The exchange rate goes far beyond planning an overseas trip or buying something on eBay. There is also the “Currency Risk” factor that can significantly impact an international business’ bottom line.

This is an area where a company can lose millions of dollars.

For example, in 2022, Salesforce indicated that currency movements is likely to cost the company more than $800 million.

Of course, currency risk impacts aren’t always this large, but annual reports are often deteriorated by this factor, which has nothing to do with sales or product quality.

In our experience, most people aren’t very familiar with the importance of exchange rates in international trade. That’s what inspired us to create this guide.

How Exchange Rates Work and What Affects Them

This is a quick overview for those who aren’t comfortable with the topic of exchange rates. If you already have an idea about this, you can skip this section.

Like other markets, the foreign exchange market is driven by supply and demand. Currencies are commodities that people and entities can buy and sell depending on their needs and goals.

Supply and demand are the most important determinants of exchange rates. When a currency increases in value, more of the currency is being bought. When it decreases in value, more is being sold. It’s as simple as that.

Many circumstances can determine the supply and demand for a particular currency. These are called fundamentals. For example, economic events or political changes are fundamental factors.

In a perfect world, the quantity demanded of a specific currency would always be equal to the quantity supplied of that currency. This is what economists call the state of equilibrium.

In reality, many imbalances can persist for long periods of time. However, fundamental forces should eventually trigger an adjustment in exchange rates until an equilibrium rate is achieved.

For example, an unexpected referendum result can temporarily devalue a currency, but if the country has high interest rates, it may attract more foreign capital, which pushes up the value of the currency over time.

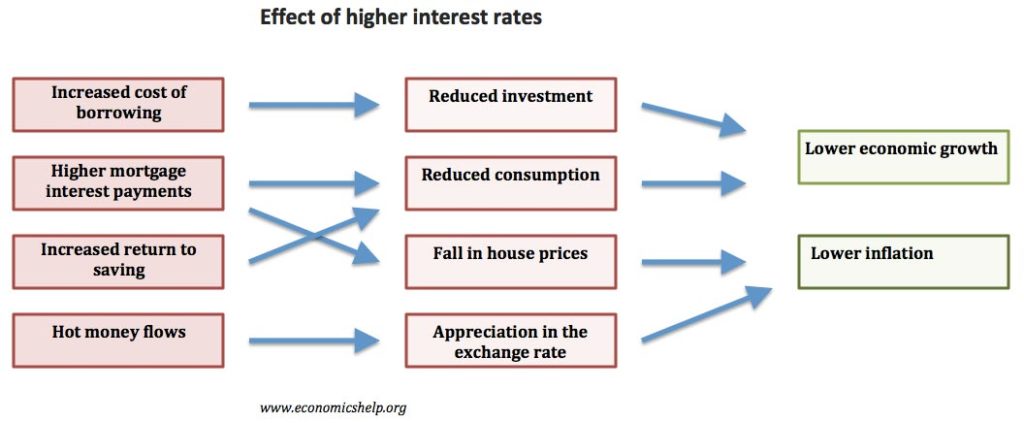

Very rarely will a currency’s price be 100% determined by pure market conditions. For instance, if a country set high interest rates, it’s typically a deliberate decision to moderate economic growth.

(Source: economicselp.org)

Some degree of management is usually essential because otherwise too many uncertainties would be involved. This may change rates over the long term, but in most countries, the government can’t directly regulate exchange rates; it can only influence a more favorable direction.

Effects of exchange rate fluctuations on businesses

Almost every type of business or industry is affected by exchange rates in some way.

The simplest scenario is when a business is directly affected.

For example, if a Canadian company is contracted to pay an American supplier for a shipment of electronic equipment in two months at a cost of $100,000, every little change in the USD/CAD rate matters.

This is obvious.

Now, what you might not realize is that exchange rate changes also have an indirect impact. This can affect even relatively small regional businesses that never imported or exported anything.

For example, a German electronic equipment maker that sells only locally must still fight against American products. If the euro significantly strengthens, these may become cheaper and more competitive.

It’s a complex picture, but let’s dig a bit deeper.

What happens if the exchange rate goes down?

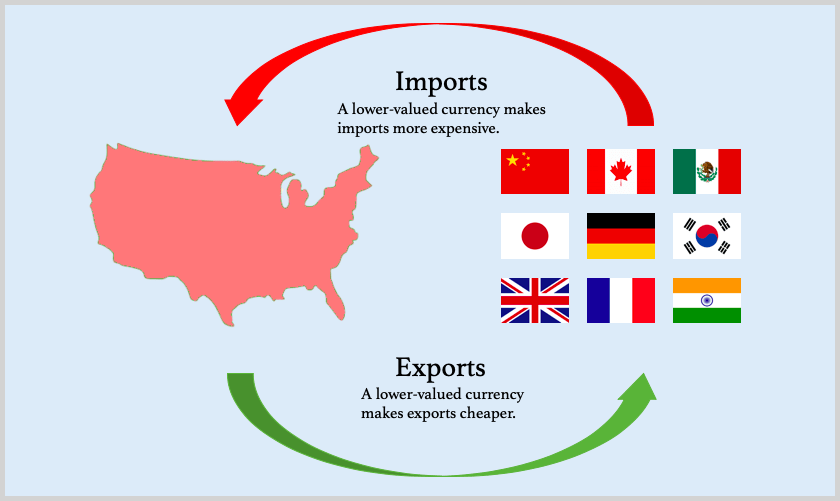

In essence, a lower-valued currency makes a country’s imports more expensive and its exports cheaper in foreign markets.

To understand how this affects different businesses, we will give you two examples. We’ll use nice, round numbers to make it easy.

Impact on importers

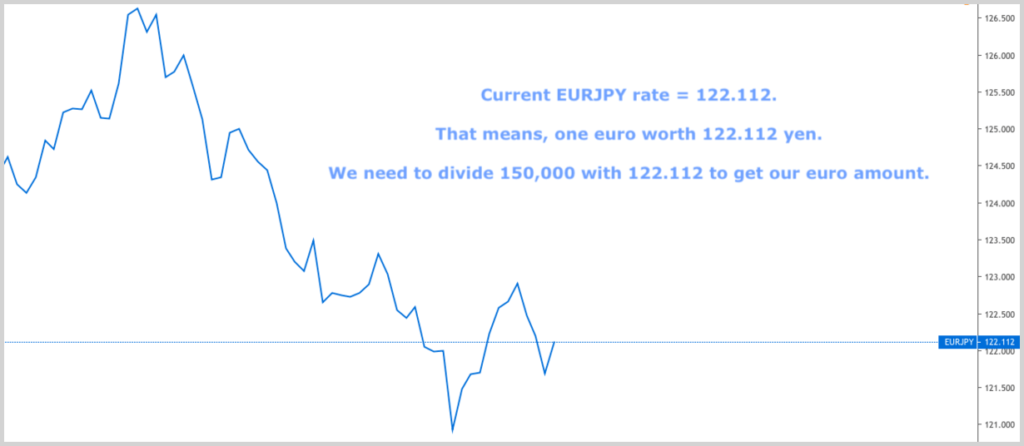

Let’s say you’re a French car maker that imports some parts and components from Japan. The EUR/JPY goes down as the Eurozone is heading toward a deeper economic slowdown.

What happens?

The cost of imports stays the same, but you need to pay your supplier in Japanese yen. Because one euro is now worth less Japanese yen, you’ll have to pay more for your imports. This will reduce your profits.

Assume an engine costs ¥150,000. This is approximately 1230 euros as of the time of this article’s writing.

If the value of the euro falls 1%, you’ll have to pay about 1240 euros for the same engine.

This might not sound like a big deal, but if you have a contract for 10,000 engines, that’s an additional €100,000 in expenses out of the blue. And don’t forget that these are only the engines.

In addition, exchange rates can drop over 1% in one day.

Impact on exporters

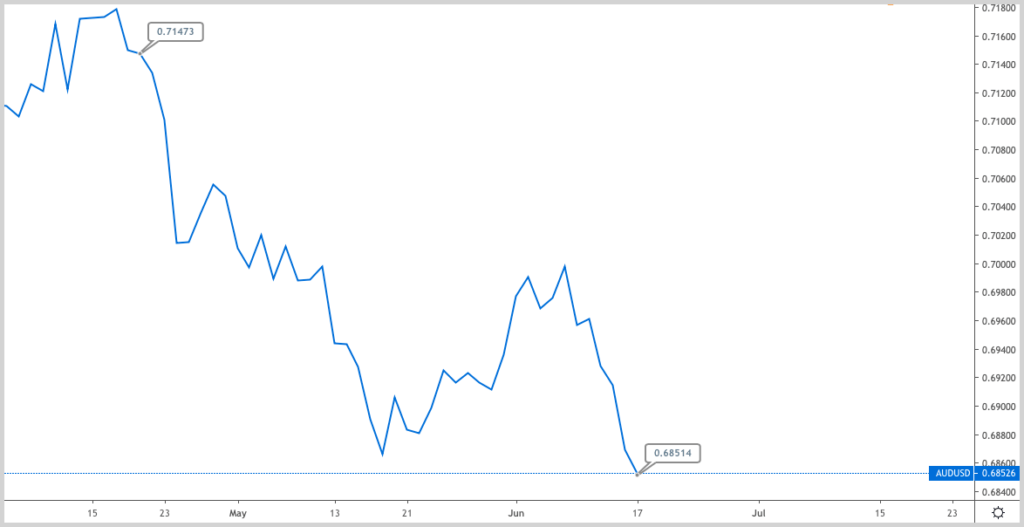

Let’s look at what has happened with the AUD/USD in the past two months.

Two months ago, one Australian dollar was worth 0.71473 US dollar. Today, it’s only 0.68514 – a value loss of about 4% compared to the USD.

Now let’s say you’re an Australian company that makes most of its revenue from exporting pharmaceuticals to the USA.

Does a currency depreciation such as this one hurt your bottom line?

The answer is no. In fact, it’s good for you.

Suppose your most popular medicine is an oral tablet. The production cost of a package is AU$80, and you sell it for AU$150 in Australia.

Two months ago, you would have sold this medicine for US$107 in the USA (150 * 0.71473). However, now, because the exchange rate went down, the American price of this medicine would be US$103 (150 *0.68514).

That’s four bucks cheaper!

We know from Black Fridays that if something becomes cheaper, people will want to buy more of it. Therefore, you can simply lower the US price based on the change in the exchange rate and bring in more sales revenue.

Super cool.

Alternatively, you might decide to keep the price at US$107. Your production costs remain the same in AUD, but the stronger USD means more revenue in your home currency. In other words, you will make a bigger profit on each sale.

What happens if the exchange rate goes up?

When the exchange rate goes up relative to other currencies, a country’s exports become more expensive and its imports cheaper.

Let’s take a look at two examples, just as we did a few paragraphs above.

Impact on importers

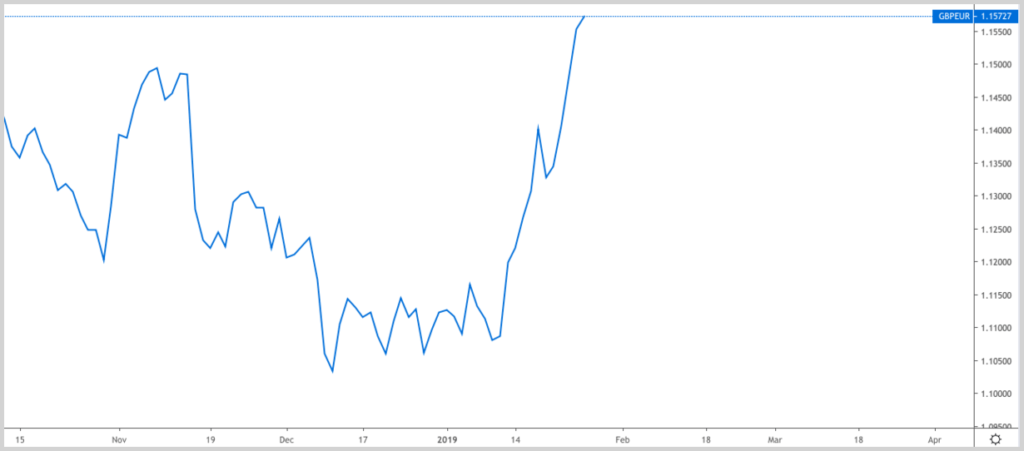

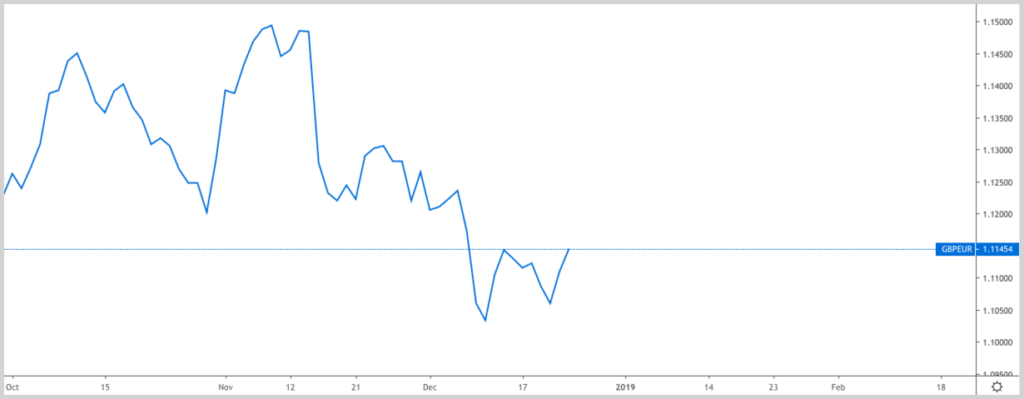

Let’s say you’re a British restaurant that imports meat from the Republic of Ireland, which is part of the EU and uses the euro. Recent political disturbances have sent the pound sharply higher against the euro.

How does this affect your business?

You’ll need to pay your supplier in euros, but you use the British pound. This means you must exchange pounds into euros before you can pay for your imports. Because the pound has strengthened against the euro, your pounds will buy more euros. In other words, your imports will get cheaper.

Assume you typically import 2000lbs of beef each month (~907kg). You agreed to pay 170 euros for 100lbs. With the current exchange rate, that costs you about 147 British pounds. That’s £2,940 for the whole shipment.

Now travel back in time a month, when the euro was stronger.

The same 100lbs of beef would take about 153 British pounds. That is a payment of £3,060 for the whole shipment – 120 pounds more than the current price.

Impact on exporters

Let’s say you’re a Japanese aircraft manufacturer.

In the civil aircraft market, you supply about 35 percent of the content for some of the most famous American aircraft. You sell things like:

- Engines

- Hydraulic systems

- Flight control systems

About two years ago, one Japanese yen was worth 0.008535 US dollar. Although the Japanese government tries to ensure a low yen value, market pressures caused the yen to climb in value. Now one yen is worth 0.009340 USD.

The question is: How does the strengthening yen affect your bottom line?

American companies use the dollar, but they need to pay you in Japanese yen. This means they must exchange dollars to yen before they can pay for your products.

Because the yen has strengthened against the dollar, their dollars will buy fewer yen. In other words, your exports will be more expensive for them, which will lead to lower demand.

For example, an aircraft engine that cost one billion Japanese yen was 8,535,000 USD two years ago; now it’s 9,340,000. That’s almost a million-dollar difference. You can reduce your prices to remain competitive, but either way, your revenues will probably decrease.

Do heavily fluctuating exchange rates have negative effects on the volume of international trade?

The impact of exchange rate volatility on international trade flows has always been an interesting question.

It’s logical to say that a volatile or heavily-fluctuating currency may be harmful to international trade, as it increases the risk of cross-border transactions.

But is that the case?

Researchers from the United Nations have published a study on the subject, and their findings don’t seem to support this belief.

According to their study, countries whose currencies are more volatile don’t necessarily have lower rates of growth, in terms of both imports and exports.

A possible reason is the wide availability of financial instruments that firms can use to protect against exchange rate risks (e.g. forward contracts or currency options).

Although heavy exchange rate fluctuation has limited importance, the study found that exchange rate misalignments substantially affect international trade flows.

Therefore, an undervalued currency is found to promote exports and reduce imports, while an overvalued currency tends to do the opposite.

Conclusion

In this article, we have examined a couple of situations in which fluctuating exchange rates affect various businesses.

The overall conclusion is that an undervalued currency is good for exporters and bad for importers, while the converse holds true for overvaluation.

It’s important to note that exchange rate changes don’t always have drastic effects on businesses. That’s because most companies put a massive effort into minimizing their currency-related risks.

For example, BMW moved much of its production overseas and developed ways to spend money in the same currency as where most sales are taking place.

Nevertheless, the adverse exchange rate change is a permanent risk factor that international companies must keep at the top of their minds.