We all know that the forex market is comprised of multiple trading sessions.

If you are reading this guide, the Sydney session is probably ideal for you to trade and hence you are trying to figure out what currency pairs to look at in this session.

This is precisely what we are going to explain today, so look no further!

Quick Overview of the Sydney Session

Before we begin, let us just give you a brief overview of the Sydney session.

Don’t worry, we won’t overload you with useless information.

You probably already know when the Sydney session takes place (if not, then just use this tool to see it in your timezone), so we’ll skip that part.

What we want to talk about are some of the more interesting details of this session, and how it is different from the other trading sessions.

Most traders will tell you that the Sydney session is rather dull and there’s not a lot of market activity going on.

Unfortunately, this is usually true.

According to the most recent triennial central bank survey, 78% of all FX trading is concentrated in the United Kingdom, the United States, Singapore, Hong Kong SAR, and Japan.

So, in general, big bursts of activity are to be expected when one or more of these trading centers are active.

That’s why the Sydney session, whose primary trading centers are in Australia and New Zealand, does not account for significant market activity in the grand scheme of things.

Having said that, let’s highlight a few more things that can make the Sydney session a little more interesting.

As you might know, the Sydney session is the first trading session to take place after the weekend.

In other words, if something happened over the weekend, Sydney session traders will be the first to react.

This article belongs to ForexSpringBoard.com Do NOT Copy

This means that, occasionally, you will that find trends starting to develop in this session get really accentuated later in the day, when the big financial centers come online.

So, being active in the Sydney session can provide you with the opportunity to place trades in line with these early-stage trends, and exit at the end of the day when big traders have pushed the market in your favor.

The only caveat to this is that if liquidity is thin (as is often the case during the Sydney session), trading conditions will be bad, meaning high spreads and delays in execution, so you will have to be careful.

Another important thing about the Sydney session is that it actually overlaps about 2 hours with the Tokyo session.

This overlapping period can be a lot more active than the Sydney session alone since important financial centers such as Tokyo, Singapore, and Hong Kong are all open at the same time.

Alright, so that’s going to do it as a quick introduction, and now it is time to get down to business.

Sydney Session Forex Pairs

Below are 5 key currency pairs that you should have on your watchlist if you are planning on trading during the Sydney session this year.

#1 AUD/USD

It probably doesn’t come as a surprise that the Australian dollar (AUD) is one of the major currencies traded during the Sydney session.

What’s important to know about the AUD is that it is considered to be a commodity currency, meaning it is heavily influenced by certain commodity prices.

As of May 2023, metalliferous ores and metal scrap account for 29% of total Australian exports, while coal, coke and briquettes make up 15% and gas is 7% (source: TradingEconomics).

So, naturally, the price of these commodities will have an impact on how well Australia, and thus, the AUD is doing relative to others.

Although the US is not Australia’s largest export market, the AUD/USD is the most liquid currency pair among those that can be used to speculate on the strength of the Australian dollar.

In most cases, you will find that that if you are bullish on the AUD, then your best option is to go long AUD/USD; if you are bearish on the AUD, then go short AUD/USD.

#2 AUD/JPY

In some cases, you might want to trade the Australian dollar but also isolate your exposure to local markets as much as you can.

For example, you might believe that the Australian dollar will overperform its regional peers, but at the same time, you also know that the US dollar is seeing large inflows globally.

This makes you concerned about a choppy price movement in AUD/USD, and prompts you to seek an alternative way to capitalize on Australia’s relative strength.

This is where the AUD/JPY can come into the picture.

Japan is Australia’s second largest export partner (The first is China, but Chinese money is not traded freely), so the AUD/JPY can provide a more localized exposure to the price of AUD while still having decent liquidity.

Consequently, the AUD/JPY pair is also heavily traded during the Sydney session.

Just like Australia, Japan is also very export-oriented, meaning that this pair can be particularly sensitive to changes in commodity prices and trade flows.

The Japanese focus mostly on machinery and electrical goods, and they have usually preferred low interest rates to devalue the yen which helps increase trade competitiveness (making goods appear more affordable to foreigners).

On the other side, Australian interest rates are typically higher. Consequently, the AUD/JPY pair has normally been very popular with carry traders.

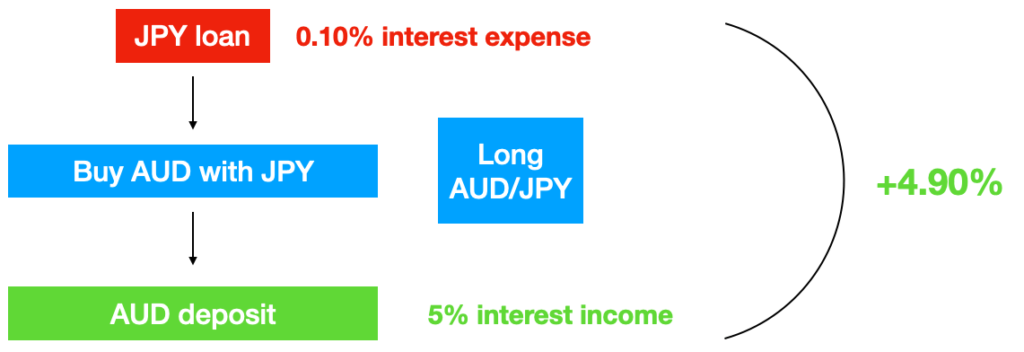

Carry trading entails taking out a loan in a currency with a low interest rate and then exchanging it for a currency with a higher interest rate.

After that, you just deposit the high interest rate currency into the bank, and keep pocketing the difference between the return you earn this way, and the relatively lower interest expense you pay after your existing debt.

Below is an example using hypothetical interest rates:

Carry trading is more of an investment type of strategy than actual trading since you wish to hold the position as long as possible (or as long as it is profitable).

It has a practical importance for traders, however, in that it often leads to structural appreciation of high higher-yielding currencies relative to those with lower yields.

This can lead to long-lasting trends but perhaps even more importantly to a sudden collapse in the exchange rate when the investment climate changes and carry traders unwind their positions all at once.

The AUD/JPY is a particularly good example as it had been a popular choice for carry traders in the period leading up to the global financial crisis in 2008.

When the crisis’ initial waves began to be felt, investors panicked and started to flee the market causing the AUD/JPY exchange rate to plunge.

So, whether on the way up or on the way down, the AUD/JPY can be an exciting choice to trade during the Sydney session – just make sure you are careful and don’t overexpose yourself.

#3 NZD/USD

New Zealand is an island country which consists of two main landmasses—the North Island and the South Island—and over 700 smaller islands.

It also happens to have its own currency, the New Zealand dollar (NZD).

The NZD, or kiwi, as forex traders sometimes call it, is a widely traded currency in the Sydney session, so it can be a good choice if you are looking for currencies that are more active during this time.

New Zealand has extensive trade relationships and a very effective agricultural system which provides the foundation for its main export items: dairy products, meat, forest products, fruits, and beverages.

Changes in the cost of these products can have an impact on the direction of the NZD, as well as the price of petroleum, which is a major source of imports.

Buying and selling the NZD in relation the US dollar is the most popular way you can get yourself involved with the kiwi.

#4 USD/JPY

The USD/JPY is one of the most commonly traded currency pairs on the forex market. Not surprisingly, it can also be a good choice in the Sydney session (especially during due to Tokyo overlap).

The base currency in the pair, the USD, is the world’s reserve currency.

This means that the USD is on the balance sheet of every central bank and major financial institution as it is the most accepted means to settle international transactions.

This puts the United States into a privileged position, and also explains why news about the US economy affects the FX market the most.

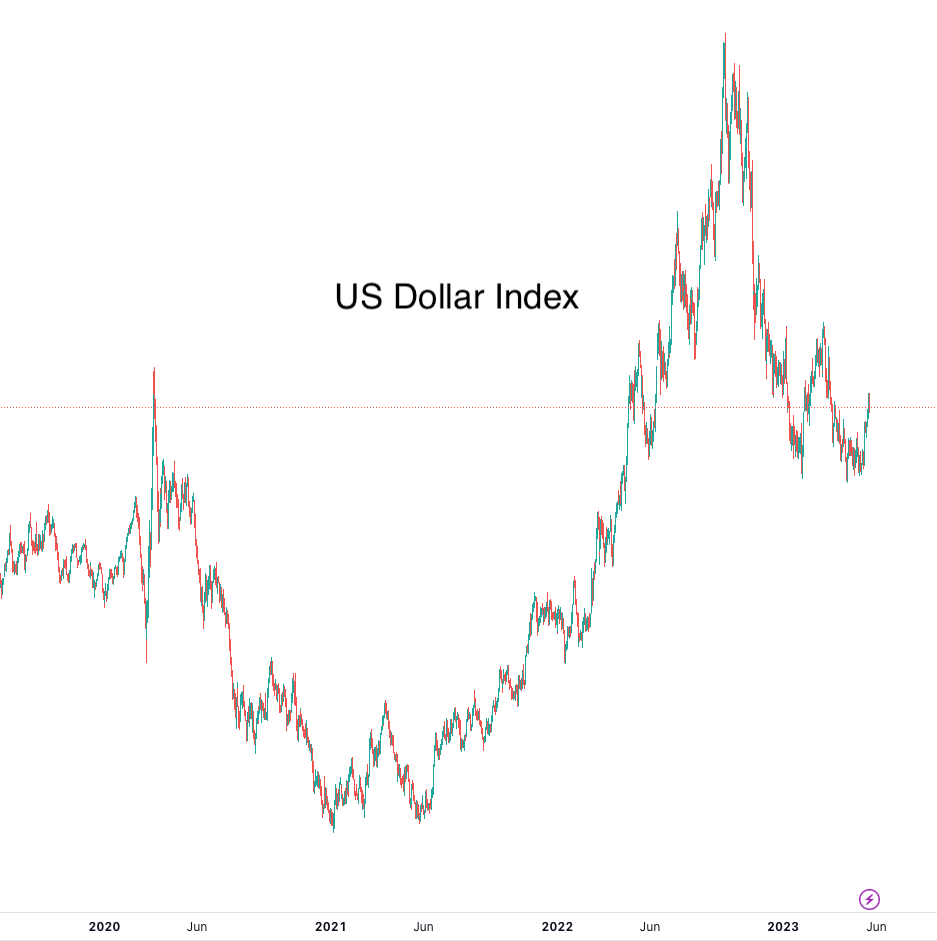

Interest rate decisions by the Federal Reserve (FED) are especially important as the United States has a lot of outstanding debt, the value of which lives or dies by interest rates.

It’s also worth mentioning that the USD is generally viewed as a safe place to store wealth during times of crisis, and it has had multiple periods of drastic run-ups in the past, most recently during the war in Ukraine.

As for the right side of the quotation, the value of yen is influenced by the performance of the Japanese economy, where exports play a big role, as we have mentioned earlier.

The Bank of Japan’s monetary policy decisions are also carefully watched because announcements about interest rates can have a significant impact on the value of the yen, which many people use to fund their carry trades.

#5 NZDJPY

The NZD/JPY shares many similarities with the AUD/JPY.

It is also a popular carry trading pair and suffered a similar fate during the financial crisis when money was promptly pulled from carry trades.

You might want to monitor the balance of trade between Japan and New Zealand to see how it changes over time.

In addition, fundamental factors such as inflation, unemployment rates, and GDP growth are all important in determining the long-term outlook for the pair.

That said, as for everything else, the immediate market for the NZD/JPY is driven by speculation.

So, it makes sense to keep an eye out for data releases from both countries if you are thinking about adding this pair to your Sydney session watchlist.

The exact time that reports are released and the period immediately following are when the pair tends to move the most, especially if the market was caught off guard and has to find a new equilibrium.

Conclusion

The Sydney session marks the start of the trading day in the Asia-Pacific region.

It is often quieter during this session, however some currency pairs, such as the AUD/USD, AUD/JPY, NZD/USD, USD/JPY, and NZD/JPY, may be busy as important data releases arrive during the Sydney session.

So, if you are planning to trade forex in the Sydney session, these pairs can be an ideal place to start.