Are you tired of scalping forex…especially because it isn’t generating any income for you?

Sure, some people are making millions scalping forex, but if you’re reading this post, you probably are not one of them.

So, why doesn’t scalping work for you?

Below are 7 frequent mistakes to consider along with easy steps you can take to resolve them.

1. You Don’t Know if Your Strategy Is Legit

You will get absolutely nowhere if you don’t follow a strategy that works.

It seems obvious, right? But many traders get this wrong. They get a promising strategy from a random place and then jump into live trading only to scratch their heads, wondering why they didn’t do well.

Even if you dabbed into an awesome strategy, it’ll be worthless if you don’t trust it. You need to find out if the strategy works and if you’re comfortable enough with it that you can follow along.

But how do you get the scoop on your strategy without risking real money?

The first thing that might get into your mind is demo trading. Most brokers offer free demo accounts that allow you to try yourself out with paper money.

Unfortunately, this is very time consuming and most people can’t spend weeks, or even months, collecting enough data to make it meaningful.

One of the best ways to get to know your strategy is by backtesting. You can quickly run through months of data to find out how your strategy performs under different circumstances.

When it comes to backtesting, the best tool for most people is definitely Soft4FX.

It offers a wide range of awesome functions including high-quality tick-by-tick data, a built-in economic calendar, and many timeframes including second charts. You can learn more about the software on its website or read our backtesting guide, in which we teach you how to do backtesting using Soft4FX.

(If you make a purchase, we get a small commission, but we wouldn’t recommend something that we don’t use.)

Backtesting can reveal a lot about your strategy’s strengths and weaknesses and it will build your trust in your strategy. It will, for sure, increase your chances of being a successful scalper.

2. You Don’t Have a Trading Plan

Let’s say the first point doesn’t apply to you.

Having a great strategy is an effective way to make money in the market.

But here’s the catch: You must put it in a trading plan.

If you have the best scalping strategy on earth, but it’s not suitable for you, your results won’t be very good. You must place your strategy in a bigger picture and consider a wide variety of factors before you risk real money.

To give you some context, making trading plans involves things like:

- Establishing your goals

- Analyzing yourself

- Analyzing your circumstances

- Setting rules for money management

Let’s take goal-setting, for example.

When you’re setting a goal the SMART way, you go through a systematic procedure that ensures your goal is specific, measurable, attainable, relevant, and time-bound. In other words, not only will you pursue something realistic, but you’ll be able to measure your progress and stay motivated along the way.

If you don’t have a trading plan, that might be why scalping doesn’t work for you. In this case, you can read our guide to making a forex trading plan. It should put you on the right track.

3. You’re Prone to Revenge Trading

No matter what kind of loss you’ve encountered, revenge trading is never a good idea.

What we mean is that you shouldn’t begin trading aggressively to recoup your account after a larger loss.

Let’s say you had an open long position in the EUR/USD when the news came out that a high-profile EU official was caught laundering money. The market suddenly dropped, and your stop loss was executed at a worse-than-expected price.

Don’t start looking for an opportunity to win back your loss with a huge positions size.

Sure, you might succeed. But, beyond that, it’s important to recognize that this approach has multiple issues.

Revenge trading involves acting out of your emotions rather than logic and strategy. You may convince yourself that this is a one-time occasion, but losing trades happen all the time; if you’re prone to revenge trading, you will eventually amplify your losses and won’t be a successful scalper.

Luckily, there are things you can do to overcome the temptations of revenge trading.

The simplest and perhaps most effective is to stand up and leave. You need time to clear your head before you can make objective trading decisions again. Depending on the severity of your loss, you might need days or even weeks to get back into the proper mindset.

It doesn’t matter how long you stay away; the point is that you don’t want to be on the market until you have completely left the situation behind.

Encountering an exceptionally bad trade is also the point when you want to analyze your past trades to see if the loss was a result of an issue with your strategy, a mistake you made, or simply due to bad luck.

Take the loss as an opportunity to learn and improve yourself. If you’re able to identify what went wrong, you’ll be able to avoid similar situations the next time around.

4. You Don’t Have Enough Money

The first thing to know about scalping is that successful scalpers tend to treat scalping as a business. They have a system in place; they are disciplined, they are consistent, and they have enough trading capital.

It can be particularly disheartening if you’re brand new to trading and planning to turn your few hundred dollars into a fortune.

The truth is: It’s not going to happen.

Even if you’re really good, you’ll bring in only peanuts if your trading account is small. To make matters worse, it’s much more likely that your performance is closer to average—and we all know the meaning of that…

At the end of the day, you need money to make money. If you want to make a lot of money trading forex, you already need to be pretty rich.

Now, does this mean that everyone who can deposit a boatload of money will automatically be profitable?

No, of course not. However, the odds are somewhat better and here’s why:

When you have a large account, you can get away with risking less and still make a decent income. This will make it easier for you to remain calm and exclude your emotions—which, in turn, leads to better performance and profitable trading.

For example, if you have an account size of $100,000 and you risk 0.5% per trade, that’s still $500. Calculating with an RR ratio of 1 and a win rate of 60%, you can expect to win $100 on each trade you make.

Though this doesn’t include commissions, you can make a great living if you make 3-5 trades per day as a scalper. If you wanted to make similar gains with a small account, you would need to take large position sizes, and a losing streak would eventually blow you out of the market.

Sure, you may not be able to deposit $100,000. It takes time to get to that point. But you can easily open a small account and concentrate on making a profit in percentage terms.

If you can build a track record of successful trading, raising money is easier than you think.

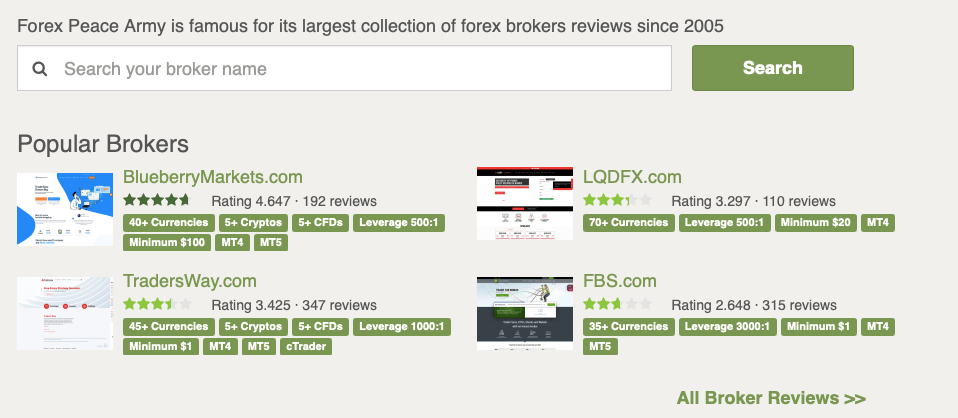

A simple Google search for “forex prop firms” should give you plenty of companies that are eager to fund traders who can prove their experience. Here’s an example:

To summarize, if you don’t have a lot of capital, don’t expect to make significant returns. You’ll need to take big risks, and a few losing trades will blow up your account. Instead, sharpen your skills and eventually you’ll be able to receive funding.

5. You’re Better Suited for a Different Trading Style

You know what the trouble is with brokers? They make money off you. And the more you trade, the more commissions you generate for them. With that said, it’s not surprising that scalping is often promoted in a very favorable light.

But just because there are successful scalpers doesn’t mean that you should be a scalper. There are successful position traders, swing traders, and algo traders, too.

There’s a reason why there are so many different trading styles. There’s no one-size-fits-all solution. The best position trader on earth might lose their account the first day if they began to scalp.

Scalping is one of the most demanding trading styles and you’re not going to do well if you’re in it only for the money. Enthusiasm for trading, a fast reaction time, and a great deal of discipline are “musts.”

If you choose to be a scalper without putting any serious thought into it, there’s a reasonable chance that you made the wrong choice—especially if you’re struggling to see results.

In this case, figuring out the ideal trading style for you can work wonders.

You’re in for a treat because we have an entire guide on trading styles. There’s also an online quiz on DailyFX. Once you answer the 14 questions, it will tell you which style of forex trading is ideal for you.

6. You Trade at the Wrong Time

Timing will always be important, and there will always be a luck factor involved. However, that shouldn’t stop you from preferring situations in which your trading strategy is supposed to work the best and avoiding situations in which it is expected to perform poorly.

Put another way: If you’re trading when you have some time and ignore fundamentals and market sessions, you’re doing it wrong.

Let’s start with fundamentals.

Although fundamentals are usually not the most important thing for scalpers, you shouldn’t completely disregard them. News releases tend to be accompanied by increased market volatility, which can have a significant impact on your open positions.

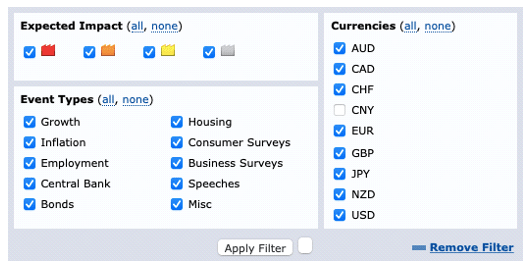

Even if you don’t directly use fundamentals in your strategy, the least you should do is check the economic calendar before the trading day to determine when you can expect large price movements.

Many economic calendars are made exclusively for forex traders. Our favorite is the ForexFactory calendar. You can go to the top left corner to filter by expected impact and affected currencies.

Unless you’re a news trader, avoid trading around news to protect yourself from large price swings.

By the way, ForexFactory is a useful resource for newbies and seasoned traders alike. If you’re not familiar with it, check out our guide to learn about all the cool things that you can use it for.

The second thing you must consider is market sessions.

Swing and position traders have more flexibility because the long timeframes make the matter of when they place their trades less important. Unfortunately, you must be more careful. Intraday market volatility can vary drastically and trading at the wrong time will negatively influence your results.

Of course, “wrong” is subjective. It depends on your strategy.

If you need fast price movements, trade when the New York and London exchanges overlap. This is when the volatility is the highest and you’ll find plenty of trading opportunities. On the other hand, if you prefer slower markets, the Asian session is your best choice.

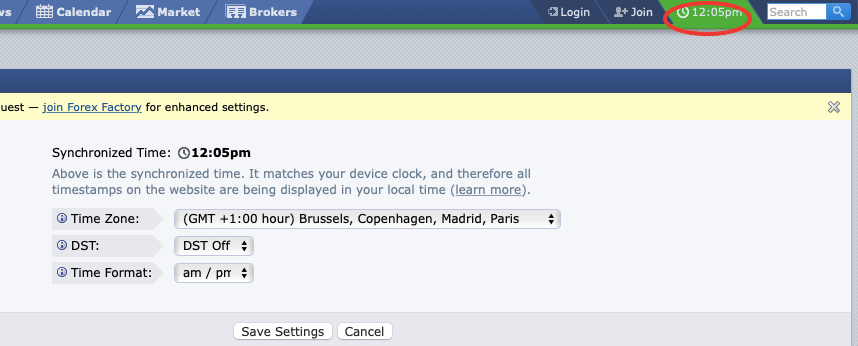

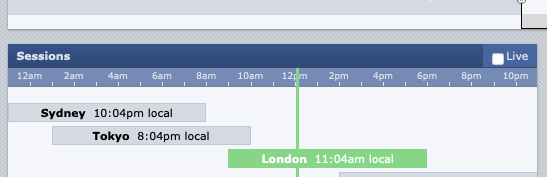

The beginning and end of these trading sessions will vary depending on where you live. You can check when each session takes place according to your time without leaving ForexFactory.

First, make sure that it uses your local time.

Then go to the “Market” tab and scroll down until you see the “Sessions” block.

7. You Have High Latency

If you make dozens or even hundreds of trades a day, it quickly gets annoying when you have slow quotes and fills, so you want to make sure that latency is not an issue.

While a low-latency condition is essential for profitable scalping, some things can go wrong.

The first and most obvious is your internet connection.

In the stone age, you would simply call your broker and have your order filled. Today, however, orders are sent to the market via the internet.

On the one hand, this is much faster and more efficient. On the other hand, if your internet is slow, it might take some time for your trades to go through—not to mention that everything else (news, price quotes, etc.) gets to you with a delay.

We’re not talking about hours of loading time, but even a few seconds of latency might be enough for the market to move away from your desired price. When your goal is to capture a few pips, this is something that can significantly impact your bottom line.

While you probably won’t be able to catch up with the speed of institutional participants, the fastest internet connection will be worth the investment.

It’s important to note that any disruption in the data stream will create excess latency and can potentially harm you. In addition to making sure you have the best internet connection, it’s worth choosing a high-quality broker so that you can be confident everything is fine not only on your end but on their end, too.

You can go to ForexPeaceArmy and search for any broker to see what your trader peers think about a particular company.

It can happen that latency occurs not because of connectivity issues but because of inadequate hardware.

Devices quickly become outdated or bogged down by glitches and viruses. Therefore, securing a fast and reliable computer is also essential to minimize latency issues.

Conclusion

There are reasons why scalping doesn’t work for most people. If you want to be successful, you must focus on avoiding common pitfalls.

Perhaps the most common issue is the lack of an established trading strategy. By “established,” we mean a strategy that has been backtested and shown to be profitable over historical market data.

Trading such a strategy will increase your confidence and you’ll be more likely to remain disciplined. This will help you to avoid yet another common issue: revenge trading.

You also want to have a trading plan. This will ensure that you pursue realistic goals and adopt a trading style that is suitable for you.

Overall, scalping can be very profitable. Even if you don’t have enough money to make it worthwhile, you can concentrate on building a track record and secure funding from proprietary trading firms.