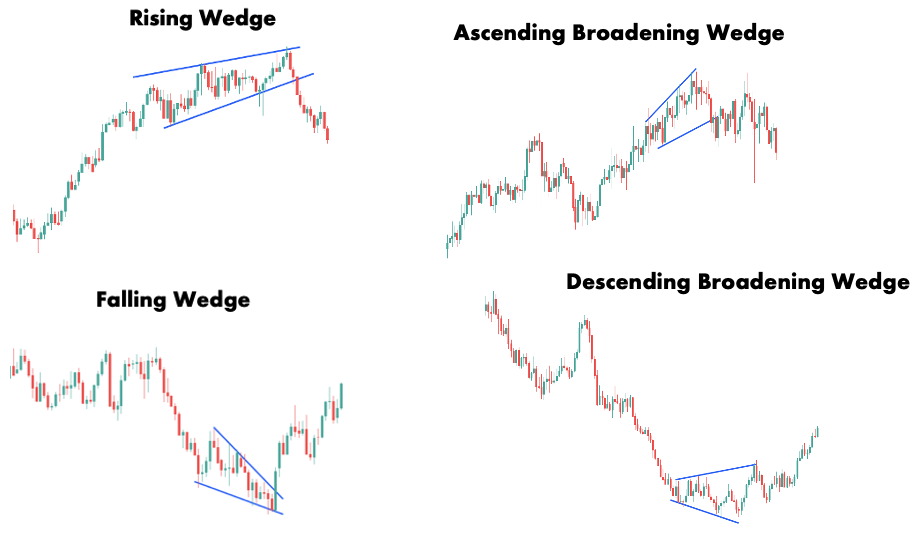

The broadening wedge pattern is a popular formation that you may have come across on the internet (the ascending broadening wedge pattern and the descending broadening wedge pattern, to be exact).

These are variations on classic wedge patterns.

(Expanding wedge patterns is another name for them.)

The pattern’s appearance is the most noticeable distinction. Unlike classic wedges, which are defined by two converging trend lines, the broadening wedge’s bordering trend lines diverge.

Broadening wedges occur when market volatility is high. This is an important consideration compared to traditional wedges, which signal volatility compression.

Although the tactics we’ve previously described can be used to trade broadening wedges, a more common approach is to trade the oscillations contained within the formation.

Traders that use this strategy believe that as the pattern expands, the price will vary from its mean value. This means reversion will eventually occur, which can be exploited for profit.

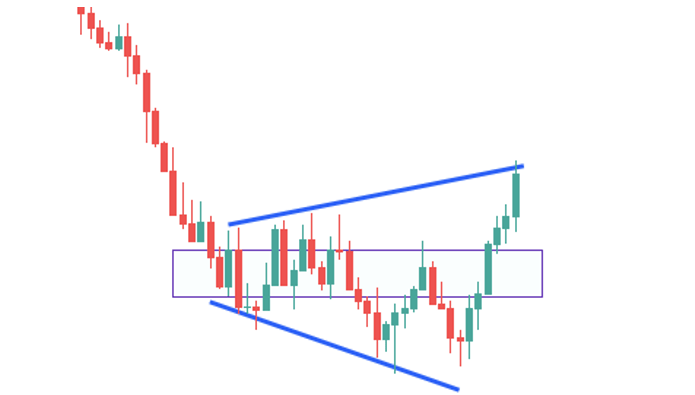

Consider the descending broadening wedge pattern shown below:

It is easy to detect that the mean values are somewhere in the shaded area. As you can see, the downward and upward expansions resulted in a divergence from these mean values.

The trend lines constructed from the prior highs and lows denote possible areas for mean reversion.

If you wanted to trade this broadening wedge pattern, you could simply go short around the upper trendline with your stop above the trend line and your take profit in the wedge’s middle.

Frequently Asked Questions

The rising wedge is a bearish pattern that occurs when the price is consolidating in a range that slants up. Traders anticipate a downward breakthrough from the pattern, implying that the downtrend will continue or the uptrend will reverse.

The falling wedge is a bullish pattern that occurs when the price is consolidating in a range that slants down. Traders anticipate an upward breakthrough from the pattern, implying that the uptrend will continue or the downtrend will reverse.

This depends on the type of the wedge. The rising wedge is a bearish formation so traders will sell the market. The falling wedge is a bullish formation so traders will buy the market.

The descending broadening wedge is a variation of the falling wedge pattern. In the case of the broadening wedge, the boundary trend lines are diverging, indicating bigger price swings.

Conclusion

Learning the nuts and bolts of forex wedge patterns takes time, but once you do, they will continue to assist you in identifying excellent trading opportunities.

You can experiment with wedge patterns using the strategies we’ve shown you to discover if they’re right for you. Simply practice in a risk-free demo environment before trading real money.

After some practice, you’ll be ready to look into how you can create your own trading strategy.