If you’ve been trying to understand forex order blocks but found the YouTube videos confusing or just prefer reading, you’re at the right place.

We wrote this guide with beginners in mind, so it is going to be super easy to understand. At the same time, we jam-packed it with useful insights so even more experienced traders will find it interesting.

Let’s dive in.

Note: Order blocks was popularized by the Inner Circle Trader YouTube channel as ICT order blocks. This is not an article about ICT and his methods. Rather, it is our attempt to give you an explanation for order blocks in general.

What is a Forex Order Block?

You can find so much information and different theories on forex order blocks that they might look super complicated.

We want to keep it simple. Here’s our definition:

An order block is a zone on your chart that forms when someone is conducting large-scale buying or selling.

Large traders (such as banks and institutions) tend to fear that if others see them executing a large buy or sell program, their intentions will become public and prices will move against them. Thus, they will try to discreetly arrange large trades out of the public eye.

For example, if there’s a sell order for 1 billion EUR/USD it might be sliced up and executed as ten sell orders for 100 million. Often these orders will be located at around the same level so when they get executed, they will create a sideways range on the chart. This creates the forex order block.

Forex order blocks are often associated with the situation in which a large player builds their positions slow and steady and out of the public focus. This view is similar to the accumulation phase in the Wyckoff market cycle theory.

In our opinion, people often overstate the importance of order blocks. They exist because large orders are typically impractical to execute at one go. They do not necessarily mean market manipulation.

It would be far-fetched to assume that every time there’s an order block on the chart someone is pulling the strings in the shadows trying to screw you over.

The sell order for the 1 billion EUR from the previous example might come from an American company wanting to repatriate their European profits. They don’t care about you, but they care about the possibility that they might scare EUR holders into selling or attract short sellers.

Both of these will result in a worse selling price for the company. Thus, it will naturally go the extra mile to ensure the trade gets executed with a minimal footprint and at a great price.

Let’s assume the market is now trading 1.2198.

One simple thing the company can do is to leave a reoccurring sell order at 1.2197 for 100 million euros. So, other traders will see a sell limit for 100 million EUR at 1.2197, but the moment the order is filled it will refresh to show 100 million again. This will continue until the whole 1 billion position is sold out.

This type of order is sometimes called an iceberg order because each order represents just “the tip of the iceberg”.

Of course, there are many other creative methods for executing large orders. The point is that while these methods are designed to conceal institutional activity, they are often not there to hurt you.

In fact, it’s often the opposite. They’re there to protect the institution from traders finding out about their need to buy/sell and exploiting it to their advantage.

How to Find Forex Order Blocks?

The truth is that while you can find interesting set-ups, you never know for sure if it is an order box unless you are tipped off by someone or you are the one executing the order.

That said, there are things you can do to find potential order blocks.

Look out for situations when there is only a modest activity on the market so big orders cause discernable exchange rate moves even if they’re executed in chunks.

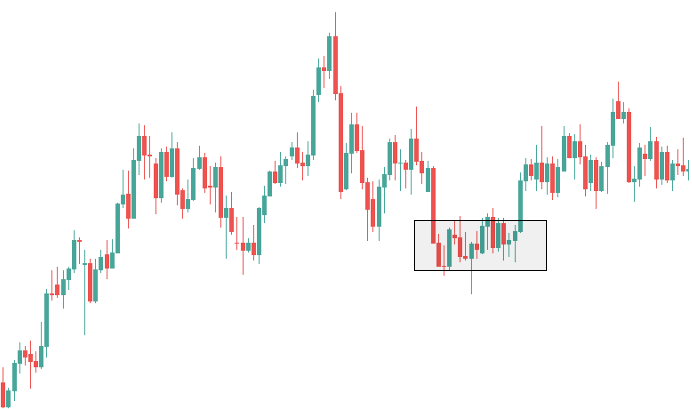

Whenever you see a sudden price rejection each time the market gets to a specific area on the chart, it’s a telling sign.

Simply draw a rectangle that contains the horizontal level from which the price keeps rebounding, and the accompanying market structure. This is where a potential forex order block might be located.

This content belongs to Forexspringboard.com. Do not copy without permission.

Essentially you need to find situations where the market is in a narrow range and the price keeps turning around at a specific level. You might see these areas better using lower timeframes.

What’s the Difference Between Forex Order Blocks and Support/Resistance?

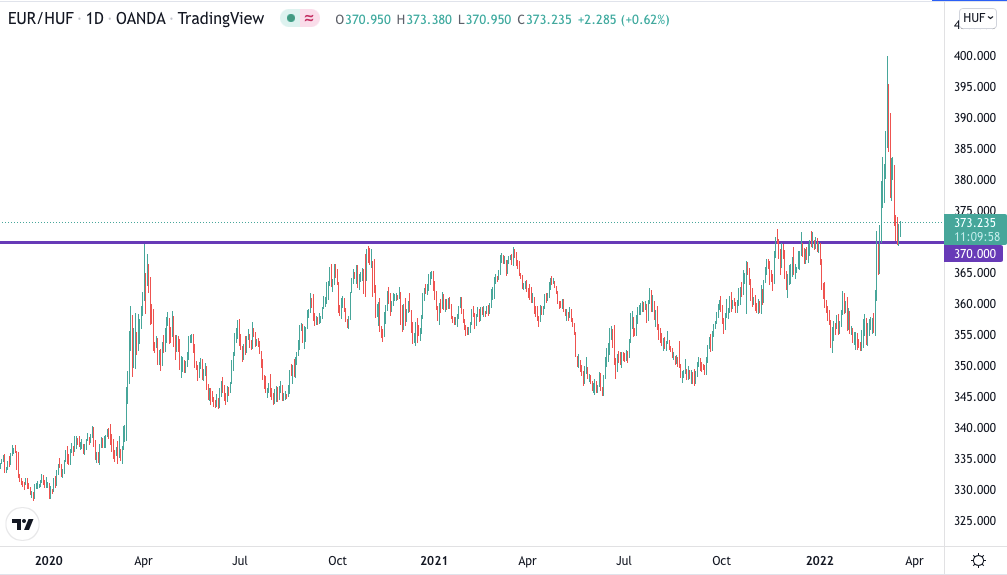

The difference is that many important support and resistance levels cover a long time period where touches are spaced away months or even years. Order blocks, on the other hand, relate to short-term price action.

For example, for about two years any time the EUR/HUF exchange rate attempted to go above 370 it quickly sold off. Any exchange rate above this level was considered to be unacceptable Forint weakness for many market participants (including the central bank) so the demand for forints around this area was high.

This created a clearly visible resistance area on the chart, which was only broken after war in Ukraine put significant pressure on regional currencies. Even then, the price came back to retest the level.

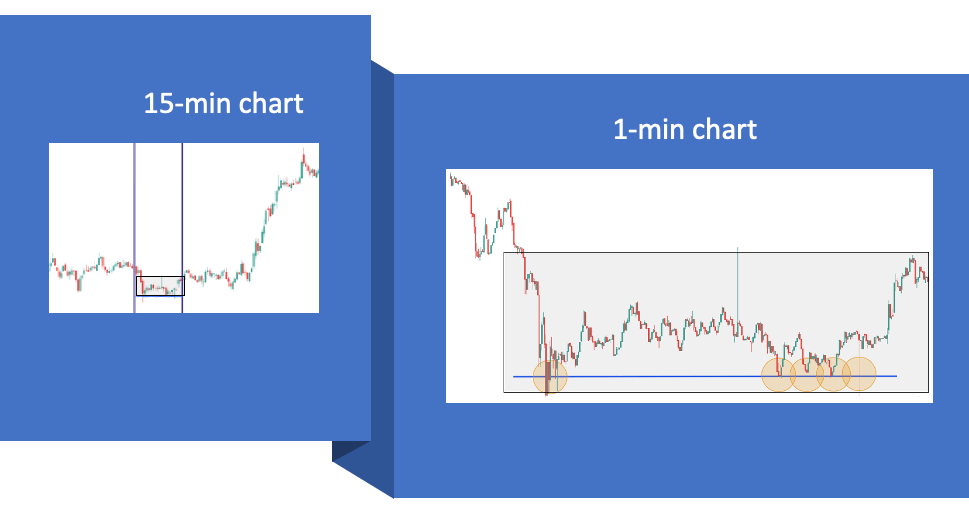

For comparison, look at what happened on the 1-minute AUD/NZD chart between 9PM and 9:30PM:

The market seemingly bottomed out at 1.06474 but whenever buyers attempted to push the price higher, they ran into a large supply of AUD at 1.06562.

There’s a decent chance that someone wanted to sell a larger amount of AUD at this level. When the order was finally filled the resistance disappeared and the price slowly began to take off.

We encourage you to look at a few low-level charts and see how they behave especially when the London and New York markets are closed. You will easily find many similar scenarios.

Now that you know what to look for, let’s see how to trade forex order blocks.

How to Trade Forex Order Blocks?

If you want to trade forex order blocks, there are several ways you can go about it.

Researchers from The Tinbergen Institute (a joint institute for the University of Amsterdam) did an interesting study in which they investigated the behavior of high-frequency traders when a large institutional order executes through a series of child trades.

While this study was performed on stocks, the findings are relevant here too.

Inspired by other theoretical studies, they highlight the three primary ways order blocks can be approached by traders:

- Traders could be liquidity suppliers who take the other side of the order. They would, for example, be selling in the period when a buy order executes.

- They could prey on such buy order by also buying initially to sell when the order is almost finished executing, essentially riding the price-pressure wave. Vice versa for sell orders.

- They might decide to trade along with the institution if its position is regarded to be information motivated.

In the following, we’re going to share our thoughts on each of these points and provide you with a bit more perspective.

Supplying Liquidity

Supplying liquidity is just a fancy way of saying that you take the other side of a transaction.

So, when you supply liquidity in the context of forex order blocks, it basically means that you sell when the institution buys and buy when the institution sells.

Why would you do that?

On one hand, you might do it inadvertently when your stop loss gets executed.

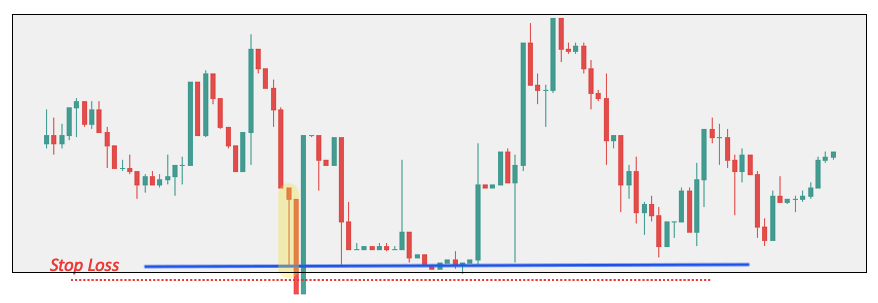

Let’s take the following situation as an example from a 1-minute chart:

Say you went long at the close of the pin bar candlestick pattern (highlighted). You placed your stop loss slightly below the pin bar, which is normal practice.

You expected the market to rise after lower prices had been rejected. Instead, the next candle was a huge bearish candlestick. The price dipped below your entry point and triggered an institutional buy and stopped you out the same time.

Since being long means that you had bought the currency pair, the moment your stop was triggered, you were forced to sell to close the position. This could result in the strange situation when you actually helped filling the institution’s buy order.

While this is rarely desired, it occurs from time to time. You might try to use wider stop losses or learn how to trade fakeouts.

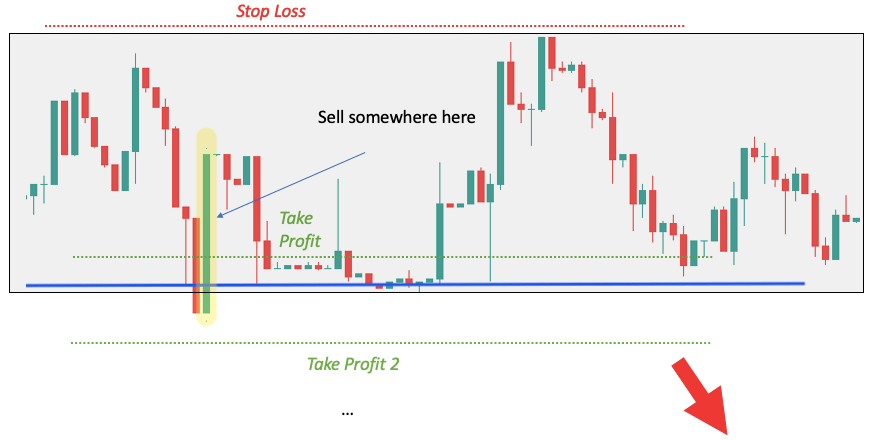

Arguably a more preferable way of supplying liquidity can look something like this:

If you feel you someone placed order blocks on a support level to buy a larger quantity of the currency, but you’re convinced that the market is bearish, you might sell into the emerging bullish candle to express your bearish view.

This is a high-risk trade, but it might allow you to grab a few pips as part of a quick scalp:

Of course, you can reverse this explanation for bullish situations.

Riding the Price Pressure Wave

Reading the previous section might left you wondering why to go against the huge bullish candle when you can ride the wave – even if it is only transitory.

This is a valid observation.

Although not an order block per se, a good example here is the EUR/CHF (Euro/Swiss Franc) from September 2011 to January 2015.

During this time the Swiss central bank’s official policy was to maintain a minimum exchange rate at CHF 1.20 per euro. The bankers insisted that they will defend this level with “utmost determination,” and to buy unlimited amounts of foreign currencies if needed.

You can see from the picture above that each time the floor was tested it held successfully as the central bank could simply print more francs and sell them for euros to protect the floor.

Many traders figured that buying the EURCHF every time it gets close to 1.2000 is a nearly risk‐free trade as the central bank will step in and they can sell the subsequent rally for a profit.

It worked exceptionally well, until it didn’t. But that’s a different story.

The takeaway is that if you believe an institution is buying/selling large quantities at a specific level, you can trade along with the order and then quickly close the trade for a profit.

Trading with Information-Motivated Orders

Have you heard about the Bloomberg terminal?

It brings together real-time data on every market, breaking news, in-depth research, analytics, communications tools and much more — in one fully integrated solution.

There’s only one problem: It costs approximately $2,000 per month or $24,000 per year.

While it’s hardly ever a feasible option for retail traders, the Bloomberg terminal is sitting on the desks of banks, hedge funds, and the world’s most influential decision makers in general.

By Travis Wise

We promise this is not an ad for the terminal. It just goes to illustrate that institutions are equipped with better information that retail traders. And while this can often be a disadvantage, it doesn’t always have to be.

The idea is the following:

You sniff out forex order blocks where there’s a good chance that the institution is trading off superior information. Then you simply trade along with the institution.

Is it easy to do? No.

But nothing is easy in trading. It’s speculation. And if you see that, for example, someone is buying heavily before an important news release, why not speculate on the possibility that they might know something?

Conclusion

Any supposedly superior trading technique should be taken with many grains of salt.

Lots of people talk about forex order blocks on the internet, many of them will give you wrong expectations.

Order blocks do exist, but you never know for sure if what you are seeing is a true order block or just the market randomly consolidating.

Even if you did know, it doesn’t mean much. You still need to time your trade properly, take profits at the right time and manage your risks. All these make it difficult to profit from even great insights.

Stay open to learning new things and broadening your understanding of the market but try to steer clear from empty promises of easy money and different conspiracy theories.