Wouldn’t it be nice if you could see which currencies will appreciate or depreciate over time?

We all know that the future is unknown. At the same time, a lot of theories can help us forecast exchange rates. Purchasing power parity is one of them.

While it’s generally regarded as a poor predictor of short-term exchange rate moves, it’s generally more accurate over the long run.

This is true to such an extent that an issue of the ECB Working Paper – a paper aimed at enhancing the policy-making of the European Central Bank – maintains that for advanced countries, it is better to rely on the concept of long-run PPP rather than on the Random Walk Theory, which says that price movements are unpredictable.

In this guide, we’ll explain the concept of purchasing power parity. Then, we’ll show you the best sources for finding PPP exchange rates. Finally, we’ll discuss the shortcomings of the model and the implications for forecasting exchange rates.

Let’s dive in.

What Is Purchasing Power Parity in Simple Terms?

The definition of purchasing power parity is this: The rate of currency conversion that equalizes the purchasing power of different currencies. It also refers to the theory that exchange rates adjust until this equilibrium rate is achieved and the prices of identical goods in different countries are about the same.

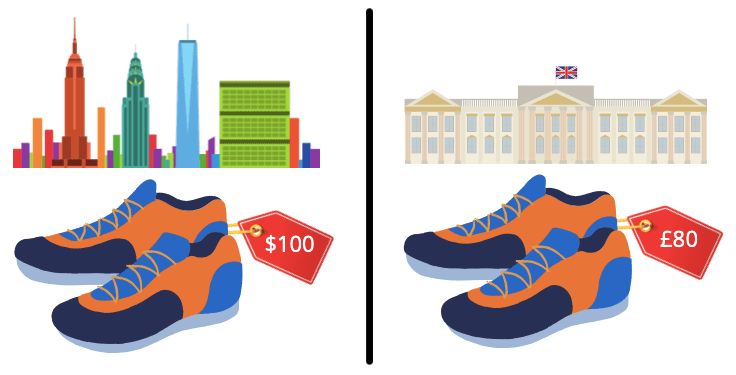

Suppose that the price of a pair of Adidas shoes is $100 in New York and £80 in London.

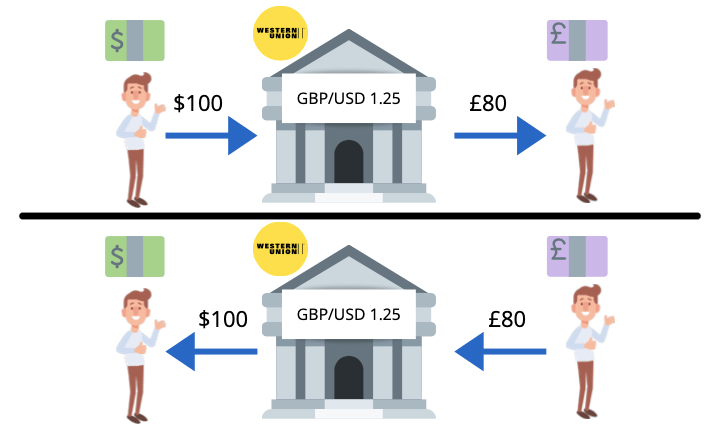

If the current GBP/USD exchange rate is 1.25, the two currencies have the same value. This is because if you exchanged your 80 pounds into dollars at this rate, you’d get exactly 100 dollars. Similarly, 100 dollars would be converted into 80 pounds.

In other words, you can buy the same shoes regardless of whether you’re in the US or the UK.

If we assume that this pair of shoes is representative of the price differential between the two countries, we can say that the purchasing power parity equilibrium is 1.25. This would mean that prices are equal when converted at this exchange rate.

Now, we probably don’t have to tell you that, in reality, prices and exchange rates can vary significantly.

As of the time of this writing, the actual GBP/USD exchange rate was around 1.33. If we used the above example to reflect the pound-dollar’s PPP value, this would suggest that the USD is significantly undervalued relative to PPP.

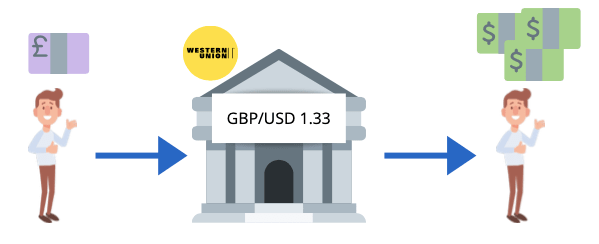

At this rate, the UK price for the Adidas shoes would be 106.4 if translated to USD. This is 6.4% more expensive compared to the US. It’s easy to see that consumers in the UK would prefer to buy the shoes from the US to take advantage of the differing prices of the same asset. This is called arbitrage.

Now, remember that we assumed that the shoe is representative of the general price differential.

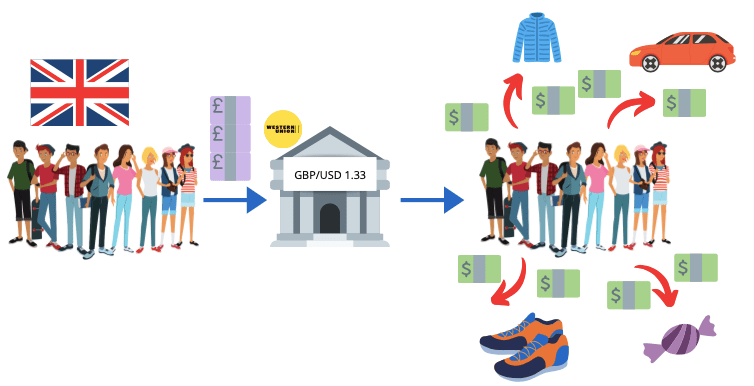

If arbitrage happens at a large scale, the UK consumers buying US goods will bid up the value of the US Dollar.

Put another way: The price of the dollar will go up and the price of the pound will go down until the purchasing power parity is restored to 1.25 – where the goods will again have the same price.

In reality, PPP is expected to hold if:

- There are no trade barriers

- There are no transaction costs

- The good being traded is perfectly homogeneous

- There is unrestricted access to information

Obviously, these assumptions are not very realistic. The takeaway is that the actual exchange rate tends to reflect a degree of over or undervaluation relative to PPP, and you can expect that it will gradually revert to PPP through different transmission mechanisms.

In the following, we investigate the PPP theory in more detail. In particular, we’ll discuss absolute and relative purchasing power parity.

The Difference Between Absolute and Relative PPP

There are two versions of purchasing power parity, but you don’t need to be an economist to understand the difference. In fact, it takes just a few minutes and a little bit of scrolling 😉

Absolute PPP

Absolute PPP refers to the equalization of price levels across countries. This is what we explained at the beginning of this guide. It says that exchange rates adjust until the prices of the same goods are identical everywhere.

The basic mathematical expression of absolute PPP is:

E = P/PF

Where:

E = The PPP long-term equilibrium exchange rate value

P = The domestic price level of goods

PF = The foreign price level of goods

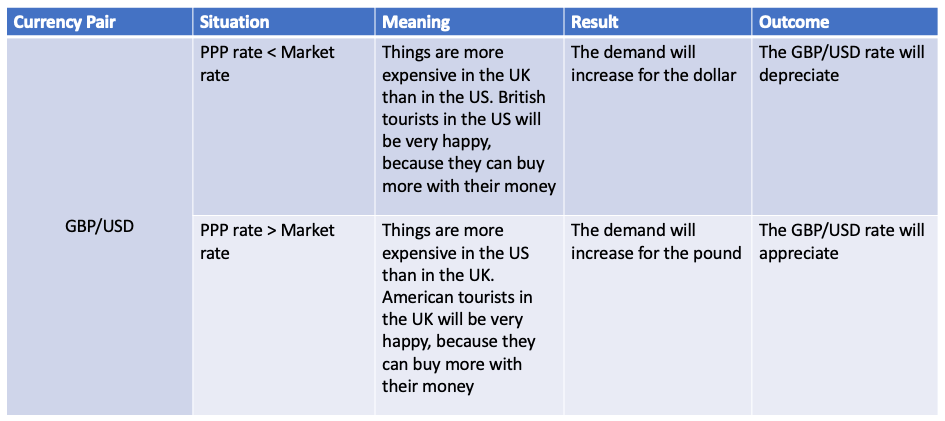

This reflects the PPP exchange rate to be given by the ratio of price levels between countries. When there’s a deviation from PPP, the exchange rate is expected to adjust. Here’s a simple illustration:

Previously, we used the Adidas shoe as a representative good for demonstrating the difference between the US and UK price levels. Obviously, in the real world, a pair of shoes is not representative of the general price differential between two countries.

Normally, price indices are used to express such differences.

Price indices measure the average prices in an economy. For example, the consumer price index (CPI) quantifies the price level by tracking the cost of a basket of goods and services that average households consume. On the other hand, the producer price index (PPI) measures price changes from the perspective of producers.

Considering price indices, we can say that the PPP exchange rate between two currencies is equal to the ratio of their price indices.

Unfortunately, if you start dividing price indices to calculate PPP, you’ll get very misleading values. This is because these indices are weighted averages of the individual prices of different countries.

In other words, unless two countries have identical consumption patterns and include the same goods and services in their indices, simply dividing price indices is not going to work.

For this reason, there’s an alternative, more frequently applied view of PPP, which does not require either the same basket of goods or the same weights applied to these goods in the price index.

Relative PPP

Relative PPP deals with percentage changes in the price indices and states that changes in price levels will be related to changes in exchange rates.

The formula for relative PPP looks like this:

%∆E = %∆P – %∆PF

Where:

%∆E = The percentage change in the exchange rate

%∆P = The percentage change in the domestic price level of goods

%∆PF = The percentage change in the foreign price level of goods

Note that the percentage change in the price level is called the rate of inflation.

Let’s say that the US inflation rate is higher than the UK inflation rate. In this case, according to relative PPP, the purchasing power of Americans will erode compared to that of the British, and the value of the US Dollar against the British pound will adjust to balance the purchasing power of the two currencies.

This adjustment should equal the difference between the inflation rates.

For instance, if US inflation is 6% per year, while inflation in the UK is 2% per year, the dollar should depreciate by 4% per year. This is because high inflation rates will eventually increase the costs for foreigners whether they want to import goods from the US, invest there, or simply travel. Demand for the dollar will decrease and it will fall relative to the pound to restore its competitiveness.

According to this view, a currency is overvalued if it has appreciated more than the inflation rate differential as implied by the relative PPP. Similarly, a currency is undervalued if it has appreciated less than the inflation rate differential.

Where to Find PPP Exchange Rates?

Due to its complexity, the PPP calculation is best done by experts.

Let’s take a look at a few sources where you can find PPP exchange rates for free.

International Monetary Fund (IMF)

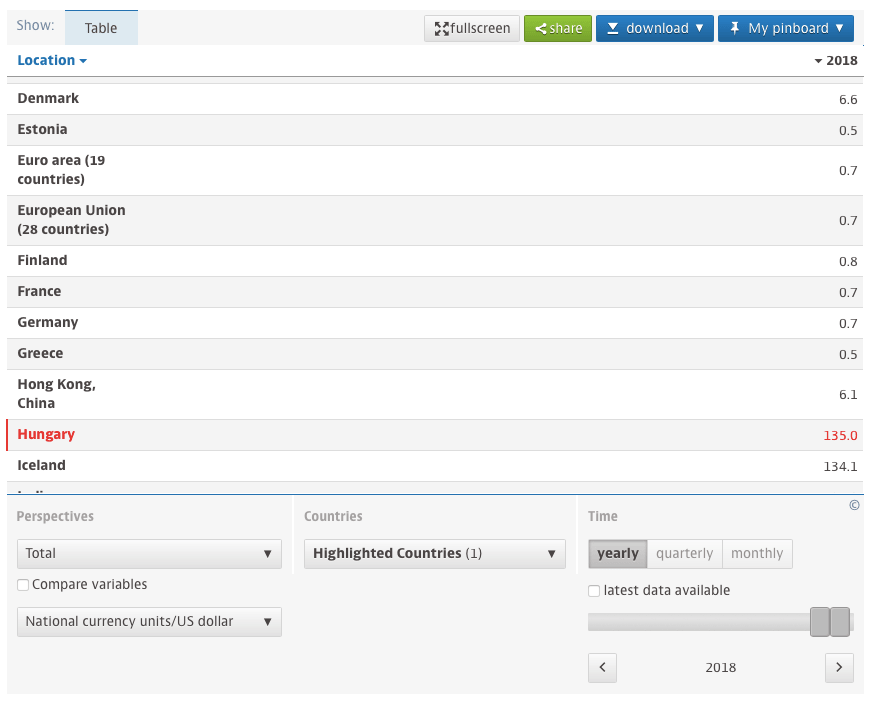

The International Monetary Fund (IMF) provides implied PPP exchange rates on its website. You must go to the world economic outlook database and choose one of the three options to get started.

Click on “By countries” and you’ll be presented with a screen where you can customize what countries you want to include in the report.

Once you are done choosing countries, click “Continue”.

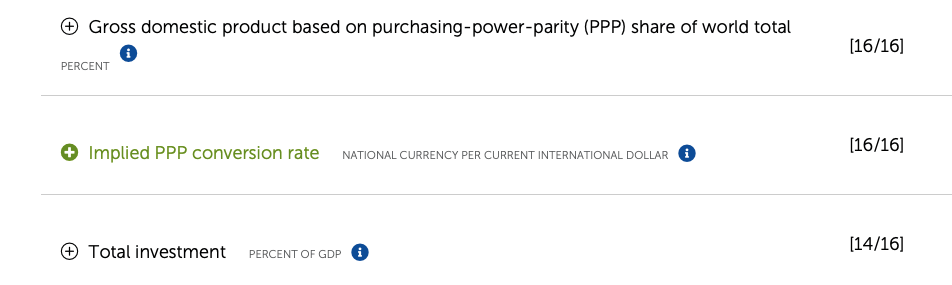

This will bring you to the third page, where you can select the subjects of the report. Somewhere at the bottom of the “National Accounts” section, you’ll find the “Implied PPP conversion rate”. Add it to the report and click “Continue”.

In the last step, you can set the date range. What is really cool about this report is that you can choose a future date as the end of the reporting period. In the final report, future dates will appear as shaded blue cells, indicating that the values are only estimated.

So, this is how you get PPP exchange rates from the IMF.

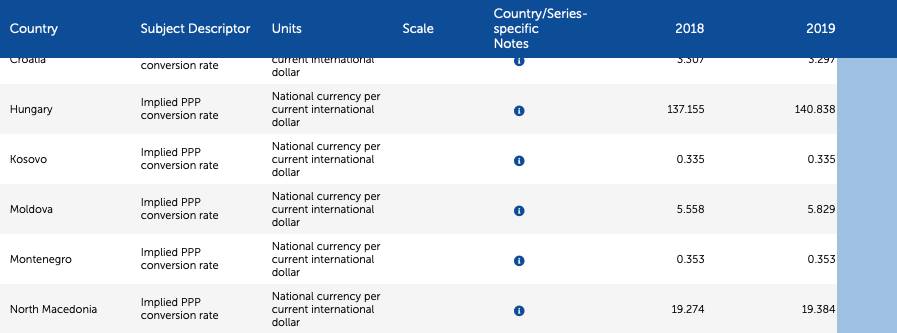

You can see that, for instance, in 2018 the PPP rate for the USD/HUF was 137.155. The actual exchange rate in the same year was around 280 according to an online currency converter.

This suggests that the forint is undervalued relative to PPP and might appreciate over time, dragging down the USD/HUF rate.

Organisation for Economic Co-operation and Development (OECD)

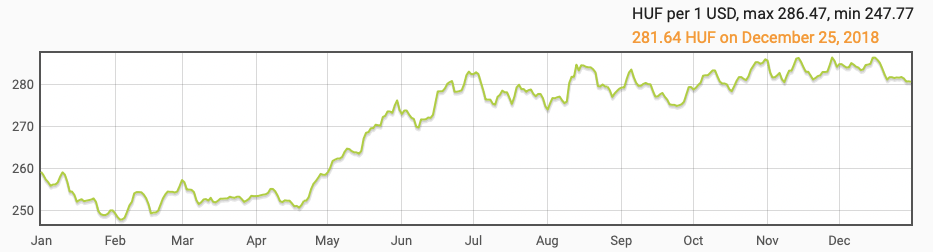

Another, similar resource for obtaining PPP exchange rates is available at the OECD’s website.

This is very straightforward to use. Just look at the left-hand side and follow the respective row to see how the PPP rate varies year to year. You can also filter by years and highlight the countries you wish.

In the case of the USD/HUF, we can see that the PPP rate is similar to that of the IMF’s.

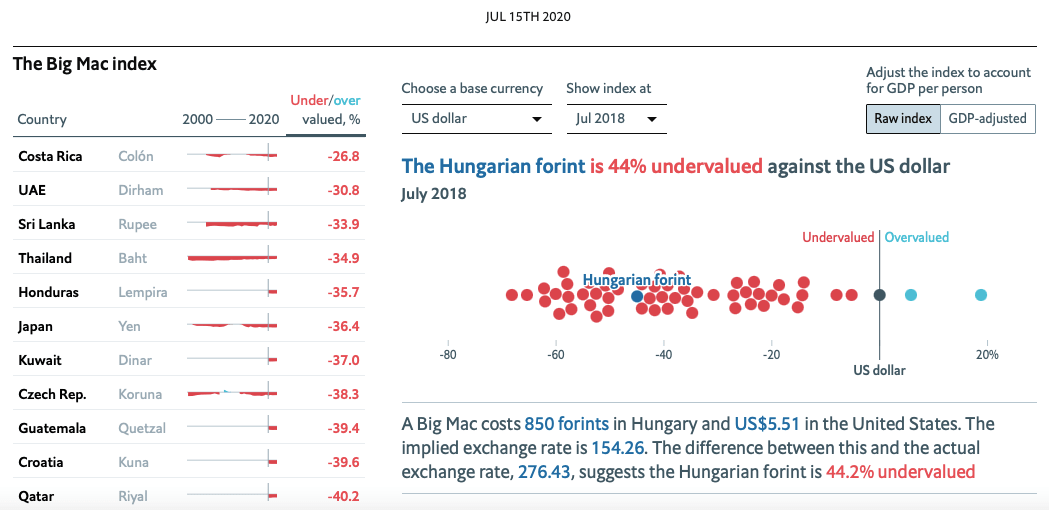

The Big Mac Index

In 1986, the Economist magazine invented a popular tool for monitoring PPP levels, the “Big Mac Index”.

The idea was to take a product that is identical everywhere and compare its domestic price with foreign prices translated into USD. This would provide a lighthearted guide to whether currencies are at their “correct” level.

While this may seem like a funny experiment, it is PPP in its simplest form. The composition of the Big Mac can be viewed as a composite index of goods that overcomes the problem that CPI baskets are usually different across countries.

Thanks to its straightforward and entertaining nature, the index gained quite a bit of popularity. Today, there is an interactive online version that you can access without a magazine subscription.

Let’s revisit the USD/HUF exchange rate one last time to see whether the Big Mac Index suggests that the HUF is undervalued relative to the USD.

Turns out that it says the same thing, although the numbers are slightly different from those of the other two sources.

While it’s a funny way of finding potentially under or overvalued currencies, the Big Mac index is not without its flaws.

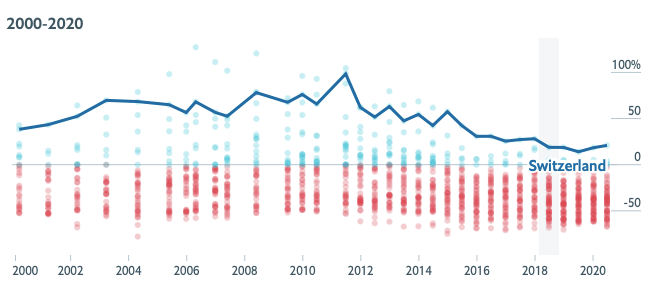

If you take a closer look at the price levels, it’s clear that the price is persistently above the US price in a few rich countries such as Switzerland. At the same time, it’s persistently below the US price in lower-income countries.

The persistent differences arise from different relative prices of service, not from over or undervalued currencies.

To mitigate this issue, the Economist created a GDP-adjusted index, which is based on what Big Mac prices should be given a country’s GDP per person. You can use the toggle at the top right corner to switch between the original and GDP-adjusted indices.

Researchers from the University of Connecticut found that the adjusted version has been more accurate regarding currency changes than the original “raw” Big Mac index.

Nevertheless, the Big Mac can serve as a useful example of why there tend to be significant departures from PPP.

Issues with PPP and Implications for Forex Trading

Exchange rates that don’t reflect PPP values are said to be misaligned.

Theoretically, misalignments should be eliminated quickly, as price differentials in goods should create an arbitrage opportunity: You buy the good in the cheaper country and resell it at a profit in a place where it’s more expensive. This should increase the demand for the currency of the cheaper country and push up its value relative to the more expensive one.

While you would expect that these price adjustment mechanisms would happen quickly in a profit-seeking market, it often takes years before exchange rates begin to return to a level consistent with PPP.

With that said, you should not base a short-term financial decision on the PPP model.

There are several reasons why short-run PPP might as well stand for “pretty poor predictor”.

If you ever ordered something from Amazon, you know that international trade involves taxes and shipping costs. Therefore, while the PPP model assumes perfectly free trade, there are trade-related price distortions that influence the exchange rate.

Furthermore, the PPP concept assumes that there are no barriers to exploiting price differentials; however, neither the service-sector labor nor the property where goods and services are provided is easily traded internationally. Countries where the cost of the service component is high will often have higher price levels.

Products are also subject to different corporate pricing strategies. The same product may be intentionally priced higher in the US than in Germany, for example, because customer tastes are different, there are fewer competing brands, or the company is more recognized in the US, so a higher price is justified.

In a nutshell, you must be careful with PPP, as a wide variety of factors can distort it, particularly over the short term. Over the long run, however, it can serve as a useful benchmark and you can use it as a framework for currency forecasting.

This last sentence is important.

It wouldn’t be smart to purchase all the currencies that appear to be undervalued relative to PPP. A much better approach would be to coordinate your existing knowledge with your risk appetite and insights given by the PPP theory. Only when everything is clearly pointing to “buy” should you pull the trigger.

Conclusion

It is quite common to hear that certain currencies are overvalued or undervalued.

The mere use of these terms suggests that there is some “proper” value for the exchange rate. Purchasing power parity can be regarded as such because it refers to the exchange rate that would make living costs equal in two countries.

If the exchange rate between two currencies is equal to the ratio of average price levels between those two countries, then the absolute PPP holds. On the other hand, if the percentage change in the exchange rate is equal to the inflation rate differential between two countries, then relative PPP holds.

Unfortunately, the consensus is that, in the short run, neither version of the PPP theory holds very well; therefore, you should consider PPP only from a long-term perspective. This is still no guarantee of success, but there’s no risk-free money in the world of speculation.