Did you know that compounding 10 pips a day can make you ridiculously rich in a few years?

Consider this:

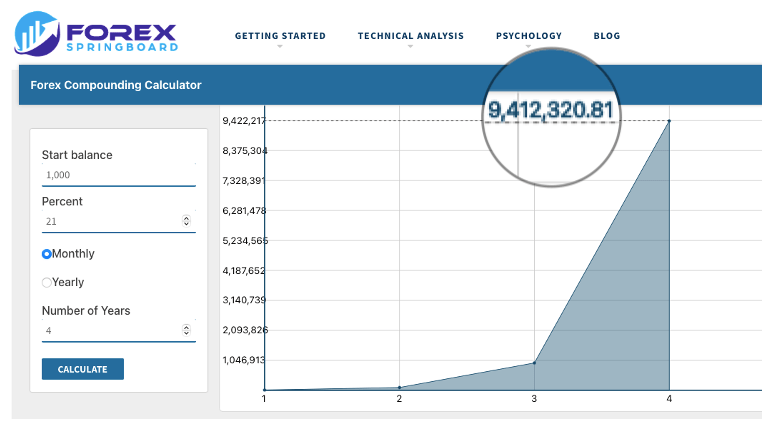

If you have a $1,000 account and make 10 pips on EUR/USD every trading day for a year, you will have $9,849.71 at the end of the year.

Do this for another year and you’ll be up $97,017.

What about three years? You’re scratching the million-dollar mark at $955,591.5.

Now get this: In four years, you will have earned a whopping $9,412,320.81.

Check out our forex compounding calculator.

Sound too good to be true?

Let’s find out.

In this guide, we’ll look at the popular 10 pips a day compounding strategy and discuss whether it’s a good idea, as well as its benefits, pitfalls, and so on.

It’s going to be a lot of fun.

10 Pips a Day Compounding Explained

To begin, a pip is the unit of measurement used by traders to describe the value change between two currencies.

If EUR/USD moves from 1.1060 to 1.1061, that .0001 rise in value is one pip

The forex market is one of the most liquid in the world, which means a lot of trading is going on. So, grabbing 10 pips a day from the market shouldn’t be too difficult, right?

That’s the idea behind the 10 pips a day compounding strategy.

The goal is to make 10 pips each day and gradually increase your position size as your account balance grows.

That way, 10 pips will translate into more and more money as compounding takes effect. Your account will grow to astronomical levels.

An extreme example of this is the above scenario, in which $1,000 became $9,412,320.81.

Let’s review how we arrived at this figure. It will help demonstrate the power of compounding.

From $1,000 to $9,412,320.81 with Compounding

To begin, we made the following assumptions:

- You deposit $1,000.

- You trade only EUR/USD.

- Every day, you earn 10 pips after the spread (so, after the transaction cost is accounted for).

- Each month has 21 trading days.

- Your initial position size is calculated so that 10 pips equals 1% account growth on your deposit.

- Each month, you increase your position size so that 10 pips equals 1% of your new account size.

- No taxes are paid during the compounding period.

Forex is traded in specific amounts called lots.

One pip on one lot of EUR/USD is worth $10. So, to pursue this strategy, you must trade 0.1 lot position sizes in your first month of trading.

This means you will buy or sell 10,000 units of currency. This is possible even with a smaller deposit because in forex you have access to leverage.

You will earn $10 a day, for a total of $210 over the first month. (Remember, we calculate with 21 days.)

After the first month, you will have $1,210 in your account, so from the second month on, 10 pips must equal $1,210*1% = $12.10.

Once you know that 10 pips must equal $12.10, you simply have to find which lot size corresponds to $1.21 per pip. That way, making 10 pips per trade will amount to exactly $12.10.

If 0.1 lot equals $1 per pip, then 0.121 lot must be $1.21 per pip.

You will have earned $12.10 * 21 = $254.10 by the end of the next 21 days. Your new account balance is $1,210 + $254.10 = $1,464.10.

Rinse and repeat.

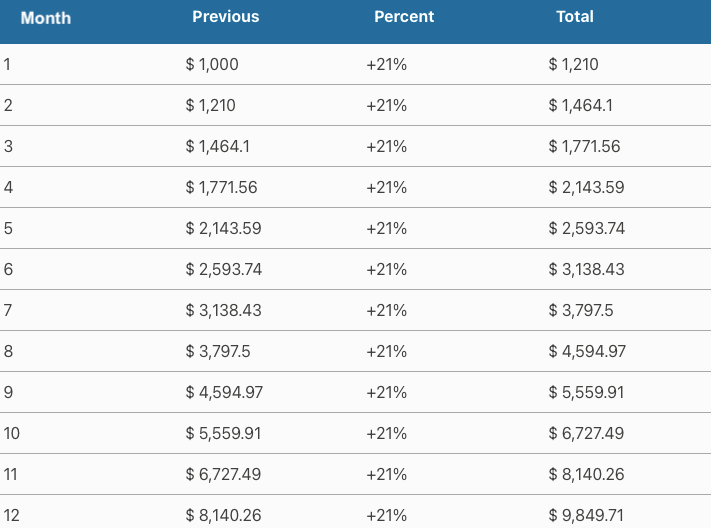

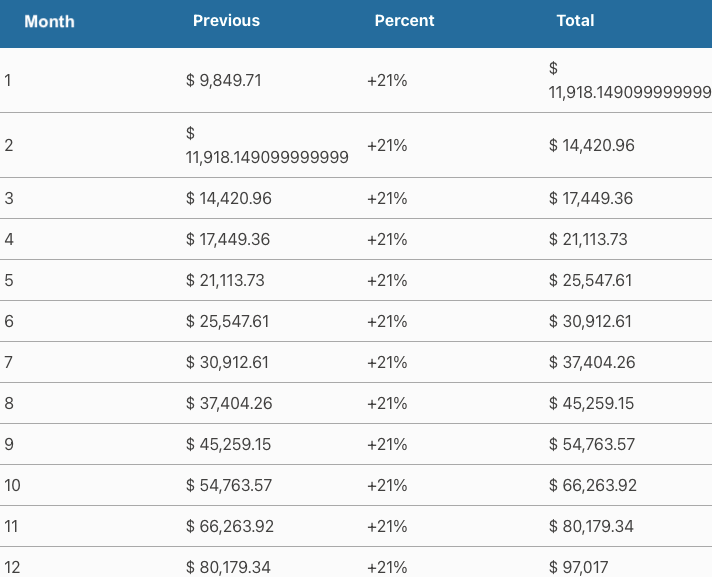

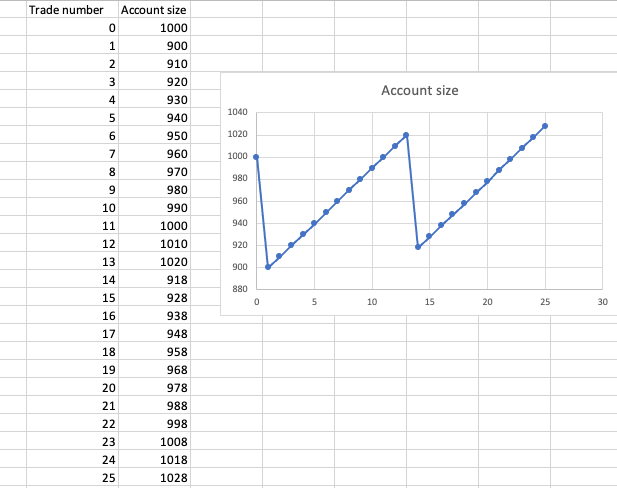

The following table illustrates how your account grows during the first year:

You finish the year with $9,849.71 in your account.

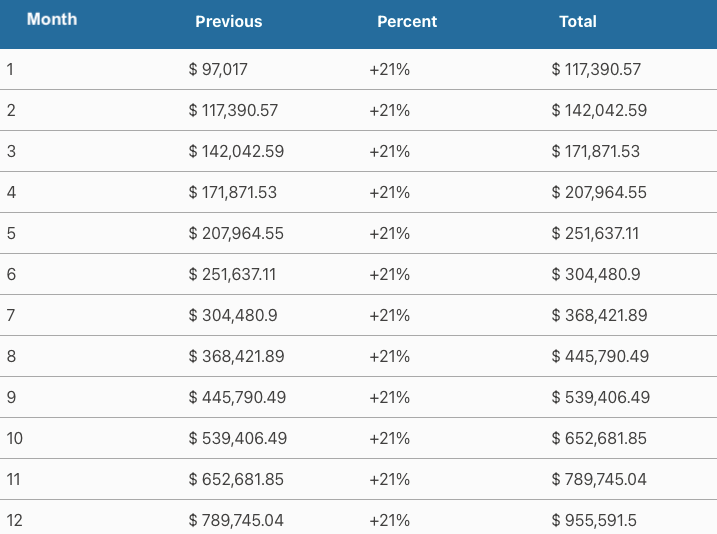

This is your starting balance for the second year. You continue to grow your account in the same manner, adding 1% every trading day by scoring 10 pips on the market.

The second year is over and you have $97,017. Let’s jump right into year 3:

The amount is $955,591.50. Not too shabby! But wait for the last year:

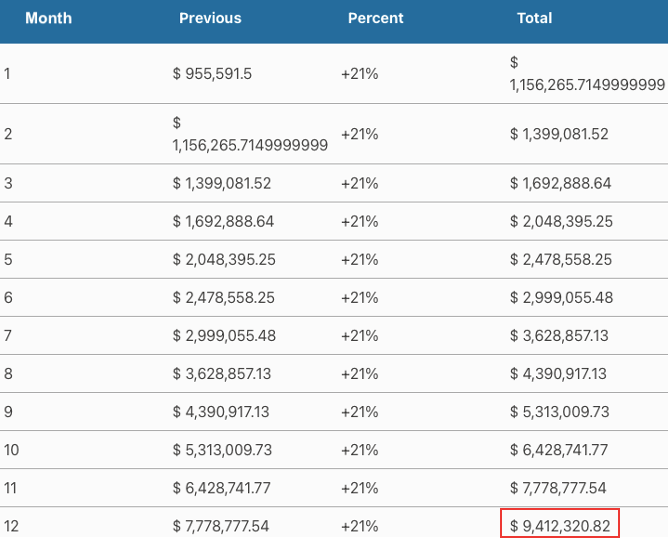

By the end of the fourth year, you have $9,412,320.81.

That’s a lot of money.

So, using the 10 pips a day compounding strategy, it is theoretically possible to make millions of dollars with a $1,000 deposit.

The question is, can you actually do it?

Can the 10 Pips a Day Compounding Strategy Make You Rich?

Making only 10 pips a day and letting it compound over time can make you rich, as we just illustrated. The issue is that all of it is theoretical.

In reality, several caveats make it difficult to pursue the 10 pips a day compounding strategy.

To begin, it’s good to say you’re going to make 10 pips a day, but how are you going to achieve that?

Sure, the internet abounds with different trading strategies, but none of them wins 100% of the time.

In other words, you must consider what happens when you run into a loss.

Will you keep trading until you recoup your losses and end the day with a profit of 10 pips?

That’s great, but what if you run out of funds to keep trading? What if your loss was so severe that it completely wiped out your trading account?

You might think, ‘Well, that’s impossible because I’ll use a stop loss.’

That’s a very good idea, but then you face another issue. Where will you place your stop loss?

Let’s say you decide to keep a 100 pips stop loss and your very first trade goes against you.

If you use the 10 pips a day compounding strategy, you must now make 110 pips on the same day. That will place a lot of strain on you.

Most likely, you’ll start hopping in and out of trades and switching between currency pairs in your attempt to make the required pips.

Because most of these trades are forced, rather than true high-probability opportunities, your odds of suffering another loss are considerable.

This can lead to a downward spiral of losses and the loss of your account.

The situation isn’t much better if you use a tight stop, such as 10 pips.

Even with a good trading strategy, your chances of winning your next trade are close to 50% in this situation. As a result, you will regularly experience losses. Instead of quitting and waiting for another favorable opportunity, you will have to keep trading to reach your 10 pips profit.

In a nutshell: Because most losses occur when market conditions don’t align with your strategy, the fact that you are committed to making 10 pips a day can make things worse.

Instead of stopping and waiting for better opportunities, you’ll keep trying to meet your goal and end up losing even more money.

This makes it extremely difficult to become rich using the 10 pips a day compounding strategy.

That said, compounding your forex profits is still a good idea. However, the time it takes to turn a little deposit into a fortune is far longer than most people believe.

It is also not done in a set manner, such as “I’m going to make X% each month and compound it for Y time.”

Sorry, but your FX account is not a bank savings account. You never know what percentage return you can achieve in any given month, and you will have losing periods as well.

A More Realistic Approach to Compounding in Forex

It would be fantastic to make insane monthly returns and compound those returns, but the more extravagant your gains, the less sustainable they are.

Let’s revisit the situation in which you keep a 100-pip stop loss and your first trade goes against you.

Instead of trying to recover the loss the same day and add 10 pips of profit, why not call it a day? You can earn back the lost amount the next day or the day after that. There is no need to rush and risk making mistakes.

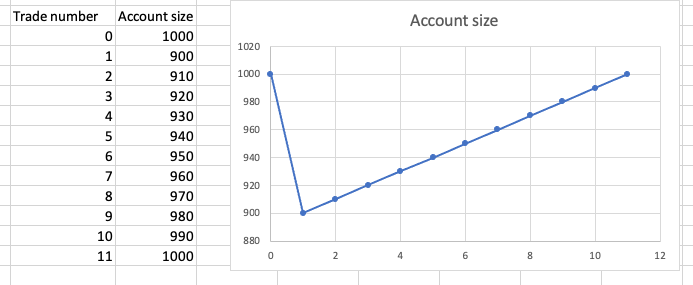

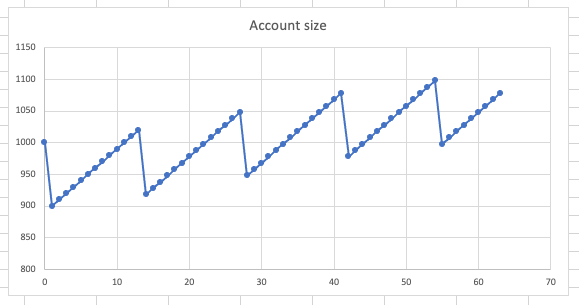

Assume you stop trading after the loss and resume trading the next day. You will continue to aim for 10 pips every day, but you will stop trading if you lose or win for the day.

If everything goes right, in 10 days you will be back at breakeven.

This article belongs to forexspringboard.com. Do NOT copy.

Suppose that your winning streak lasts for two more days, then you suffer another loss. You stop trading for the day and begin working your way up the next day.

Notice that after the end of the 21-day trading month, you were under your deposited amount, so there is no increase in the risk per trade.

But suppose you keep trading and by day 63, when the fourth trading month begins, you are in the black with a $1,078 account size.

Note how the above balance curve resembles what you would expect from a profitable trader. No crazy swings, but moderate and steady growth over time.

Although it might appear to be a small amount, a 7.8% gain in three months is enviable even for expert traders or fund managers.

Instead of withdrawing your profits, you can continue trading and increase your risk on each trade from $10 to 1% of 1,078, or $10.78.

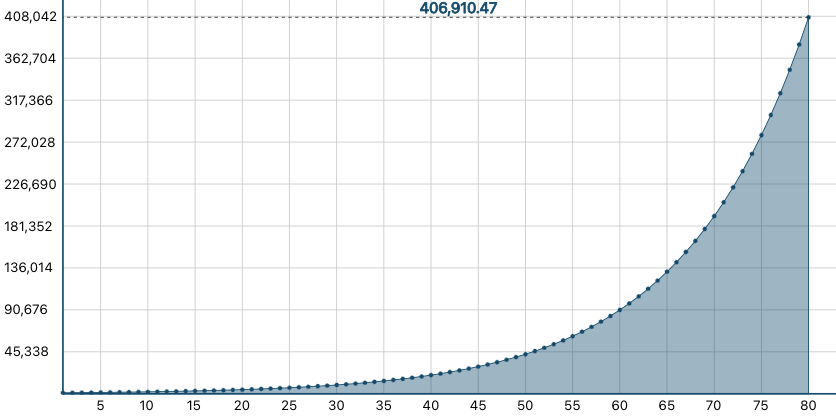

If you can sustain 7.8% returns for three months and compound those returns over time, here’s how your account will grow:

You will have made $350.43 in profit after one year!

Now, take a look at this.

If you do not withdraw anything and continue trading in the same manner for the next 19 years, your profits will keep compounding. Here’s what your equity will look like:

(The X-axis represents the quarters; one year has four quarters, so 20 years has 80.)

As you can see, compounding can make you wealthy, but it takes time and effort. We hope this example has helped you grasp the true nature of trading and set realistic expectations.

Conclusion

When people try the 10 pips a day compounding strategy, they usually place their stop loss far out, so they often experience a string of profitable trades right at the beginning.

This can give the wrong impression that getting rich using this system is a no-brainer.

What is often overlooked is that, while a distant stop loss boosts the win rate, it also increases the expected loss. Sooner or later, your trading account will suffer a huge blow.

This is where the issues of the 10 pips a day compounding strategy surface. It forces you to recoup the lost money and add 10 pips in profit the same day.

So, instead of recognizing that you are too tired or that your method does not have an edge in the current market conditions, you continue trading in suboptimal conditions.

This can make things worse. The deeper your account falls below your deposit, the more difficult it is to break even, let alone start generating gains.

That’s why you might find it very difficult to get rich using the 10 pips a day compounding strategy.

That said, compounding has a place in a successful trader’s toolkit. However, your FX account is not a savings account; you never know for certain how much profit you can compound.

Typically, it takes much longer than most people expect to see meaningful benefits from compounding, as traders frequently overestimate their ability to grow their accounts.