This is the place for those who are looking for the best Forex broker in the UK.

Here’s what you can expect from us in this guide…

We’re not going to give you tedious comparisons and boring statistics.

Instead, we’ll tell you EXACTLY what we believe to be the best Forex broker in the UK (in 2019). Not only that, but we’ll also let you know the reason why.

Before we get started, we want to be completely transparent with you: this is not an unbiased guide! To keep this site afloat, we have an affiliate partnership with the featured broker. (That means we get a commission if you decide to trade with them.)

However, if we weren’t 100% convinced about the quality of their service, we would never recommend them.

Sound fair? Great!

Then, let’s get started.

Best UK forex broker: XM Group

Of course, no broker can be the best choice for all traders. Even the most prominent companies don’t focus on satisfying everybody’s needs. Why? Because it’s nearly impossible.

XM is still able to serve hundreds of thousands of customers because they prioritize things that actually move the needle.

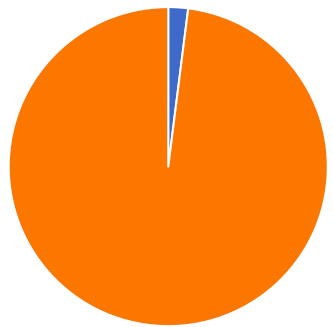

Just take a look at the screenshot below…

Now, fast forward just one year and here is the growth in customers they were able to produce…

YES! They increased the number of people who trade with them by about 42% in one year.

Not many brokers can say that. But you know what’s even more difficult than getting a ton of clients?

Keeping them.

Not only was XM able to acquire these customers, but they were able to ensure they’re happy and well-served.

Sure, XM offers a fair and trustworthy trading experience. But so do many of their competitors. Still, they are winning and outperforming them all.

Even in this competitive industry, XM Group is able to crush it by having a unique advantage.

So, what’s that ONE THING that XM does better than anybody else?

It’s customer service.

We can probably all agree: all good relationships are based on strong communication.

If a client feels neglected, they’re likely to turn elsewhere.

In fact, research shows that nearly 7 out of 10 customers will leave a business not because they’re dissatisfied with the service, but because they don’t feel valued.

By recognizing that trust could mean the difference between customer loyalty and customers who jump ship, the management of XM made customer service the responsibility of the entire company, not just a department.

Just look at what they say on their website:

“The operational philosophy we follow is simple: by ensuring client satisfaction, we earn their loyalty.”

Sound too good to be true?

We tested them.

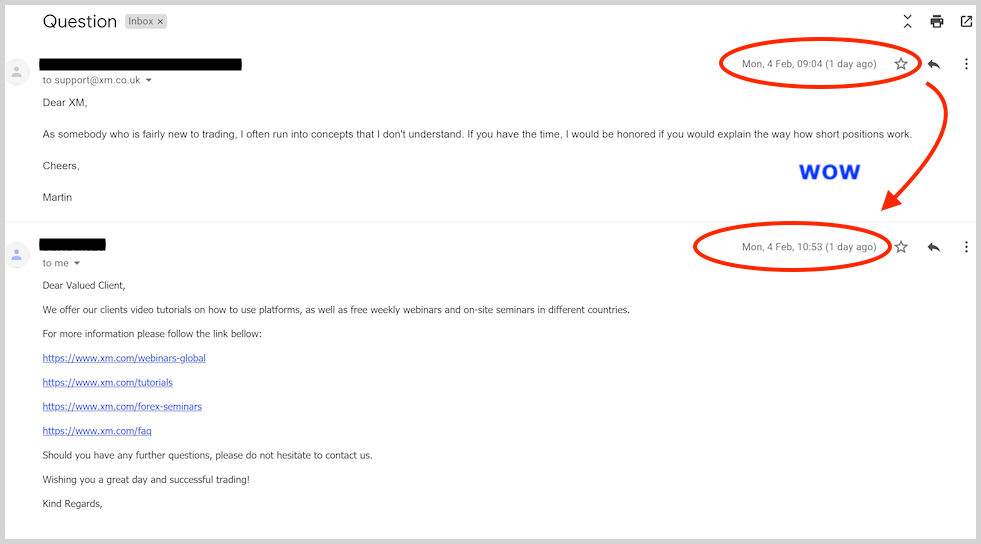

To start off, we sent them an email. They were unbelievably fast! Instead of letting us wait for days, they responded within 2 hours.

Pretty sweet.

The next thing we did was call them.

We don’t know what the average connection time at other brokers is; here, we had to wait for about one minute, which didn’t feel that long at all.

Once we were connected to a customer service agent, we asked him one simple question:

Is it possible to have a negative account balance?

Here’s the response we got:

We offer negative account balance protection to our clients; you can never lose more money than the amount you have deposited.

As you can see, the customer service was quite efficient in both cases.

So, the real question isn’t if they’re good…it’s whether or not they are actually the right choice for you.

If you want a HUMAN company that provides you with tools, tight spreads, educational resources and the ability to make fast-paced foreign currency trades, then XM is for you.

If you want to work with XM and grow your Forex business with the services above, keep reading…

Step 1

Do This Now

Start by registering a live account here.

You’ll see a brief series of questions about yourself that you need to answer to open your trading account.

It’s nothing too crazy; they need the basics about who you are and how they can communicate with you.

Answer these questions, and be sure you give correct details.

Step 2

Here’s What You Have to Do Next

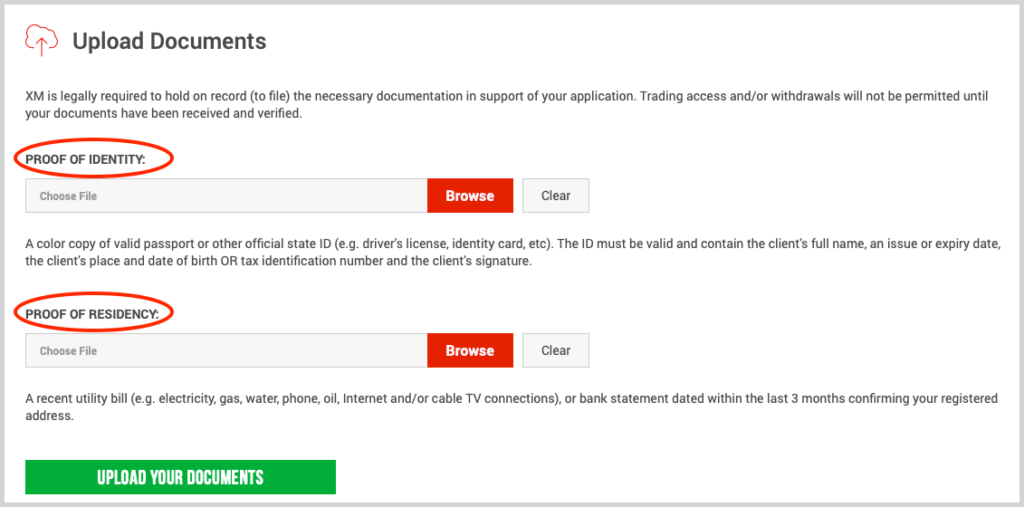

Once you’ve filled out the questionnaire, you will be able to deposit money into your account, but we recommend you confirm your identity first to avoid issues in case you mistakenly gave the wrong information somewhere.

You need to take a photo of your ID card or passport and of one of your bills or bank account statements that prove your residency.

That’s all.

Identity confirmations should not take more than a couple of business days, and once you’re verified, you can deposit money and start trading live.

If you don’t want to move forward, that’s fine too.

Choosing a Forex broker requires more thought, and you probably have some questions first. If that’s the case, we have done our best to help you out!

You can use the jump links below for quick navigation.

- Is XM Regulated in the UK?

- Is Your Money Safe with XM?

- What Currency Pairs Can You Trade with XM?

- Is XM Good for Scalping?

- How Much Do I Need to Open a Trading Account?

- Can I trade through a Mobile App?

- Is XM Ideal for Beginners?

- How Expensive Is It to Trade at XM?

- I’m Not from the UK; Can I Still Trade at XM?

Is XM Regulated in the UK?

In short: yes.

They are based in the UK and hold a license from the Financial Conduct Authority, which is the leading regulator in the United Kingdom.

The best part?

Licensed brokers are subject to frequent examinations and hefty fees if they fail to meet the required standards.

Is Your Money Safe with XM?

XM has to comply with all the strict FCA rules.

For example, they can’t use your money to support their own business activities. Instead, they must keep your funds separated at highly-rated banks in Europe.

XM must also guarantee that all withdrawals are processed immediately and that the company can seamlessly meet all financial obligations.

Now, we know what you’re thinking: it’s all nice, but what if things don’t go as planned and they go bankrupt or something?

Even in this unlikely event, you’ll have nothing to worry about.

Here’s the thing:

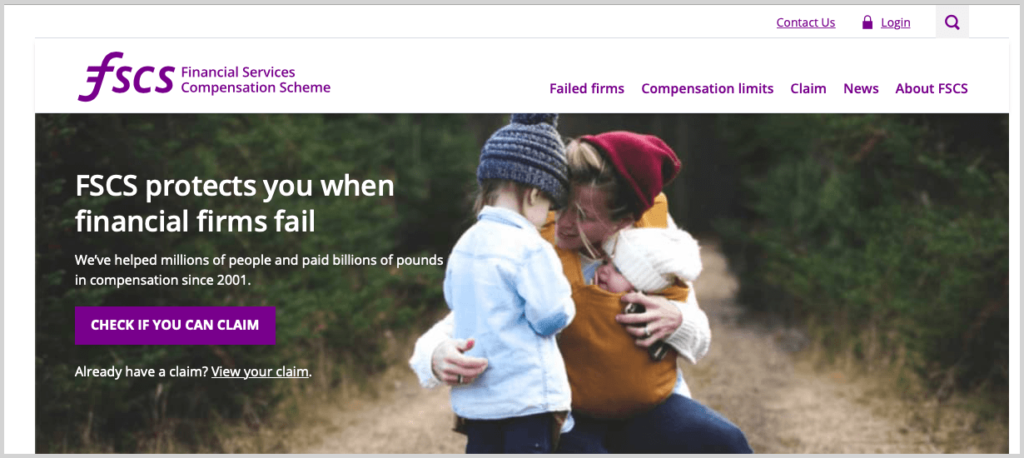

XM is part of the Financial Services Compensation Scheme.

In the unlikely event that XM is unable to pay you out, you can simply contact the FSCS and they will help.

What Currency Pairs Can You Trade with XM?

At XM, there are more than 1000 available trading instruments. From those, 57 are currency pairs including majors, crosses, and exotics.

In most cases, you’ll find major currency pairs to be more than enough.

These pairs are associated with the most developed countries that conduct a high volume of international trade. For example, GBP/USD, EUR/USD or USD/JPY are all major pairs.

Generally, the majors are the most active ones, which mean they are cheaper to trade and there’s a lot of news on them.

Nevertheless, you can trade plenty of lesser-known currency pairs, such as GBP/SGD (Great British Pound/Singapore Dollar), GBP/NOK (Great British Pound/Norwegian Krone) and GBP/DKK (Great British Pound/Danish Krone).If you want to trade a very specific pair, take a look at the offered pairs to make sure it’s available at XM.

Is XM Good for Scalping?

You want to be a scalper.

Or perhaps, you are already a scalper, but you are not satisfied with your current broker.

Due to the small timeframe, you may lose a ton of money if your broker can’t execute your orders promptly at the levels you require.

Without

Fortunately, XM is a real pioneer in this aspect.

They offer 100% execution with the vast majority of trades (99.35%) being executed in less than one second. That’s mind-blowing!

These conditions are assured up to a trade size of 50 lots (5 million units of the first listed currency of a pair).Considering all these, unless you are not willing to trade more than 50 lots, XM is an excellent choice for scalping.

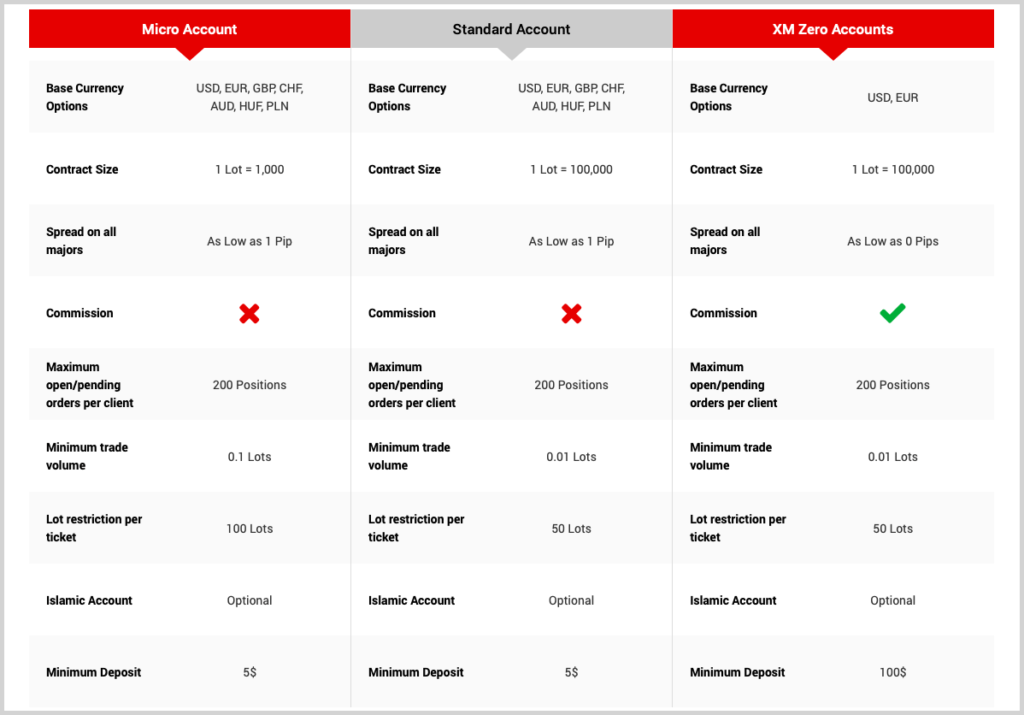

How Much Do I Need to Open a Trading Account?

The minimum deposit at XM depends on the type of your account:

– Micro: $5

– Standard: $5

– Zero: $100

As you can see, none of the accounts has a high deposit requirement. However, we don’t recommend going with the absolute minimum.

Why?

Just think about startups: one of the most common reasons startups fail is because they run out of cash.

That’s something you want to avoid.

Fortunately, it’s not difficult if you keep one simple rule.

Can you guess what it is?

Never risk more than one or two percent of your trading capital on any single trade.

This is so important that you should read it again.

Also, you can immediately see the problem with small accounts. You can only achieve larger returns if you take very high risks relative to your balance.

That could work for a while, but eventually, you would destroy your trading account.

In general, a minimum of $1,000 allows you more flexibility and better risk management. Depending on your goals and trading style, this number can increase a lot.

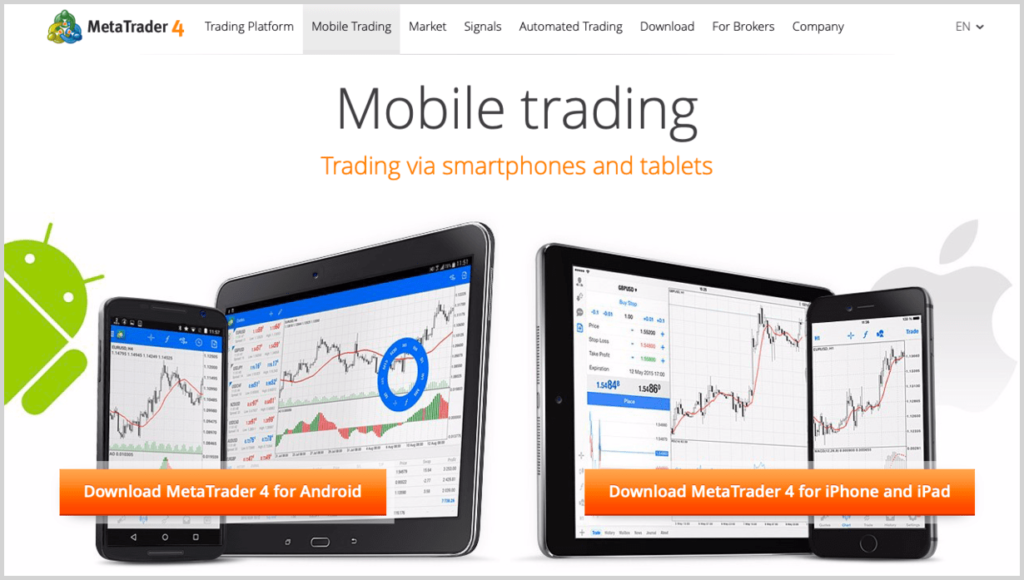

Can I trade through a Mobile App?

Yes, you can!

As opposed to some brokers, XM doesn’t have its own trading platform. However, they offer free access to MetaTrader, which is the most popular trading software in forex.

The Meta Trader has both iPhone and Android versions, which you can download from the respective store.

Once installed, you need to choose XM as your broker and enter the same login details you use to access your account on your computer.

That’s it.

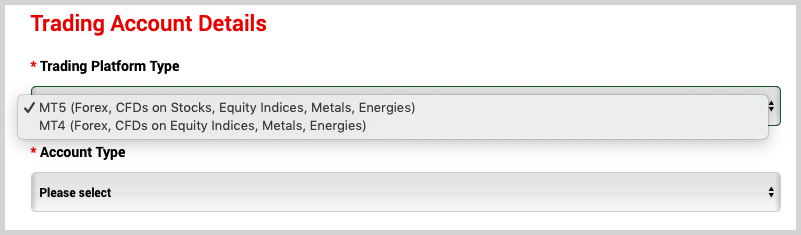

Please note that MetaTrader has two versions: MT4 and MT5.

At the time you register your account at XM, you must choose which platform you’d like to use.

When you download the mobile app, make sure you download the right version for your account. It’s important because it is not possible to trade on the MT4 platform if you have an MT5 account, and vice versa.

Is XM Ideal for Beginners?

If the world of forex intimidates you, you’re not alone. There are so many aspects, and even more experienced traders have the tendency to get things wrong.

Luckily, XM is packed with features you will find SUPER useful if you’re just getting started.

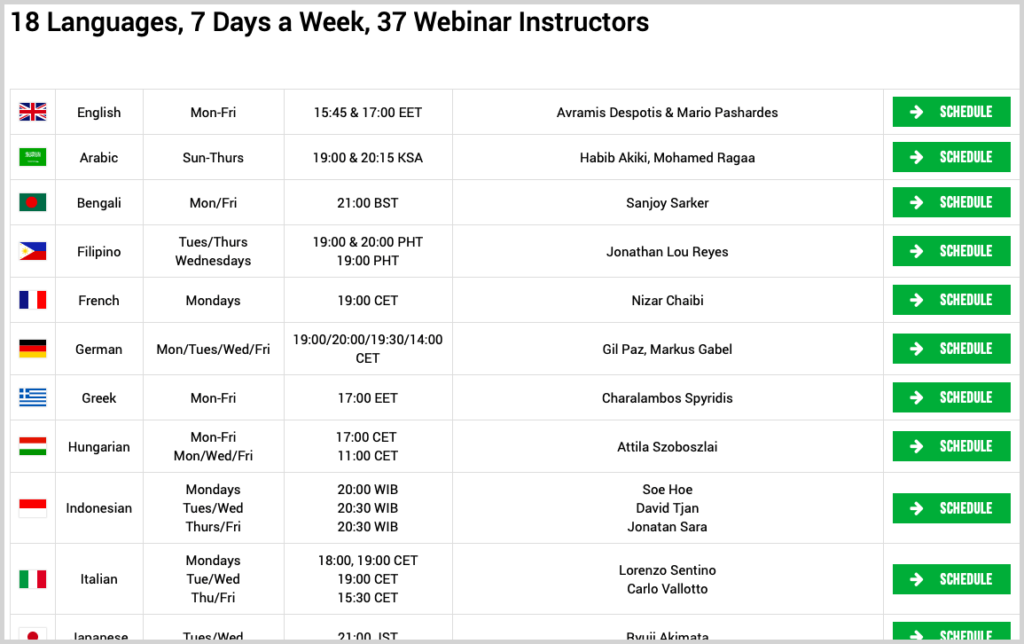

First of all, there’re free webinars every day.

Okay, English webinars only run from Monday to Friday, but it’s still pretty awesome, isn’t it? Especially when you consider that these are presented by forex professionals.

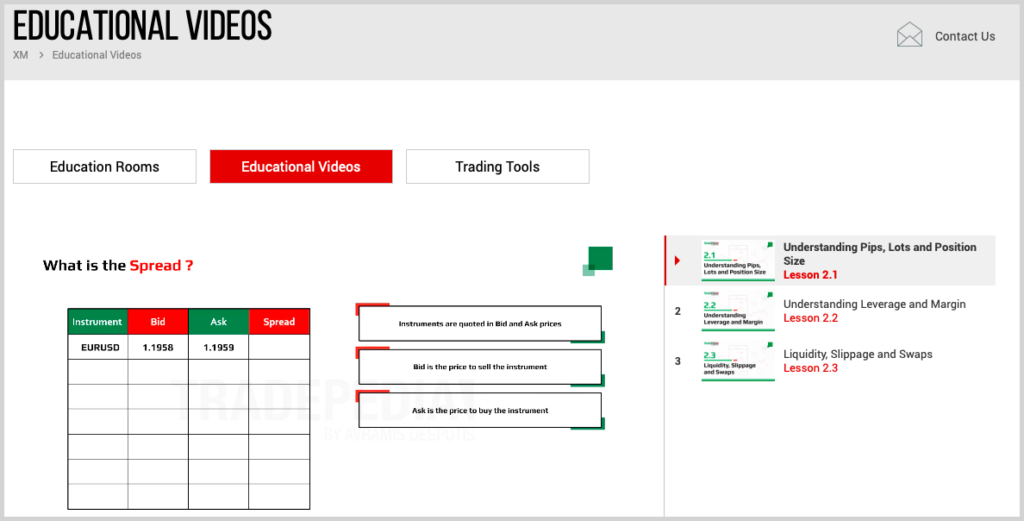

In addition to webinars, there are educational videos…

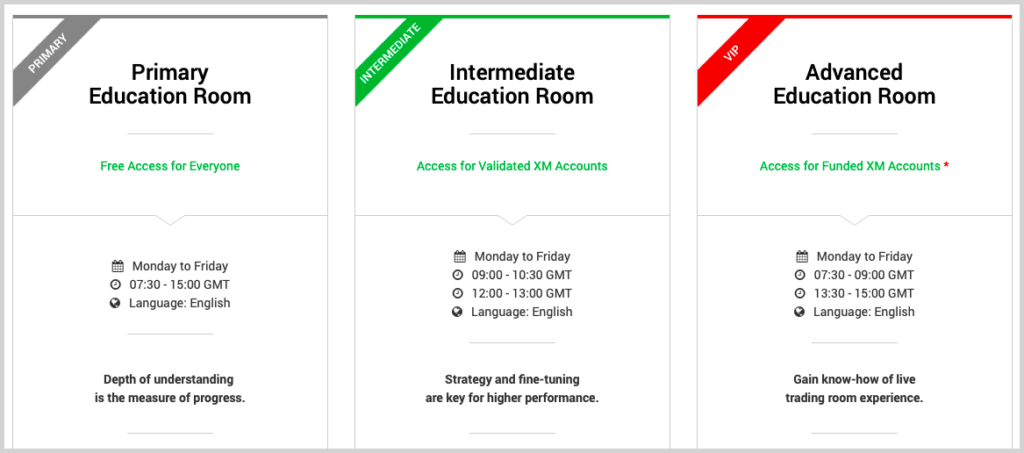

….education rooms with

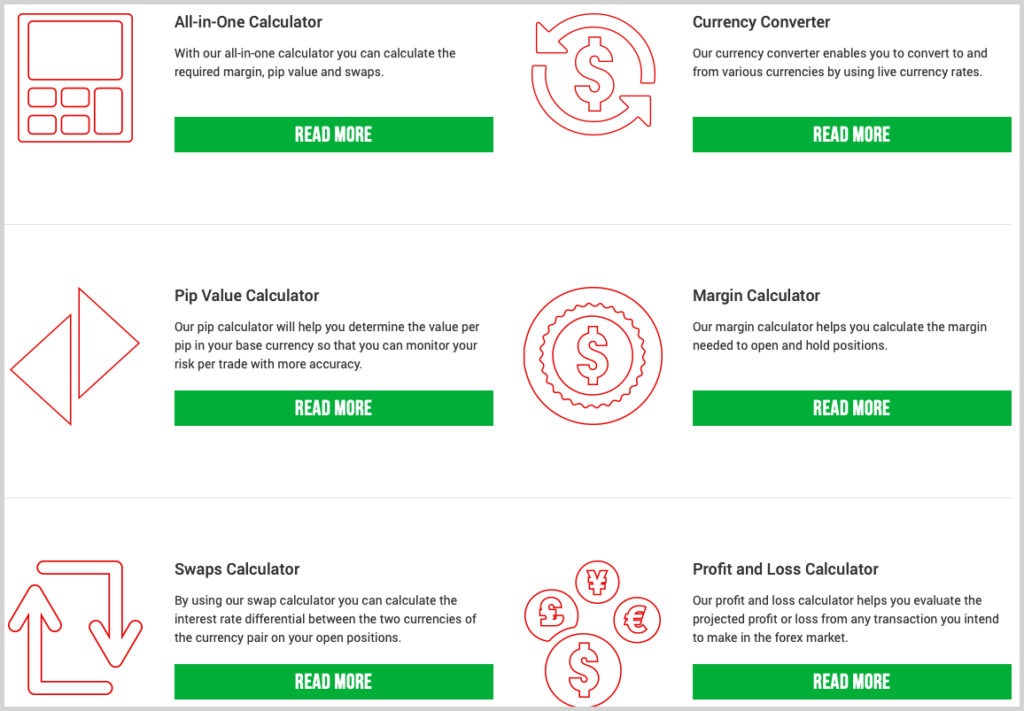

and different forex calculators.

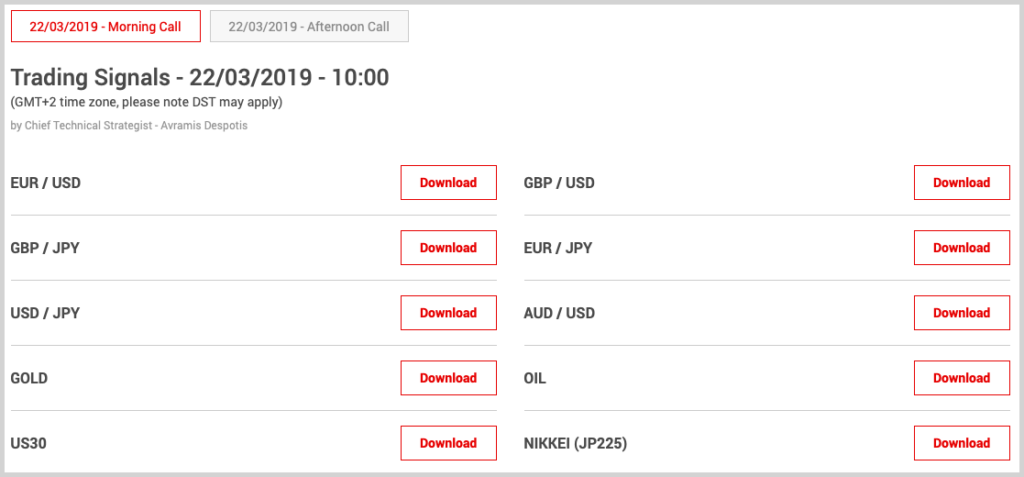

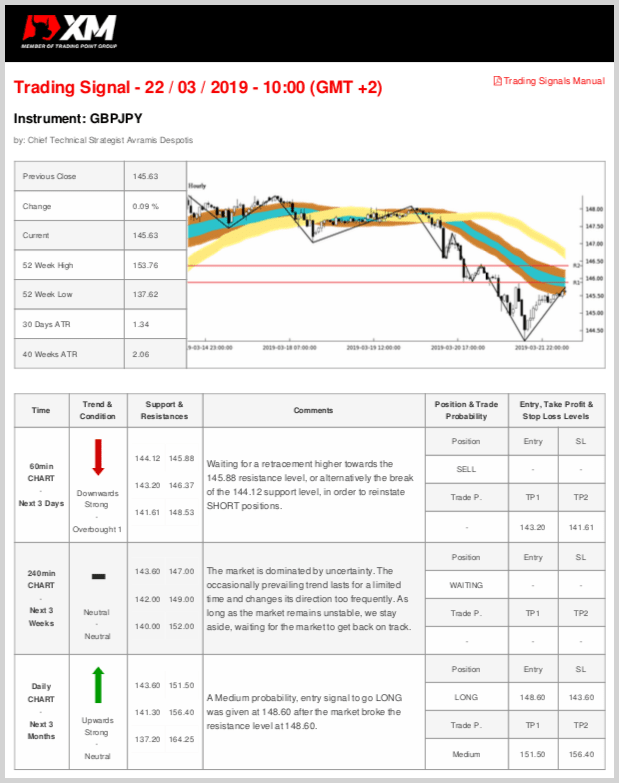

If you register a live account, you will get free access to the trading signals hub, which is available in the Members Area.

It contains analysis and daily forex signals for the most popular currency pairs, such as EUR/USD, GBP/JPY, GBP/USD and more.

And what if you want to leave the office?

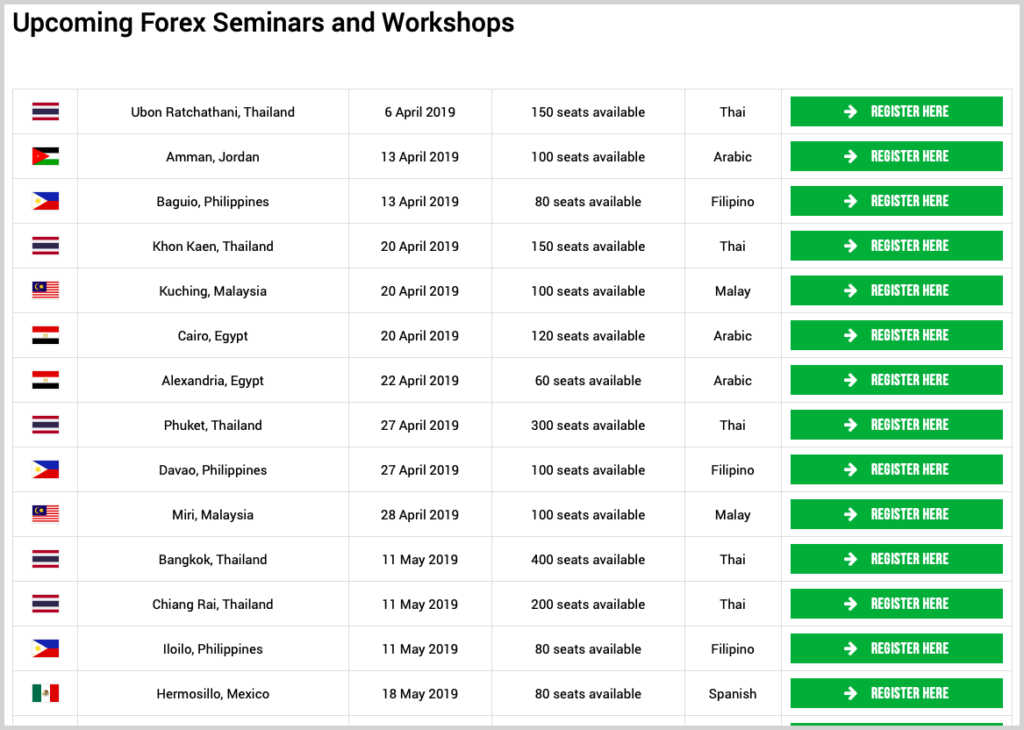

Well, XM has been hosting free forex seminars for years.

The only problem is that they’re more concentrated on developing regions, which means fewer UK-based events. Nevertheless, there are seminars in the UK, so make sure you keep a heads-up for those occasions.

How Expensive Is It to Trade at XM?

Similar to the minimum deposit, the commissions and fees at XM depend on the type of your account.

There are three to choose from, including the commission-free Micro and Standard accounts, and the commission-based XM Zero account.

Before you’d get too excited, the term commission-freeis quite misleading in forex. It only means that instead of a fixed commission per traded currency units, you pay the bid-ask spread. In other words, there is a commission, but it’s built into the price.

Luckily, XM has competitive pricing in both cases.

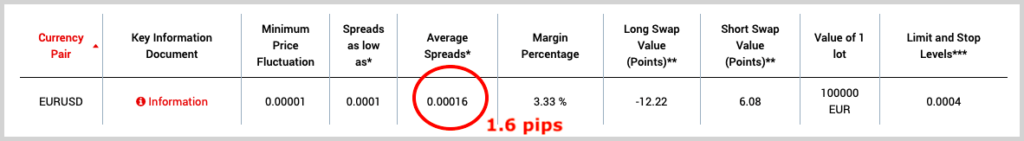

For example, the average spread of EUR/USD in the Micro and Standard accounts is 1.6 pips.

It means that every time you trade 1 lot (100,000 units), you pay $16 as commission. Note that each trade must be closed with an opposite order, so you pay the spread two times.

For the same currency pair, Zero account holders have to pay an average spread of 0.1 pips and $3.50 for each 100,000 USD traded. Similarly, you’ll incur these costs each time you open and close a trade.Please note that spreads and commissions are subject to change. You can check the current conditions here.

I’m Not from the UK; Can I Still Trade at XM?

XM is a global brand that has clients from 196 countries.

That’s A LOT.

If you are not from the USA, Canada, Israel and the Islamic Republic of Iran, you are almost sure to be able to trade with them.